Looking for Cockroaches and Holding Our Breath

The Fragile Economy

At this point, the U.S. economy is holding its breath. Every news cycle is anticipating the next market crash or signs of a recession.

Yesterday was another example of how nervous we have become, and this morning is giving vibes of fear. U.S. stock futures edged lower on Friday morning after Thursday’s session saw a sell-off fueled by concerns about regional banks’ loan practices.

It is important to note that the market fears were triggered by Zions Bank, a small regional bank, writing off two bad loans. The exposure is roughly $50 million, a trivial amount. However, they come on the heels of two recent and sizable bankruptcies in September: subprime auto lender Tricolor and larger auto parts supplier First Brands.

JPMorgan Chase & Co. CEO Jamie Dimon made a statement during a discussion with analysts.

I probably shouldn’t say this, but when you see one cockroach, there are probably more.

Looking for Cockroaches

It is reporting season, and we are hearing from banks and public companies about their profitability. The market has been forgiving because the policies coming out of Washington have been marketed as good for business. If that were to turn, then market sentiment might shift.

So when banks indicated that they were exposed to fraud and bad loans yesterday, markets gasped. The Dow lost 301.07 points, or 0.7%, while the S&P 500 and the Nasdaq Composite settled down 0.6% and 0.5%, respectively.

Maybe the news of bad loans triggered memories of 2007, or maybe it’s because Andrew Ross Sorkin has been on the news marketing his new book, 1929: Inside the Greatest Crash in Wall Street History, and how it shattered a nation. His talking point has been that he sees so many parallels between 1929 and today.

The Economic Divide

Whether you believe we’re living in a K-shaped economy, where the wealthy continue to thrive while many Americans fall behind, it’s hard to ignore the stock market’s resilience. Despite ongoing volatility, markets have held strong, and revised GDP data from the second quarter now shows annualized growth of 3.8%, up from the initial 3.1%. For those pointing to signs of economic strength, these are the numbers they’ll highlight.

By all means, these are great signs, but on Main Street, the anticipation of the next bad sign that will shake us is exhausting. The positive news about the stock market is easily dismissed as being driven by AI and concentrated growth among only the top 7 firms. Similarly, GDP growth is dismissed due to AI investments, capital infrastructure in data centers, and the collapse of imports, which will eventually lead to reduced consumption once inventories are depleted. Murmurs of an AI bubble are starting to bubble up.

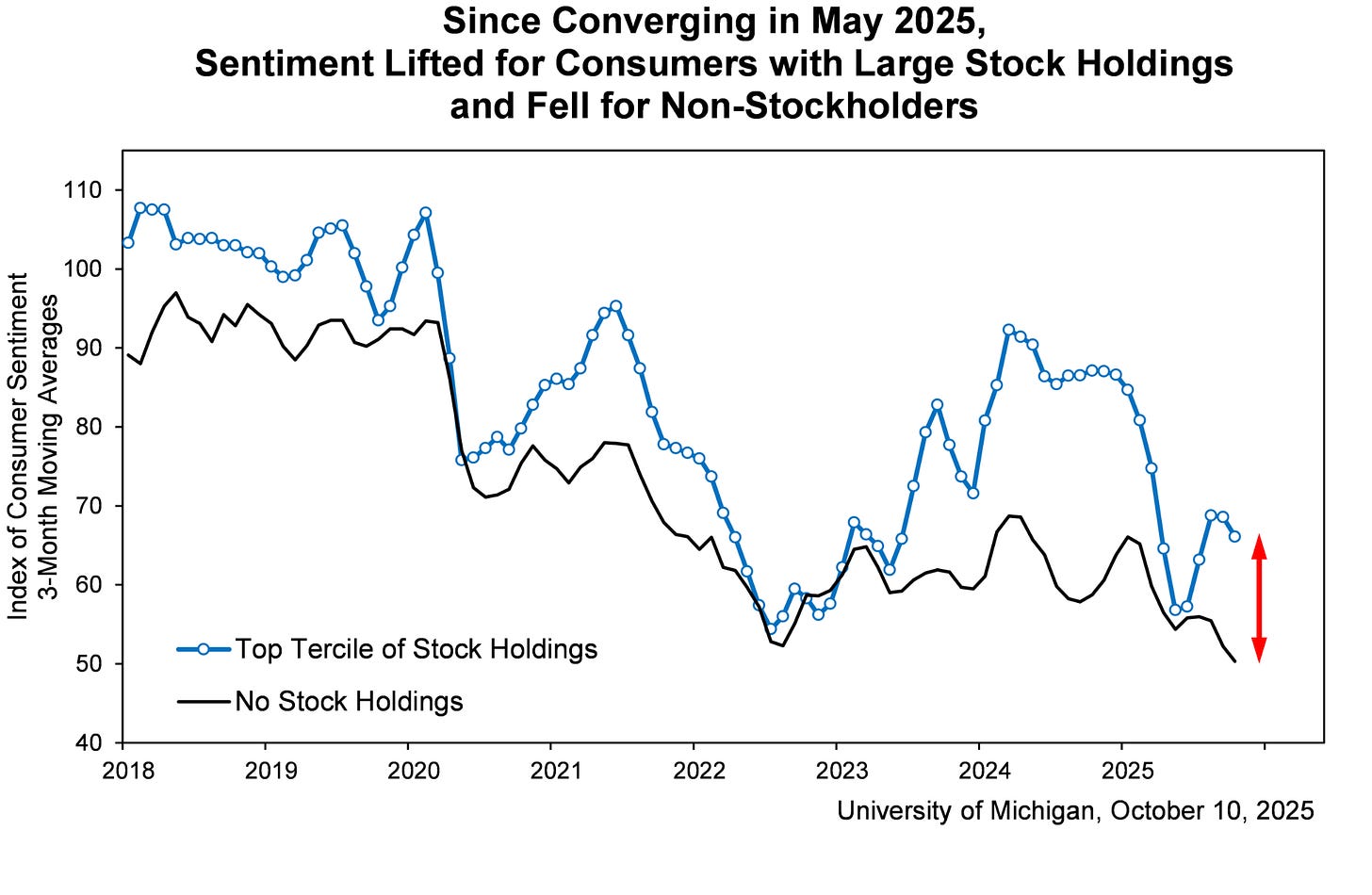

Consumer sentiment has been falling since January. However, there is a divide between the sentiment of consumers holding stocks and those without stocks. Those with stock market wealth are the ones fueling consumption in the U.S economy. The wealth effect is keeping us afloat, and overall sentiments are higher than they would otherwise be. The state of the economy is driven by how the affluent feel, and our future depends on them maintaining their sense of wealth.

What to Watch

Friday will offer another chance to gauge how regional banks are faring, with a slew of companies set to report their earnings, including Comerica and Fifth Third Bank, among others.

The Bottom Line

We will be holding our breath and looking for cockroaches. That is the current state of the economy.