Are You Really Paying 22% in Taxes?

New IRS Income Tax Brackets

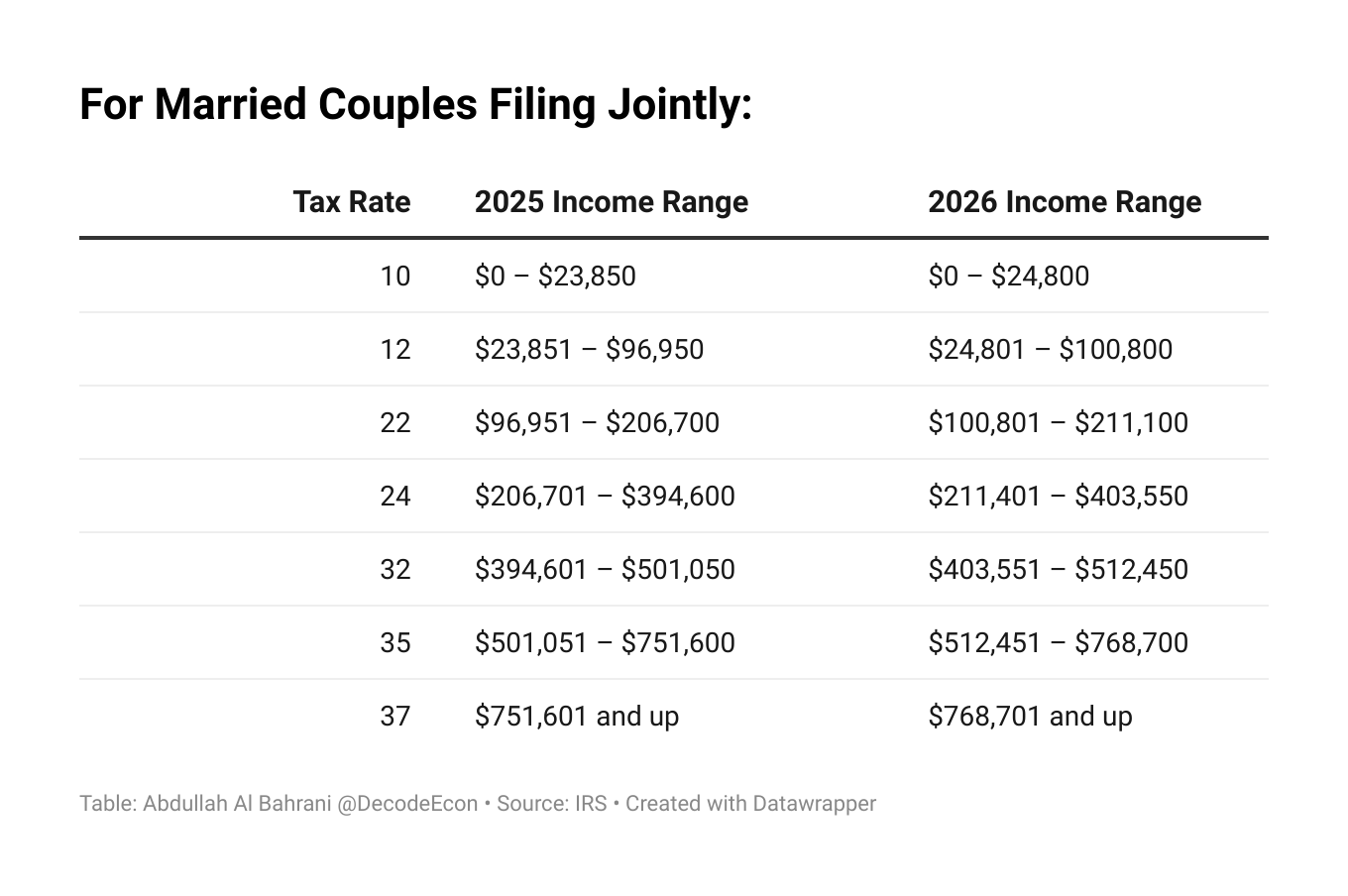

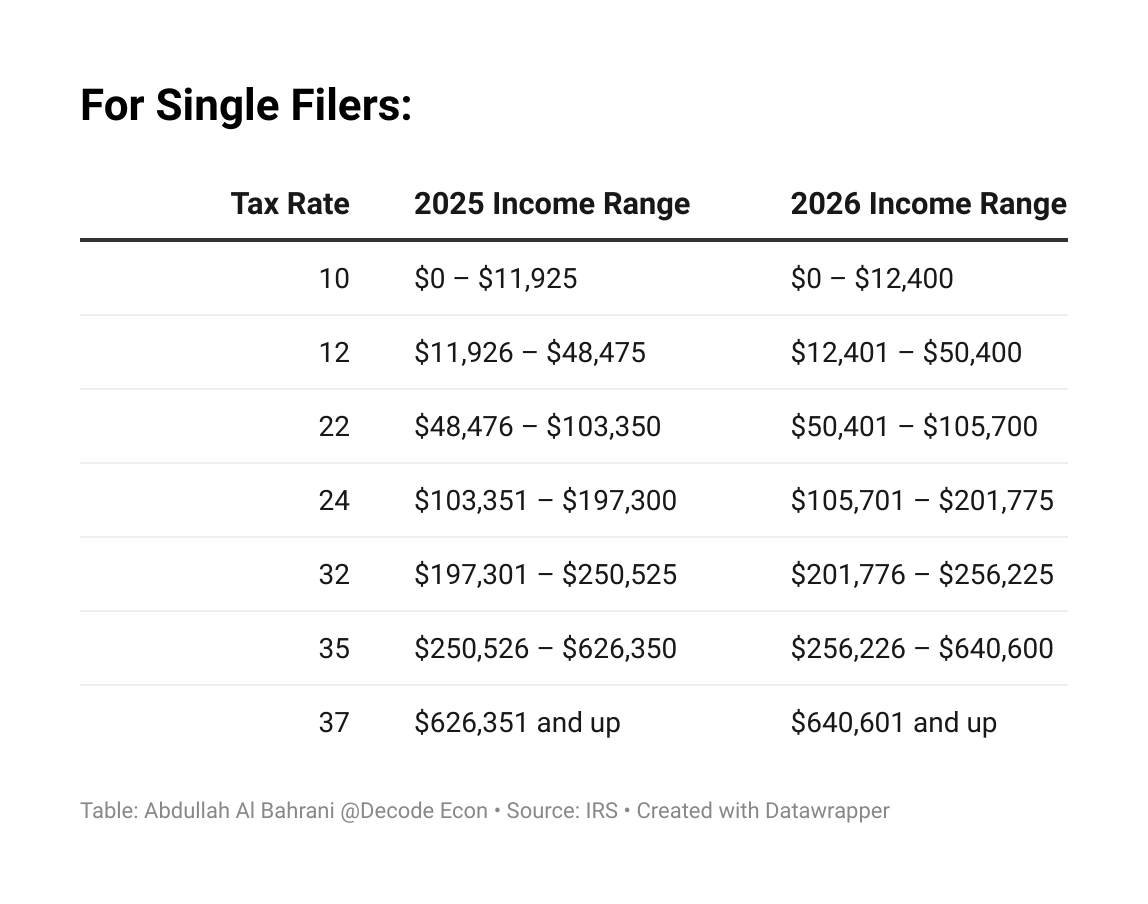

This week, the IRS released the 2026 income tax brackets and standard deductions, adjusting for inflation to prevent what’s known as “bracket creep.”

Bracket creep is when inflation pushes people into higher tax brackets even if their purchasing power hasn’t changed. To prevent that, the IRS raises the income thresholds each year, and this year’s adjustment is meaningful.

For instance, a single filer earning $50,000 will remain in the 12% bracket next year rather than moving into the 22% bracket. That shift means millions of Americans will see a smaller portion of their income taxed at higher rates in 2026.

With that said, most people don’t really know how marginal tax rates impact the actual taxes they pay. Let’s discuss this important economic and personal finance topic so that you are informed about the difference between marginal and average tax rates.

What Changed in 2026

What’s happening here is that every bracket moved upward slightly, which means taxpayers can earn more before reaching the next threshold. This doesn’t change the rates themselves, but it changes how much of your income gets taxed at each level.

It’s not really a tax cut, but it does act like one in real terms. You should have more money left over to offset inflation.

How to Calculate Your Actual Tax Rate

The U.S. uses a progressive tax system, meaning higher incomes pay higher rates, but only on the top portion of their earnings.

Here’s a quick example:

A married couple earning $150,000 in 2026 will:

Subtract the $32,200 standard deduction. Their taxable income is $117,800

Pay 10% on their first $24,800

12% on the next $76,000

22% only on the last $17,000

Their marginal rate is 22%, which is how much they would pay on the next dollar they earn. But that is not their average rate! The total share of taxable income paid in taxes is about 13%.

Another measure is the effective average tax rate, which I prefer. It measures the total share of gross income paid in taxes. In this example, that is 10.2%.

This distinction matters. When people confuse marginal and average rates, they often believe earning more means “losing money” to taxes. That’s not true; only the dollars in the new bracket are taxed more, not all of them.

How Much Do You Save from the Bracket Adjustment?

A single person making $50,000 in 2026 will save $161.88, roughly a 2.7% reduction in their tax bill, from the inflation adjustment.

The IRS inflation adjustment is designed to keep your real tax burden from rising. Across millions of taxpayers, that’s billions of dollars kept in paychecks instead of lost to “bracket creep.”

The Bottom Line

Inflation adjustments to tax brackets are one of the quiet ways the government protects your real income.

But the lesson here is about the difference between marginal and average taxes. Next time someone says, “That raise will push me into a higher bracket,” you can share this lesson with them and help them understand that they will only pay more taxes on the extra dollars they make, not on all of their dollars.

Very good explanation on how the rate hits different income. I want to share two thoughts. One, for the question of if I pay 22%, definitely not, lol. This is because of the real estate I own. The government wants people to live in decent places so they provide incentives to repair and replace many items on a home. Yes, some take advantage of this, but for the most part (as with all businesses) people want to keep their tenants happy.

The second item I wanted to discuss is the use of you marginal approach on some of my deal structures. Interest rates are high right now, for investors they can be up to 10%. If you take the situation you discussed here and applied it to assumable mortgages, you can lower your rate significantly. If someone is looking at a median priced home (maybe 400-450K) with a 250K mortgage (assuming it is assumable - meaning the buyer can take over the payments) the difference is about 150K-200K. Take out a down payment of 10-20%, say 75K, the remaining amount owed to the seller is 375K. If the loan for 250K the seller has is at a 3% rate, the difference (375k -250k mortgage) is 125K. This 125K can be financed at todays rates, but the blended rate will be much lower than a standard bank rate. Let me rewrite this in the terms used in the article above. Essentially, you are taking a previous loan with a low rate and stacking the marginal amount on top of this to lower the average interest rate.

I enjoy reading how different items can be used in different areas and I have seen many people do this in the past and I present it often when meeting with seller (not bites, the usually finance the whole thing at lower rates... but that is a different story, lol).

Thanks, take care!

Great explainer. Most people think of themselves as being in a bracket when really their income is in multiple brackets. It's sort of like how people see the refund as a sign they did things right rather than as a sign that they gave the IRS a year-long loan.