Brought to You by the Letter K

The K-Shaped Economy and Why It Matters

The Problem

If you’ve been following economic headlines, you’ve probably heard the term “K-shaped economy.” It’s become shorthand for what many Americans are feeling: that the economy is working for some, but not for all.

At a glance, the numbers look good: GDP growth is steady, unemployment remains low, and consumer spending hasn’t collapsed. But underneath those averages lies a widening split. A small slice of high-income earners is driving most of the spending, while everyone else is feeling squeezed.

That divide is showing up in our language, too. In recent weeks, President Trump has criticized the word “affordability,” calling it a distraction from economic success. But for most Americans, affordability represents the core of their lived experience. The ability to afford housing, healthcare, childcare, or even groceries defines how people judge whether the economy is working for them, and ignoring that reality risks mistaking growth for well-being.

The Economics

In a conversation with Marketplace, economist Kristina Sargent of Middlebury College explains that this concentration of spending at the top has been building for decades and is fueled by rising wealth inequality.

If you own stocks or real estate, recent years have likely been good to you. Market rallies and home price gains have boosted balance sheets and kept affluent households confident and spending. However, for middle- and lower-income households, everyday essentials, such as groceries, gas, childcare, and rent, have become increasingly difficult to afford.

Sentiment and Wealth

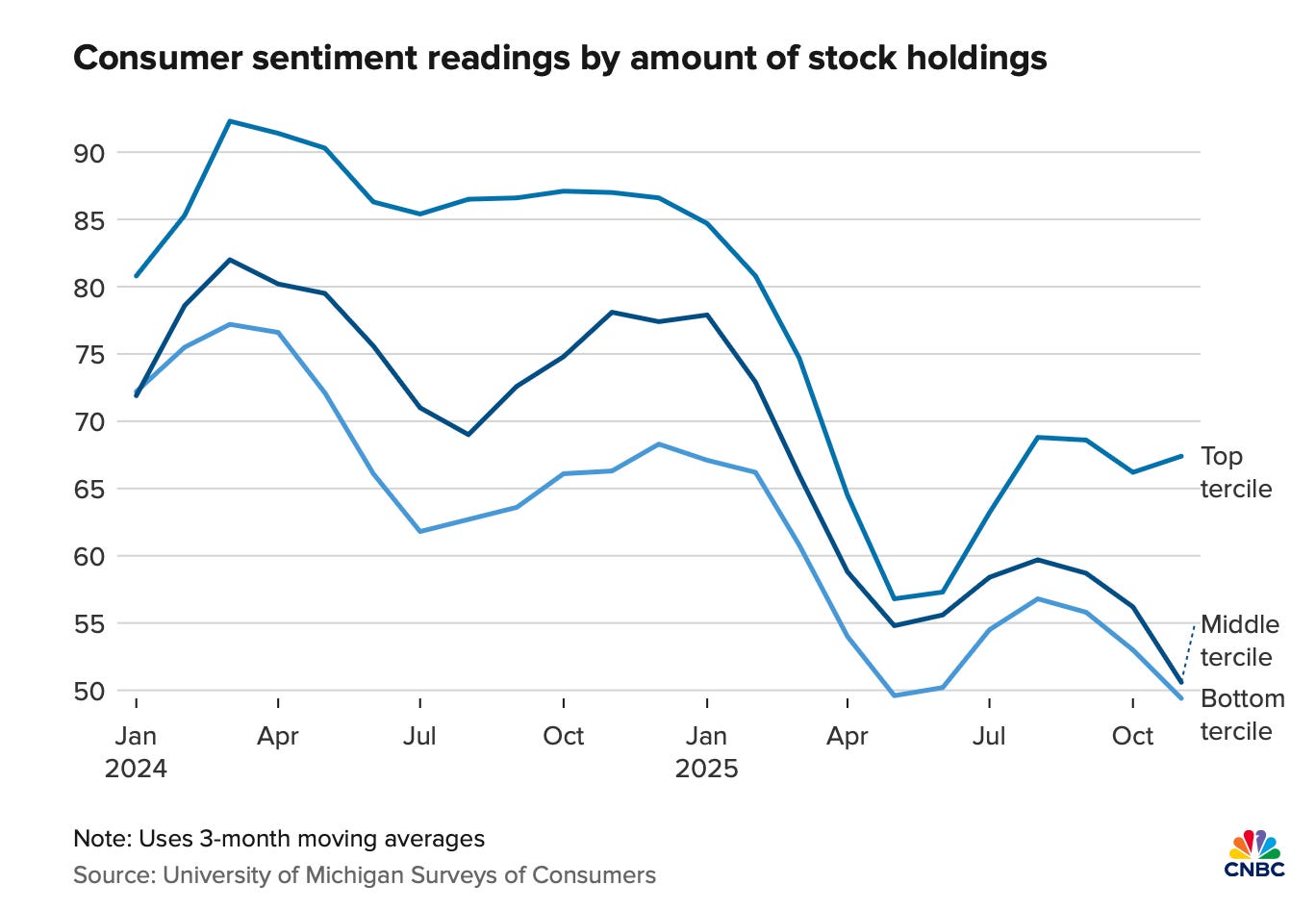

Recent data from JPMorgan’s Cost of Living Survey shows that income bracket is one of the biggest predictors of how people feel about the economy. The University of Michigan’s Consumer Sentiment Index, shown in the chart below, reveals just how stark this divide has become: those with significant stock holdings (top tercile) report significantly higher confidence than those with few or no stock holdings (bottom tercile).

Sentiment has fallen for everyone since early 2024, but those holding more assets remain far more optimistic. That means the aggregate data policymakers rely on reflects the experiences of the wealthy more than those of the majority.

Sentiment and Political Affiliation

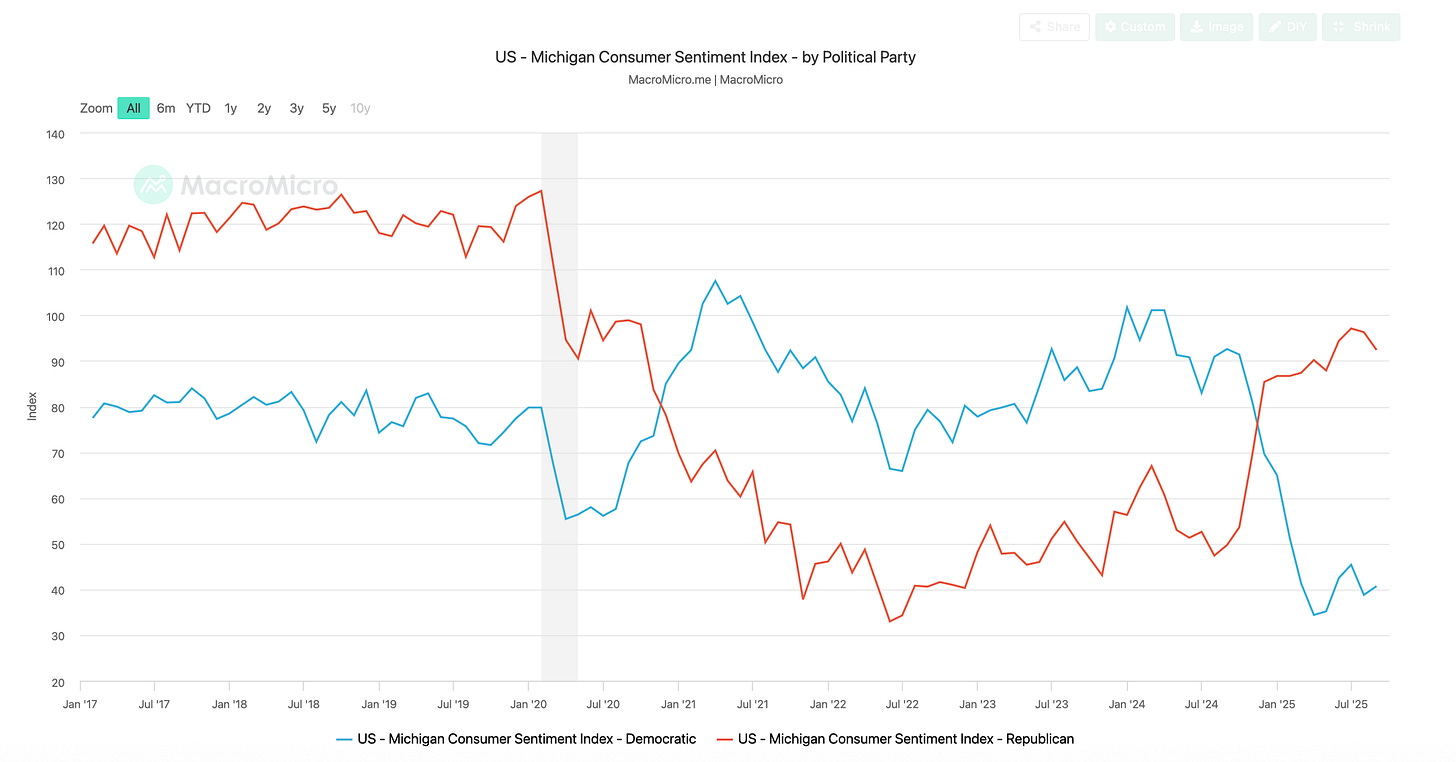

And the divergence doesn’t stop there. Consumer confidence has become sharply partisan as well. The chart below shows that Democrats and Republicans now interpret the same economy through completely different lenses.

The Bottom Line

Right now, the economy is being held up by high-income consumers whose spending power depends on stock market gains. That’s not a stable foundation. If markets stumble, or if the so-called AI boom loses steam, the top of the “K” could pull back quickly, exposing how fragile the economy really is. Top earners are spending discretionary money that can abrubtly change, and that will make for more severe economic downturns.

A strong economy should represent everyone. It can’t rely on one arm of the “K.” Sustainable growth requires broad economic participation and policies that recognize how differently Americans experience this economy. When policymakers only look at averages, they risk missing the real story: an economy that looks strong in the data but feels fragile in real life.

The lesson here? Feelings matter and they do impact the economy.

Hows the economy treating you?

It seems to me that there is also a k-shaped economy in business spending too. That AI boom is spurring huge capital expenditures for some companies. When that stops or slows the reverberations will be huge. A strong portfolio like a strong nation needs diversity.

I also wonder about the age of the spenders driving our economy. If it’s not just the rich but the rich Boomers eventually they will reach the end of their high spend years creating another problem that may drag on for years.