Making Sense of the Jobs Report

Is it good, bad, or both?

The January jobs report caught me off guard.

At 8:30 am, when the Bureau of Labor Statistics released the Employment Situation report, I hit record and captured my immediate reaction. If you watch the video below, you’ll see the surprise in real time.

This report also lets me respond to a great reader request.

Stephen Day once asked if I could take the same data release and “play both sides” — make it sound great and make it sound terrible.

Challenge accepted.

The Great

At first glance, this was a rosier-than-expected report.

Last month’s job creation came in at 130,000. That was stronger than forecasts. If you were bracing for a slowdown, this feels reassuring. The economy is growing!

Several industries showed real momentum. Health care led job gains in January, adding 82,000 positions. Social assistance rose by 42,000. Together, those two categories accounted for almost all net job creation. Construction also added 33,000 jobs.

The unemployment rate fell to 4.3%.

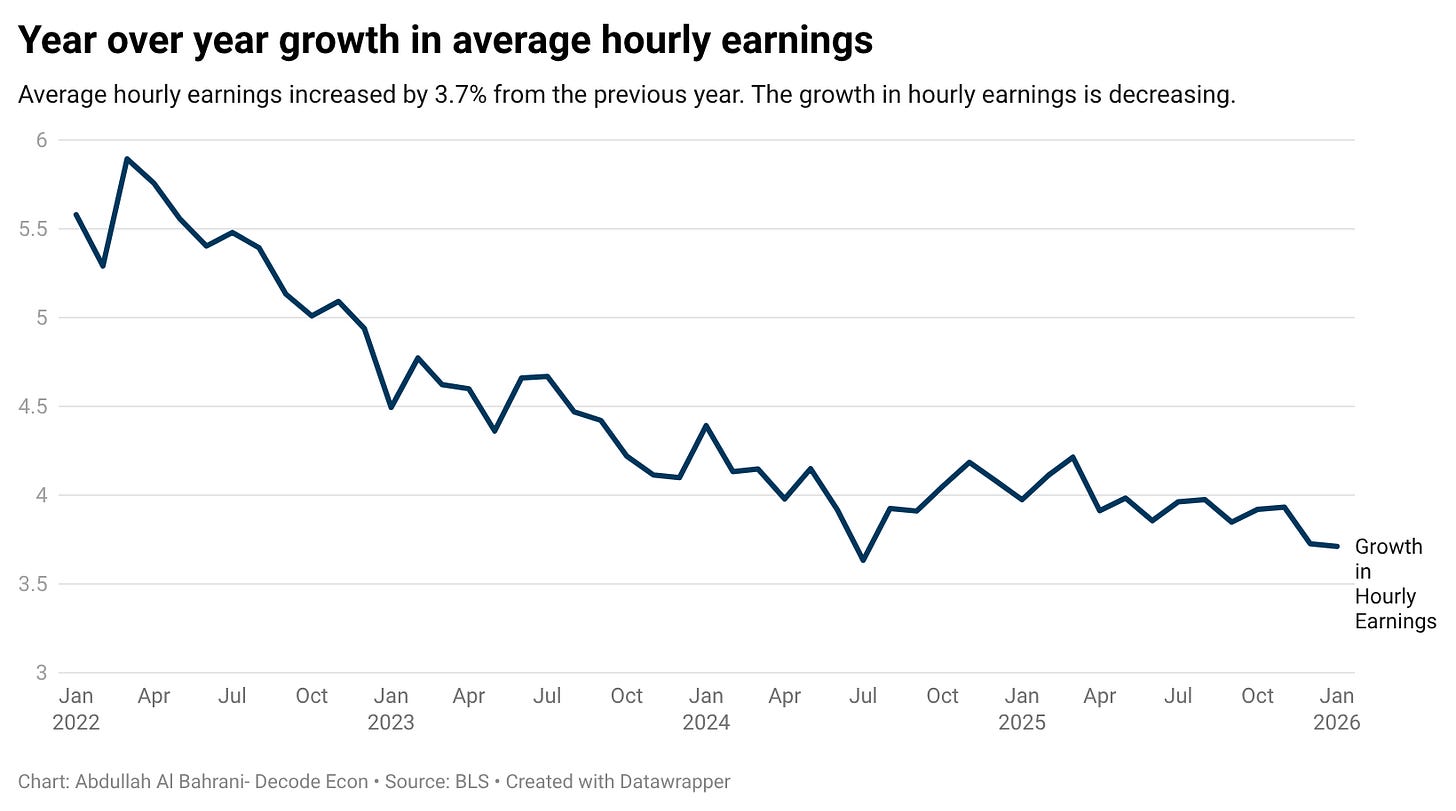

Average hourly earnings increased 3.7% from a year ago.

The role of AI in “taking jobs” might be overstated. As Ashby Drummond from BE NKY mentioned in his recap on LinkedIn

Despite ongoing headlines, AI-driven employment replacement is not meaningfully showing up in the data, at least not yet. AI-attributed layoffs totaled roughly 55,000 in 2025, just 4.5% of all layoffs. In many cases, “AI” appears to be a narrative choice — signaling innovation to investors rather than acknowledging corrections from post-pandemic overhiring.

If you want a positive narrative, it’s right there: jobs are being created, wages are rising, AI isn’t taking jobs, and unemployment remains historically low.

That sounds like a solid labor market.

The Bad

But the real story may not be January.

It’s the revisions.

The BLS also released benchmark revisions for the past year. Those revisions show that the Trump administration created only 181,000 jobs in its first full year — 69 percent fewer jobs than the administration’s initial estimate of 584,000, and roughly 900,000 fewer than in the last year of the Biden administration.

That is not a small adjustment.

It reshapes the narrative about the labor market's strength over the past year.

Wage growth, at 3.7%, is also slower than what we saw during 2022–2024. Earnings are still rising, but momentum has cooled.

And while 130,000 jobs beat expectations, it’s not a blockbuster number. Some economists already expect that, as with much of the recent data, it could be revised lower in the coming months.

Good or Bad?

Here’s the economic lesson.

The same data can support very different stories.

If you’re optimistic, you see steady job creation, falling unemployment, and positive wage growth.

If you’re cautious, you see slowing wage momentum, heavy reliance on health-related sectors, and major downward revisions that suggest the labor market was weaker than we thought.

Whether you think this is a good or bad report likely reflects your prior beliefs about the economy.

My view?

This report created more confusion than clarity about where the U.S. economy is heading. And that uncertainty, not the headline number, may be the most important takeaway.

The Video

Below is the video of “an economist reacts to the jobs report.” If you want my unfiltered, behind-the-scenes reaction as the data came in live, this one is for you.

I listened to the Inside Economics podcast last week to prepare for this job report, and a lot of what you have above echoes what they were discussing. The only real difference is that they were expecting much lower numbers than what we saw.

The devil is in this single note at the bottom of the release - "the January response rate of 64.3 percent was below average."

Add in the change in methodology to the Birth-Death Rate Modeling and the variances are going to be ugly when the revisions hit in April. Seasonality always leaves January and July as ugly numbers that can be explained away by post-holiday realignment and summer shifts in employment (education since teachers are typically contract work that affects July/August numbers).

Health care is showing immigration in hiring data. Native born population filling in gaps?

*Really a political win, cheer the headlines and ignore the revisions.