Inflation Data and Mortgage Rates

What’s Next for the Fed?

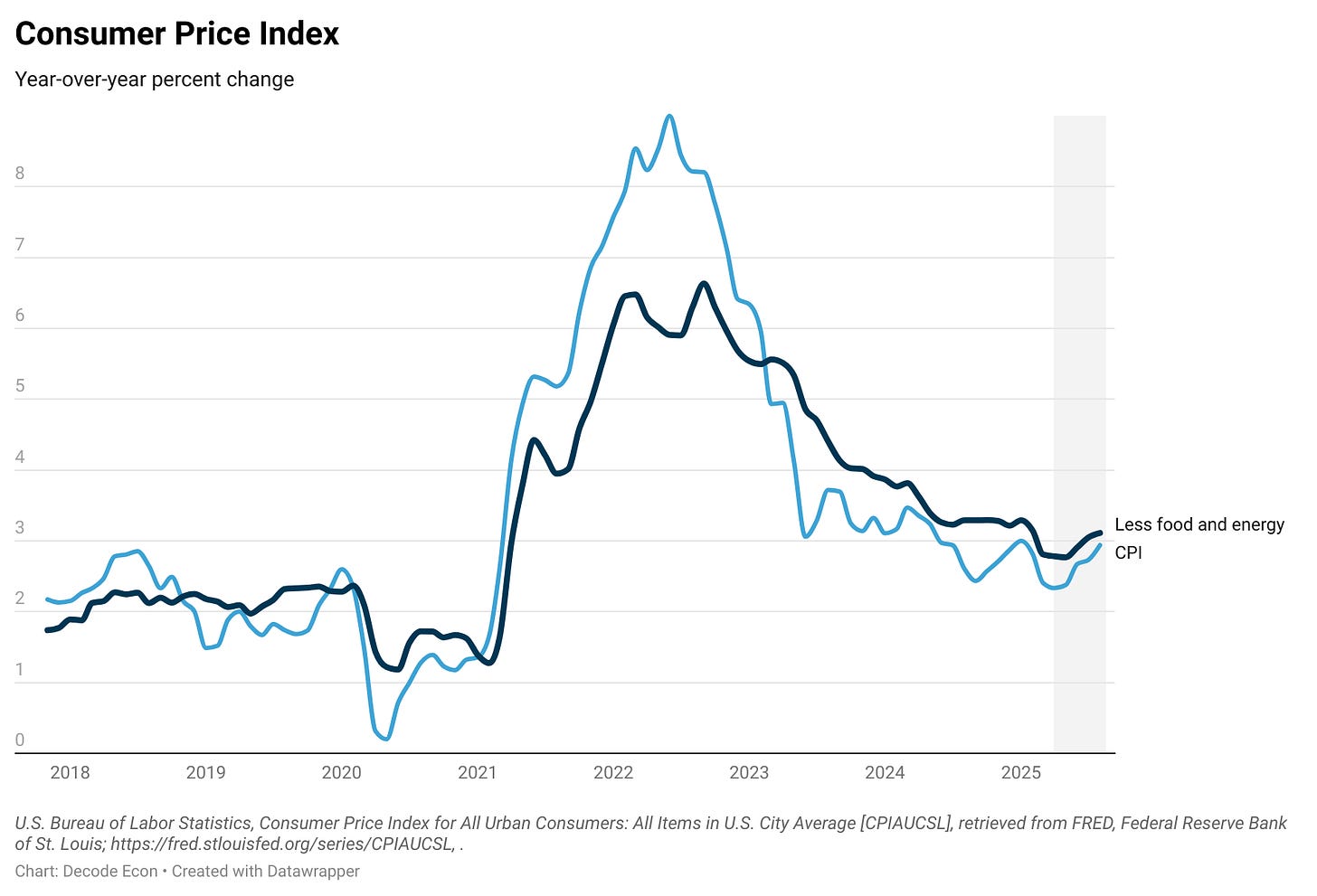

Two key measures of inflation came out this week, and the story is mixed:

The Producer Price Index (PPI) slowed to 2.6% year-over-year, down from 3.1% in July.

The Consumer Price Index (CPI) ticked up to 2.9%, compared with 2.7% last month.

The Core CPI (excluding food and energy) edged up slightly to 3.1%.

What stands out is that consumer inflation has been rising for five straight months. Back in April 2025, CPI had cooled to 2.3%, but each month since then has brought renewed upward pressure.

The Fed’s Dilemma

The labor market has softened, which on its own might justify a rate cut. But with inflation inching higher, the Fed now faces a tougher decision: cut too soon and risk fueling inflation, or hold steady and risk slowing the economy further.

Mortgage Rates

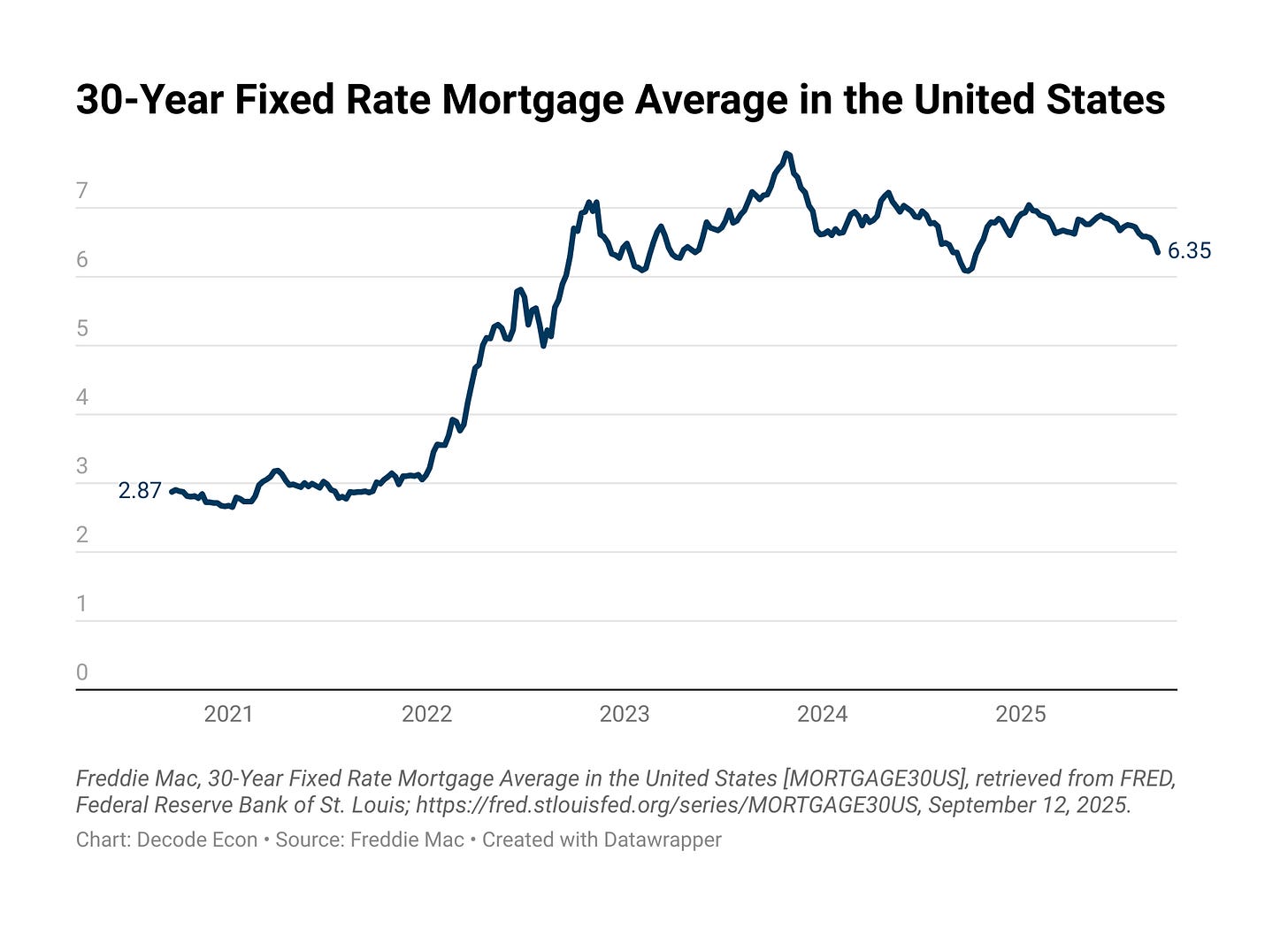

Markets are already making their bet. The average rate on a 30-year mortgage dropped to 6.35% on Thursday. That is the lowest rate in nearly a year, and just above where it stood at this time last year. Rates on 15-year mortgages, often used for refinancing, also dipped.

The decline suggests markets expect a Fed cut next week. If that happens, much of the effect is already “baked in,” meaning mortgage rates may not fall much further in the near term.

The Bottom Line

The Fed meets September 16–17. The question is simple but critical: Is inflation cooling enough, or is it still too sticky for a rate cut? What do you think?

Question for the Readers

One month into Decode Econ, it’s time to hear from you.

What’s one topic or question about the economy you’d like us to decode together in the coming weeks?

What kind of economic stories help you the most: the personal finance lens, the policy debates, or the “big picture” trends?

Your feedback will help us develop more content and ensure that future content aligns with your expectations. We will continue our effort to make economics accessible and improve economic literacy.

Regarding interest rates, just a note: We always hear about the absolute interest rate, as if that were the most important to investors, but it is not -- what matters most is the GAP between the interest rate on borrowed money (the Prime rate for large businesses) and the projected return on investment. Letting interest rates fall stimulates investment somewhat, but the main stimulant is a high likelihood of good profits from an investment. Recently we have been hearing news that investors in manufacturing in the United States are having a hard time making profits from investment in manufacturing, because tariffs increase the cost of equipment and raw materials, and the cost of labor in the US is high. Moreover, we are seeing increasing hesitation about investors in AI because, as a recent MIT paper points out, no one is yet making actual profits from AI, even as investment has been very large. If AI investors can't make money, they won't care much if interest rates fall 25 basis points this month or not, and AI investment has been the major factor driving the rise in the stock market since late 2022. https://www.entrepreneur.com/business-news/most-companies-saw-zero-return-on-ai-investments-study/496144#:~:text=building%20sustainable%20success.-,Companies%20are%20pouring%20billions%20of%20dollars%20into%20corporate%20AI%20projects,seeing%20%22value%22%20from%20AI.

I suspect inflation will continue to tick upwards as the full impact of the tariff policy is still to be felt.