What's Your Money Secret?

Talking about money is taboo

Lately, I have been critical of financial literacy education. Do not get me wrong: it is more important than ever to understand money and how it works, but I struggle with the financial education curriculum.

One issue I have is that we spend a lot of time teaching people how money works, but we spend almost no time teaching how money feels.

The psychology of money, behavioral traps, emotional weight, and lived experiences behind financial decisions are largely absent from how we teach personal finance. And that absence helps explain a quiet, shared feeling many people carry: No matter how hard I try, I’m still failing with money.

Money is emotional; it carries baggage from experiences, and those emotions must be addressed.

The Problem

Most personal finance education focuses on mechanics: budgeting, saving, credit scores, and investing. Those tools matter. But they’re built on a flawed assumption, that people approach money as calm, rational decision-makers.

People bring emotions into every financial choice:

Fear

Shame

Pressure

Embarrassment

Responsibility

They bring childhood memories of scarcity or instability. They bring unspoken expectations to support others. They bring mistakes they never talk about. Those economic scars impact decision-making and strategy.

Don’t Talk About Money

We are taught that money is private and that discussing it is taboo. That struggle and fear should be hidden. If others knew the truth, we might be judged as irresponsible or unstable. So we remain silent and try to figure it out on our own. Everyone is trying to figure out their finances in secret.

That silence is costly. It shows up as anxiety, avoidance, repeated mistakes, and cycles that are hard to break.

However, some educators are working to change that.

The Innovation: Money Secret

Money Secret, created by Wally Luckeydoo, Ed.D., is an innovative approach to personal finance education that starts where most curricula stop: lived experience.

Wally designed Money Secret after years in classrooms, observing the same pattern: students struggling not because they lacked information, but because they carried financial stories they had never been given permission to discuss. Shame, fear, pressure, and responsibility shaped their decisions long before they ever learned about budgets or credit scores.

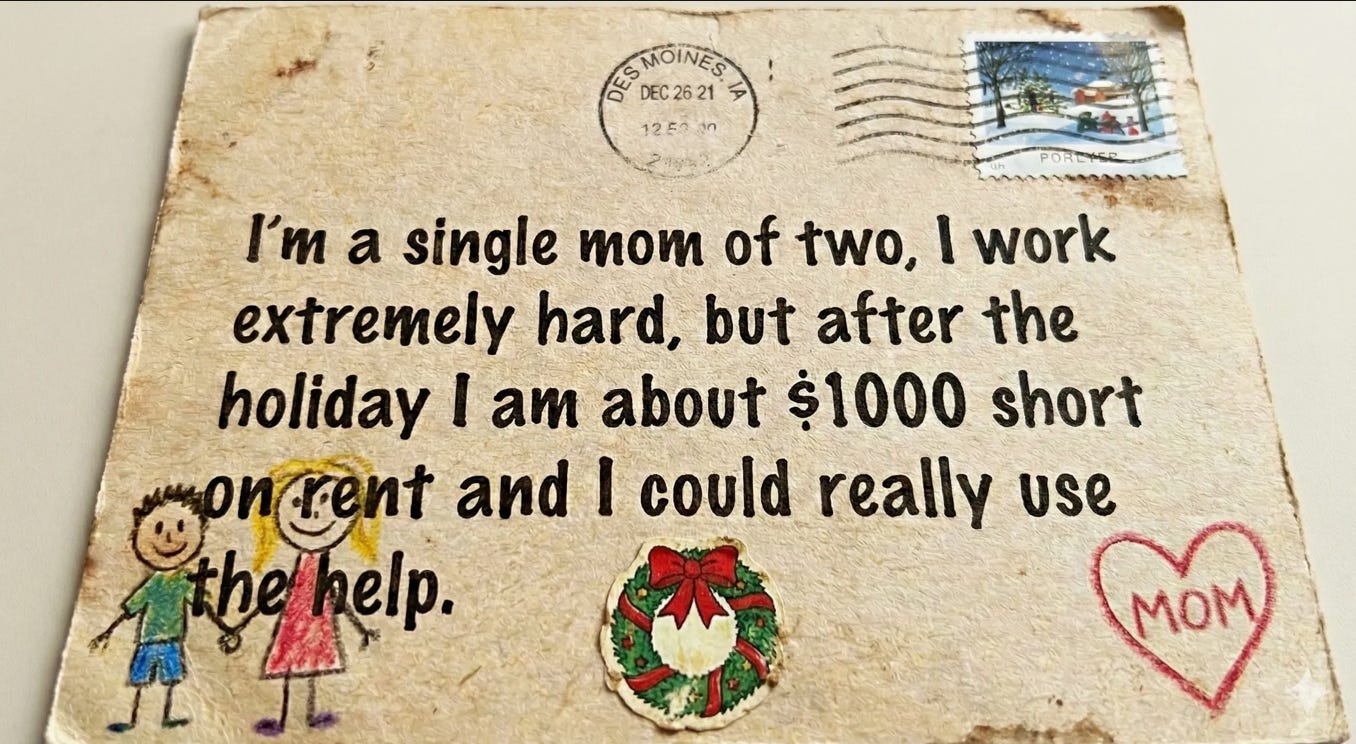

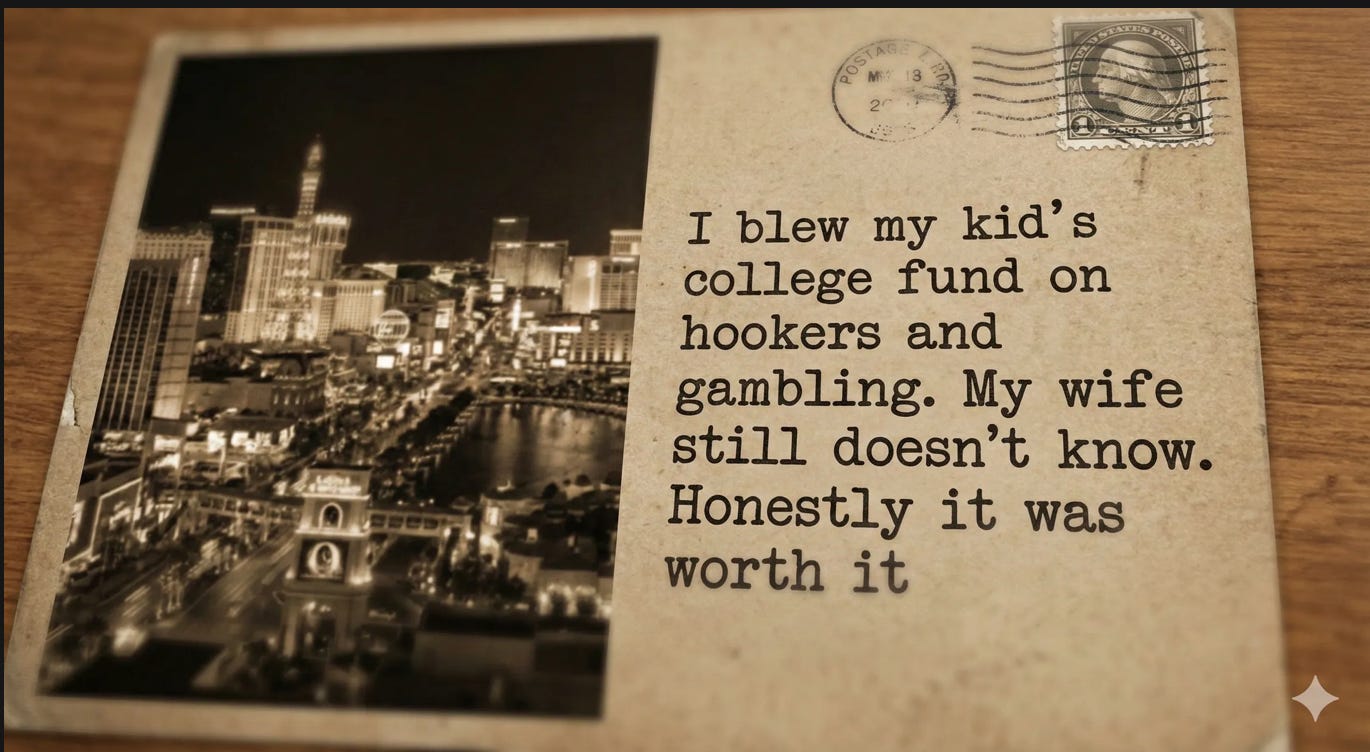

Money Secret creates a safe, anonymous space for people to share those experiences. A money secret can be hidden debt, childhood scarcity, pressure to support family, money-related guilt, or fear of instability. These stories are shared exactly as written—no edits, no judgment—and paired with AI-generated images that convey emotion without altering the message. They serve as conversation starters.

This is what makes Money Secret innovative: it treats financial behavior as human before it treats it as mathematical. By surfacing real stories, the project helps people recognize patterns, reduce shame, and understand that their financial choices didn’t come from nowhere. Experiences, good and bad, shape how we feel about money.

For educators, counselors, and administrators, Money Secret becomes a powerful entry point into financial literacy. It opens conversations that students are already carrying silently and connects economic concepts to the realities shaping their decisions every day.

Talking about money is no longer taboo, and we do not need to feel alone.

Step Into the Conversation

Money Secret is open to everyone.

You can share your story anonymously by:

mailing a postcard to MoneySecret, P.O. Box 158, Smyrna, TN 37167, or

submitting online at www.moneysecret.net

Follow on LinkedIn

If you teach, mentor, or support people navigating financial stress, this project belongs in your toolkit.

No one should carry their money story alone.

The Bottom Line

Financial literacy doesn’t fail because people are bad at math. It fails when we ignore the emotional experiences shaping every decision. If we want better financial outcomes, we have to start by letting people tell their stories. Otherwise, the only way we learn is through “learning by doing”, which is a costly way to learn about money.

What is your money secret?

Book Recommendation

From Amazon

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.

Money - investing, personal finance, and business decisions - is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.

In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics.

We just talked recently about a potential special issue of JET around teaching financial literacy. This sounds like a great future article and collaboration!

Yes! I agree and I'm happy to read this! Lack of knowledge is one of the smallest barriers I've found in my work, and all the tools you mentioned are vital and available to teach and share. And...we explore A LOT in sessions and workshops about thoughts/emotions surrounding the value of money, early money experiences, money shame, why we think certain things, and what is underpinning our actions. And more, because as another commenter wrote, it's a deep topic.

I appreciate the approach and book highlights. The book is part of my library for financial coaches, and I'll look at the Money Secret system. I support any system that elevates the highly personal nature of personal finance along with the mechanics.