Our Version of The 2016 Viral Trend

If you’ve opened Instagram or TikTok lately, you’ve already seen it.

Old photos. Saturated filters. Snapchat dog ears. The captions are nostalgic and reflective. The #2016 hashtag has already been used in over 1 million posts on TikTok and over 37 million posts on Instagram.

A throwback to a time that felt simpler. Before everything got expensive, political, and exhausting.

So we thought we would take our own look at the trend and revisit the economy in 2016 and the headlines that shaped the year.

Was 2016 actually a “good” economic year—or does it just look good in hindsight?

Let’s rewind.

What We Searched For

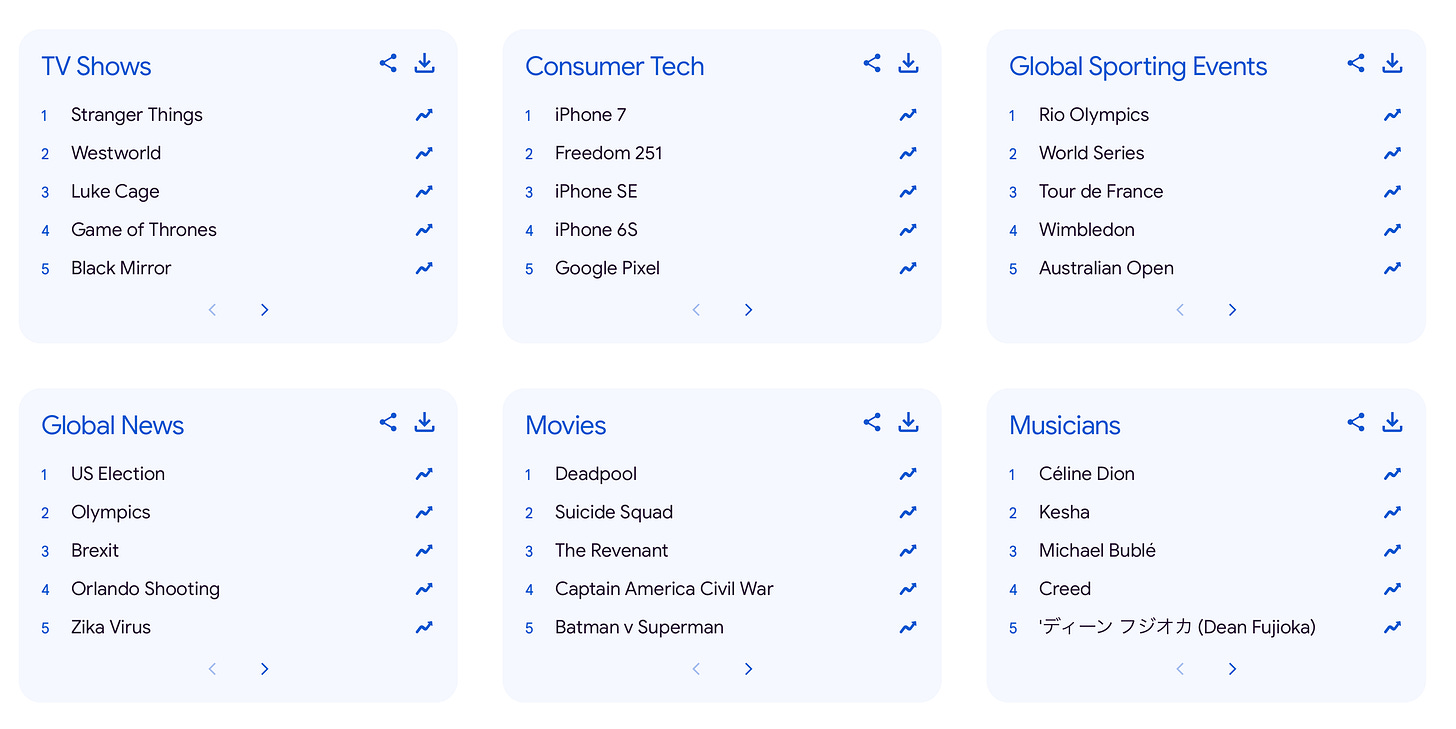

A glimpse into the trends of 2016 through search. We searched for Stranger Things, iPhone 7, the Rio Olympics, and the U.S. election. Below is a list from Google Trends.

Viral Trends in 2016

Pokémon Go: A mobile game that got people outside catching Pokémon with augmented reality.

The Mannequin Challenge: People froze in place like mannequins as a video played, often to Rae Sremmurd’s “Black Beatles.”

Musical.ly (TikTok’s Predecessor): Became hugely popular for lip-syncing videos, featuring popular Snapchat filters like the flower crown and dog ears.

Music: Dominated by The Chainsmokers (”Closer”), Drake, Rihanna, and “Broccoli” by DRAM and Lil Yachty.

Fashion: Skinny jeans, chokers, high-puff hairstyles, and bold, kohl-lined eyes were popular.

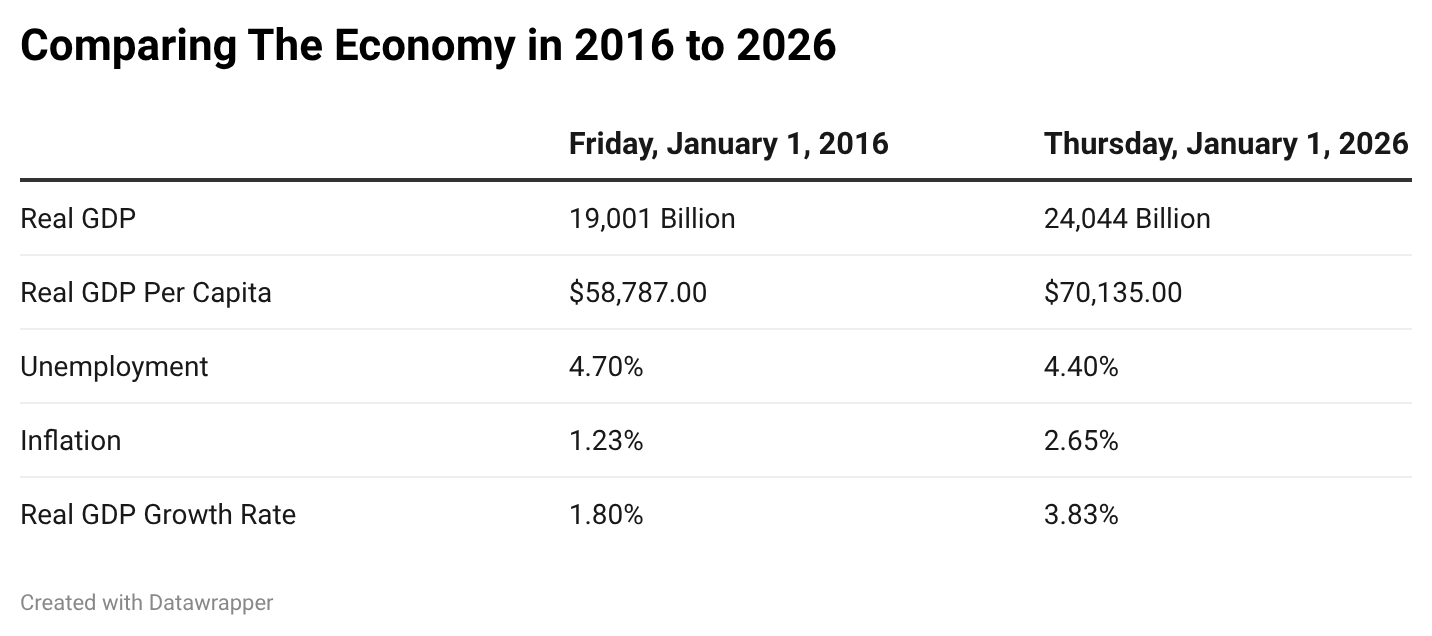

What the Economy Looked Like in Early 2016

By January 2016, the U.S. economy was deep into its recovery from the Great Recession, but it wasn’t exactly booming. Slow and steady would be a great way to describe it.

Growth was slow. Real GDP growth hovered around 1.8% for 2016, well below what most economists consider a healthy long-run pace. Consumer spending was solid, but business investment was weak.

Inflation was quiet. Prices were rising, but slowly. Inflation stayed below the Federal Reserve’s 2% target, helped by falling oil prices and weak global demand. At the time, we were more worried about too little inflation than about too much.

The labor market looked good. The unemployment rate was around 5% in January 2016, falling steadily from its post-crisis peak. Job growth averaged close to 190,000 per month over the year.

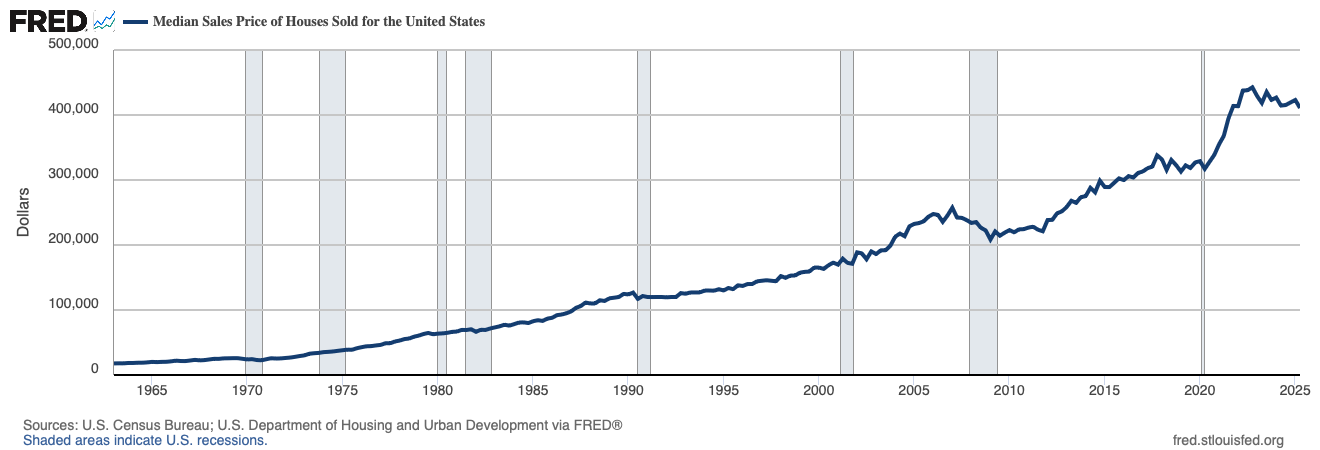

Median House Sales Price. The median home sales price in Q4 of 2016 was $310,900. Today, median home sale prices are up $100,000 to $410,900.

The Headlines That Defined the Economy in 2016

Oil Crashes, Then Rebounds

Oil prices collapsed from nearly $100 per barrel in 2014 to below $30 in early 2016, dragging energy stocks and broader markets down with them. The fear wasn’t just cheap gas; it was global demand slowing and a potential recession signal.

By the end of 2016, oil rebounded above $50 after OPEC agreed to cut output, reminding investors of a recurring lesson: commodity markets overshoot in both directions.

Brexit Shocks Global Markets

In June 2016, the U.K. voted to leave the European Union. Markets reacted instantly. The British pound plunged. Global equities sold off. Then, almost as quickly, U.S. markets recovered.

Brexit became a case study in political risk vs. economic fundamentals. The uncertainty was real, but the U.S. economy was insulated enough to rally back.

The IPO Market Goes Cold

2016 was the worst IPO year since 2003, with funds raised down roughly 40%. Valuations, especially in biotech, had run too far ahead of fundamentals.

When volatility rises, investors first retreat from risky assets. Newly public firms pay the price.

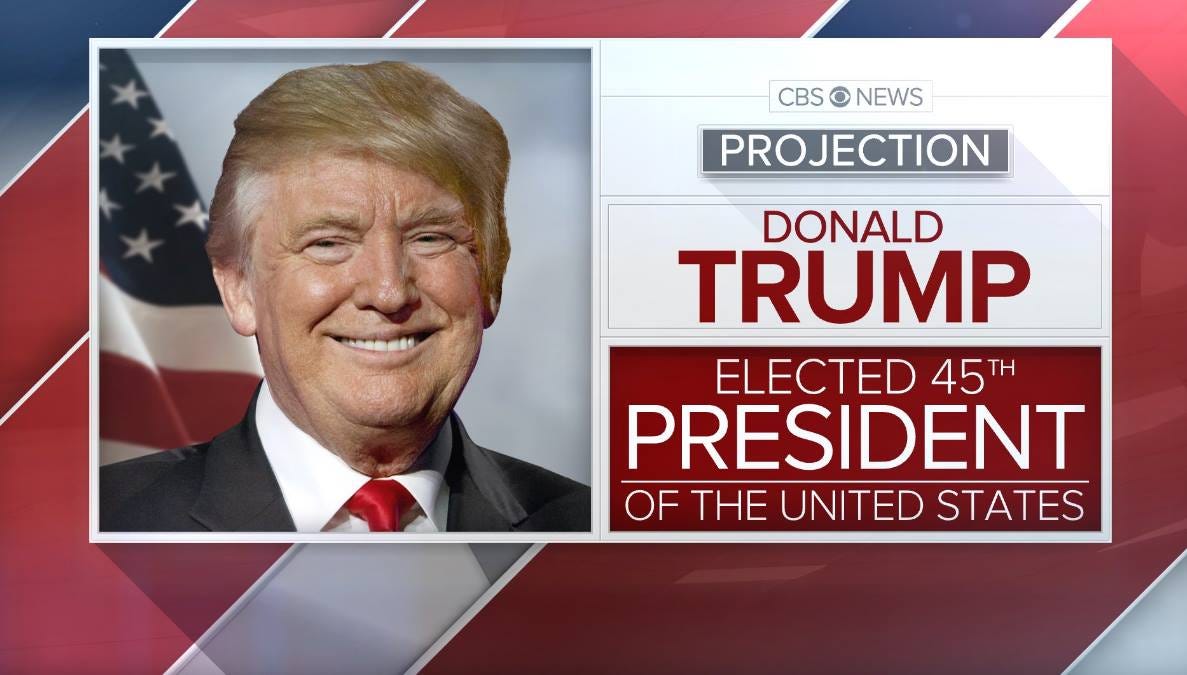

The Trump Election and the “Trump Bump”

Election night shocked markets. Futures plunged—then reversed sharply.

After Donald Trump’s victory, stocks surged into year-end as investors priced in tax cuts, deregulation, infrastructure spending, and higher inflation. Major indices gained 6–12% in the final weeks of the year.

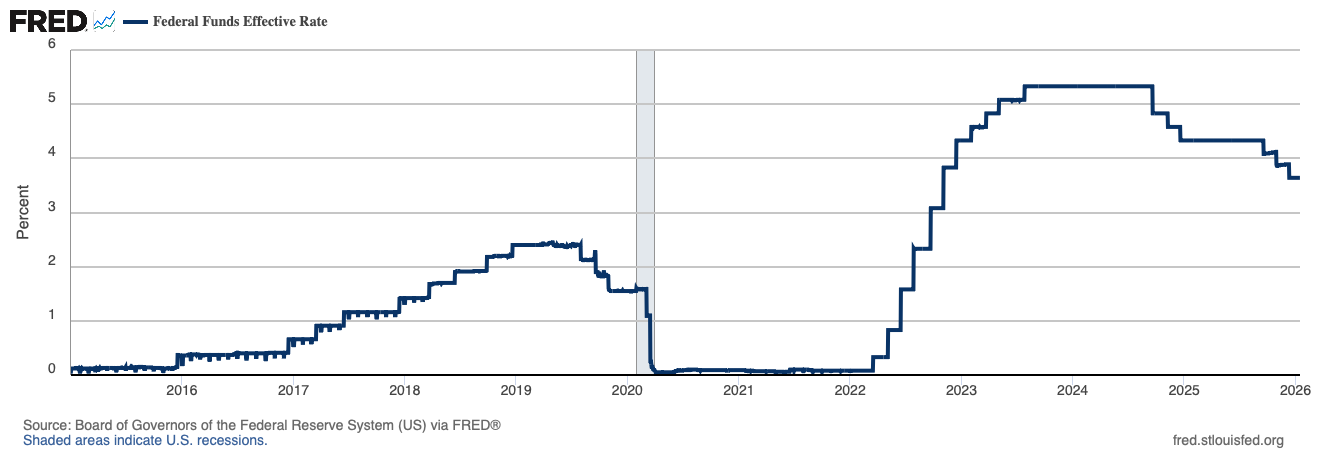

The Fed Raises Rates (Again)

In December 2016, the Federal Reserve raised interest rates by 25 basis points, only the second hike since the Great Recession.

At the time, this was seen as a sign of confidence: unemployment was low, housing prices were rising, and the recovery felt durable, even if growth was modest.

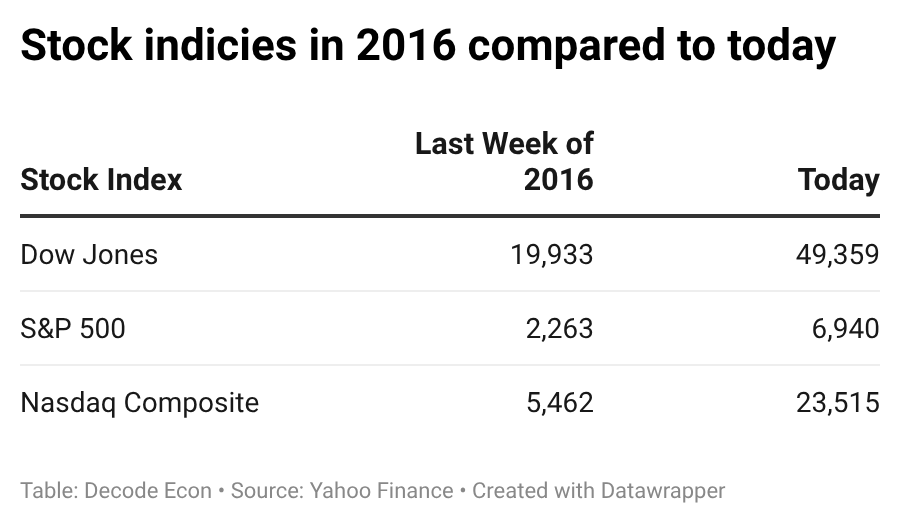

Stock Markets

As markets surged late in the year, the Dow flirted with 20,000 for the first time.

It meant very little economically, but psychologically, it mattered a lot. Investors love round numbers.

Corporate Scandals and Structural Lessons

The EpiPen Pricing Scandal

Mylan faced public outrage after raising the price of the EpiPen by more than 400%. Congressional hearings followed, and executive pay became part of the story.

Economic theme: Market power, inelastic demand, and the limits of “pricing freedom.”

Wells Fargo’s Fake Accounts

Wells Fargo was exposed for opening millions of unauthorized customer accounts. Thousands of employees were fired. The CEO resigned with over $130 million in compensation.

Economic theme: Incentives matter. Bad incentives scale bad behavior.

Samsung’s Exploding Phones

Samsung recalled the Galaxy Note 7 after battery explosions, costing an estimated $3 billion.

Economic theme: Product risk, reputation costs, and global supply chains.

Tech, AI, and the Seeds of the 2020s

AI Enters the Mainstream. 2016 marked the rise of AI-powered consumer tech, such as Amazon’s Echo.

Mega Deals Signal Platform Power

Microsoft bought LinkedIn for $26.2B

Tesla acquired SolarCity in a controversial deal

The Bottom Line

The “2026 is the new 2016” trend tells us more about today than it does about 2016.

While everyone posts their personal pics and reminisces about 2016, we thought this would be a great opportunity to look through our economic history.

What do you remember most about the economy in 2016?

My Professional 2016 Review

In 2016, I was in my third year at Haile College of Business. I was experimenting with several innovative programs.

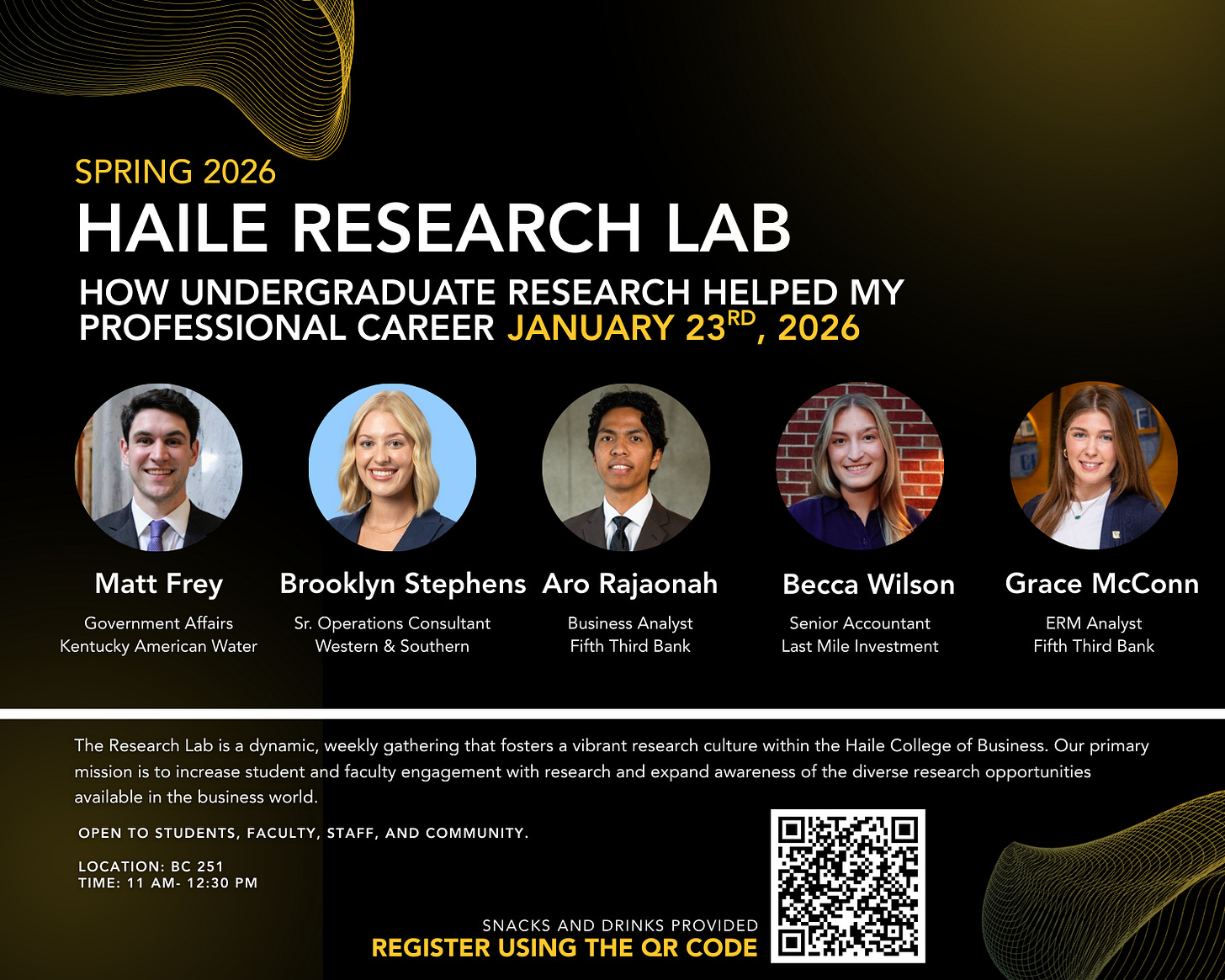

First, Matt Frey (pictured above) and I started the Fellows program. It was the start of what is now the Haile Research Lab. Matt was my first research assistant. He and Jacob Koors helped us get started. Matt is back on campus this week to discuss his experience and how research has helped his career.

Second, Econ Beats was an innovative project-based learning program to teach econ students. The program matched econ students with Electronic Media and Broadcasting (EMB) students to remake a popular music video into an economics video. I miss this project, and I miss working with the faculty from EMB.

Third, the Center for Economic Education started working on the Danny Dollar Academy. That program went on to serve 5,000 4th and 5th-grade students annually and partner with the Federal Reserve Bank of Cleveland, the Mississippi Council for Economic Education, and author Ty Allan Jackson.

The Goldshirt was a movement to help students learn about economics and entrepreneurship. It served as the stepping stones that would eventually be The Econ Club and The Emerging Leaders Club today.

As I reflect on my professional career, innovative economic education appears as the cornerstone of my work. I am motivated to make an impact by serving others and finding new ways to create community.

This was a great reflective exercise. How was your 2016 professional career?

Wow! What a blast from the past, on several fronts! Thanks for the trip down memory lane this morning.

Wow . A lot of things happened and some stayed while others vanished . Glad your work and inovation stayed with an impact on students. A great coverage.