How Does Gen Z's Income Compare?

Chart of the day!

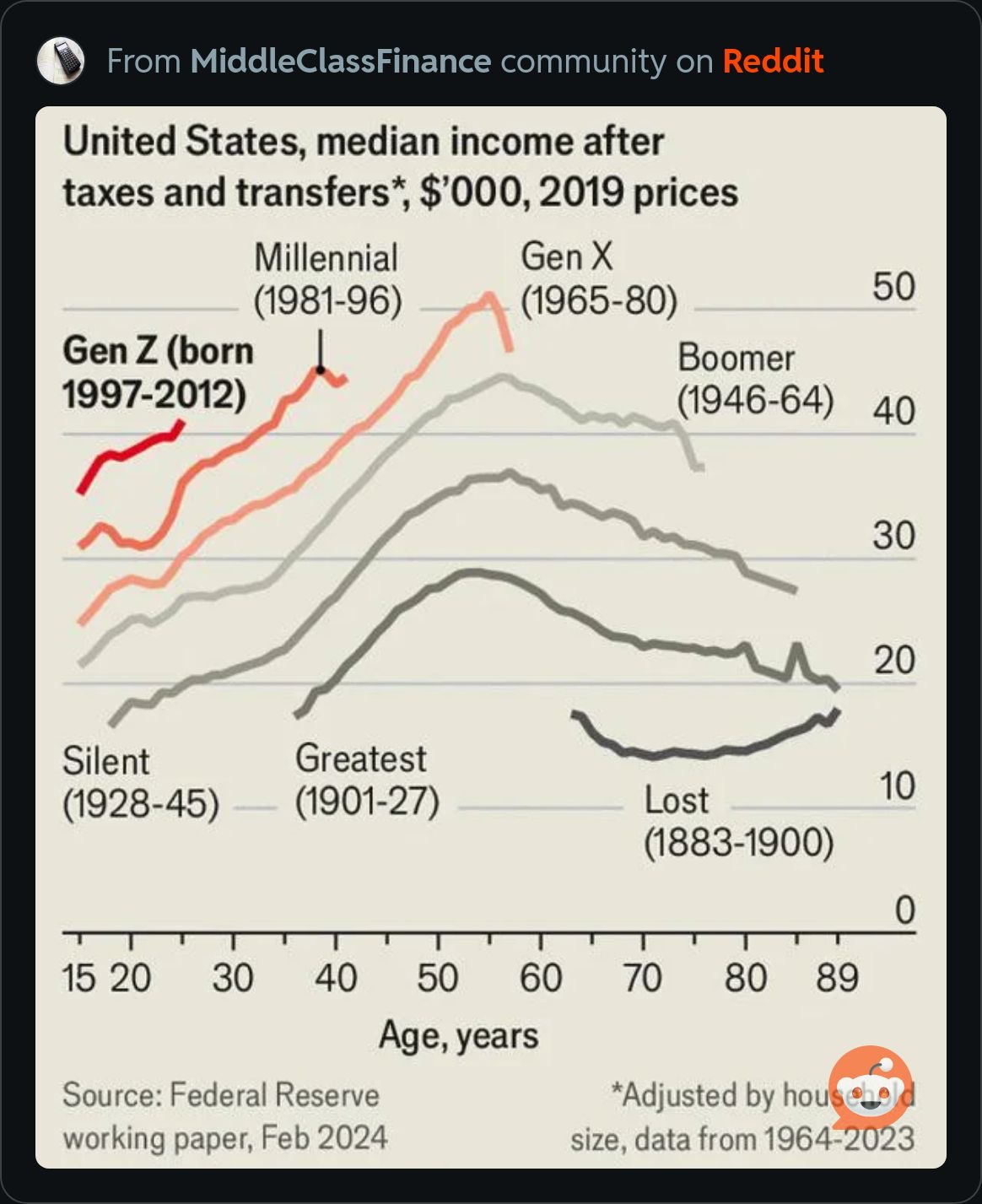

When I first saw a Reddit post claiming “Gen Z income” is higher than that of Millennials, I paused. For years, viral headlines have told us that Gen Z is worse off than any other generation. Yet this chart suggests the opposite. Is it proof that the American Dream is alive, or just a quirk of how economists measure income? Today, we’ll examine the graph and the research behind it to see if Gen Z is truly better off.

The Data Behind the Viral Chart

The chart is from a 2024 Federal Reserve working paper titled “Has Intergenerational Progress Stalled?” by Kevin Corinth and Jeff Larrimore. Using six decades of Census data, they measure median household income after taxes and transfers, adjusted for household size.

That last adjustment is key: A family of four doesn’t need four times the income of a single adult to maintain the same standard of living.

What the Chart Shows

The peak earning years for most generations typically fall between the ages of 55 and 60.

Each generation has earned more than the one before. Progress is real, even if slower than in the past.

Gen Z households in their 20s are starting richer than Millennials were at the same age.

However, the strongest income climb still belongs to Baby Boomers, who benefited from postwar prosperity, rising female labor force participation, and smaller families, which boosted their equivalized income.

The Complications

But we can’t just stop at the level of income for Gen Z. Three factors complicate the story:

Parental support. For Gen Zers still at home, the boost is statistical. Household income rises, but independence is delayed. The Fed paper notes that Millennials didn’t reach “less than 10% parental dependence” until age 31. Gen Z may follow a similar path, or maybe be delayed even longer.

Rising costs. Even with higher incomes, today’s dollars buy less housing, healthcare, and childcare security than they did for Boomers or Gen X. Although this graph accounts for inflation, growth in housing and education costs has a greater impact on younger individuals starting their lives. While real median incomes are increasing, so is financial anxiety.

What This Tells Us About Generational Progress

Economists refer to this as absolute mobility: Are today’s young adults better off than their previous generation at the same age? The Fed’s data suggests that progress hasn’t stalled. But the pace is slower, and the composition of income has shifted.

The Boomers’ big leap forward came from more hours worked (two earners instead of one).

Gen X and Millennials stalled as female labor force growth plateaued and hours leveled off.

Gen Z’s income growth so far is less about hours and more about living arrangements and transfers.

The Bottom Line

Gen Z is starting stronger than Millennials on paper. But household size adjustments and parental support mean their early advantage doesn’t necessarily translate into independence or security. The American Dream hasn’t vanished; it’s just being redefined. For Gen Z, the challenge isn’t only earning more; it’s turning higher early incomes into lasting stability in the face of housing shortages, student debt, and rising health costs. Wealth, after all, is what we are chasing, and that is a function of both income and spending.

Reader Question: If you’re Gen Z, do you feel ahead of where Millennials were? Or does the chart miss what life actually feels like?