Flat Paychecks, Pricier Beef, and the Cost-of-Living Squeeze

December’s inflation report looked… fine. Core inflation came in softer than expected, and headlines quickly framed the data as “good news.” But that’s not how inflation shows up in real life.

If your paycheck hasn’t grown and the cost of basics like beef, coffee, and housing keeps climbing, inflation still feels very real, even if the aggregate numbers come in lower than expected.

That’s the disconnect worth unpacking.

The Economics

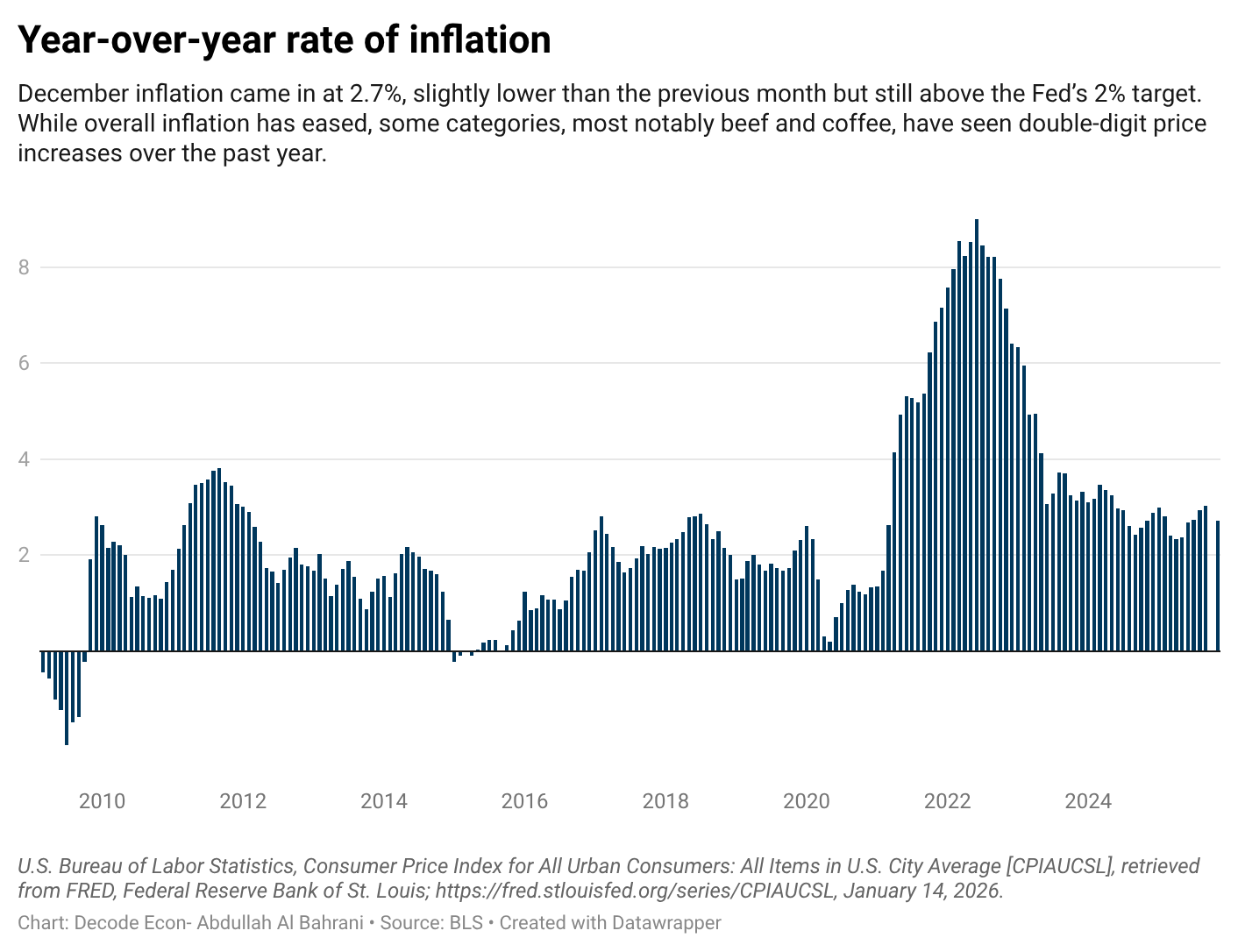

According to the Bureau of Labor Statistics, core CPI rose at a 2.6% annual rate in December, slightly below expectations. Headline inflation was 2.7%, exactly in line with forecasts. Progress, yes—but still above the Federal Reserve’s 2% target.

Housing is still doing the damage.

Shelter prices rose 0.4% in December and are up 3.2% year over year. Because housing carries so much weight in CPI, it keeps inflation sticky, and affordability strained.

Food inflation hasn’t gone away.

Food prices rose 3.1% year over year, driven by sharp increases in specific categories:

Beef prices surged again:

Ground beef: +15.5%

Beef roasts: +17.5%

Beef steaks: +17.8%

Overall, meat prices are up 9.2%.

Coffee prices jumped 19.8% from a year ago. Tariff relief came in November, but retail prices haven’t followed yet.

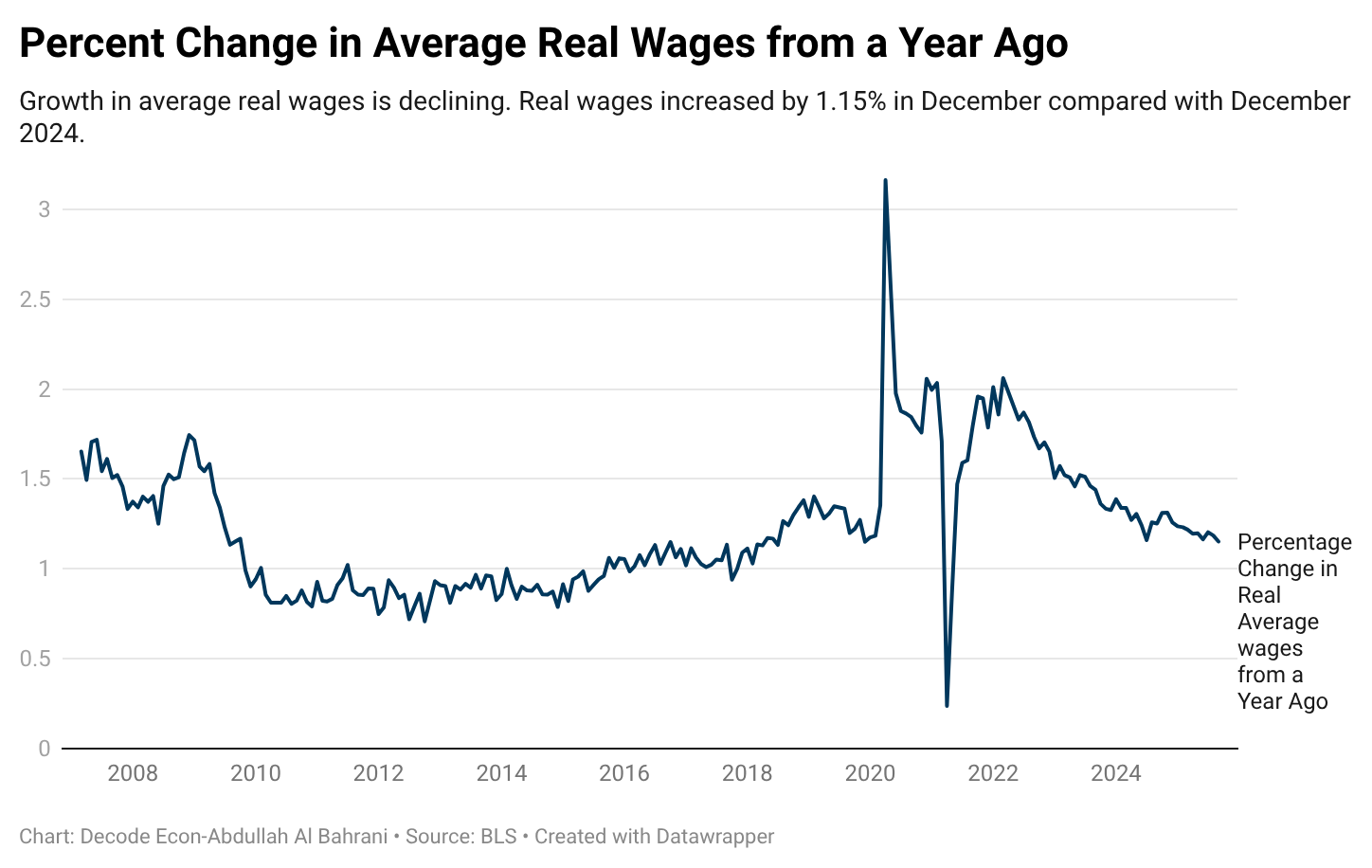

Now compare that to wages.

Real average hourly earnings were flat from November to December. Inflation rose at the same pace as nominal wages, canceling out any gain. Year-over-year gain in real wages was 1.15%.

For production and nonsupervisory workers, real hourly earnings actually fell 0.2% over the month.

Real average weekly earnings now stand at $388.33, which is about $11.35 per hour in real terms, even as nominal hourly pay is near $37.

This is why inflation “feels” worse than the headline suggests. Prices for essentials are rising faster than paychecks, and those essentials aren’t optional.

The Bottom Line

Inflation is cooling on paper, but the cost of living isn’t easing where it matters most.

When real earnings are flat, and prices for housing, food, and coffee keep climbing, households don’t feel relief; they feel squeezed. That’s also why rate cuts would be premature without a clearer labor market slowdown. Cutting too soon risks locking in higher inflation expectations rather than lowering your grocery bill.

Sounds like folks should eat more beyond meat!

Since these price increases are cumulative, they seem to be especially noticeable on groceries. Gasoline goes up and down, some housing markets (Florida) might soften, but that bag of mini carrots that I bought for $0.99 for years is now $1.25 and it's in fact "sticky".