Rare-Earth Minerals and Trump's Tariffs?

Trade wars escalate and markets experience policy fatigue

Trade wars often start as a strategy, where each move is a calculated step meant to gain leverage. But when no one backs down, strategy gives way to impulse. What’s left are two countries announcing unpredictable policies, not to win, but to inflict pain.

That’s where the U.S.–China trade conflict stands today. What began as a series of tit-for-tat tariffs has escalated into a full-blown standoff that threatens long-term global stability. At this point, there’s no clear path to resolution. Friday’s developments were a reminder of just how chaotic U.S. trade policy has become, and how cornered Washington now finds itself.

The Problem: Rare Earths Become a Weapon

Friday was a rough day for markets. President Trump announced new tariffs on China after Beijing restricted exports of rare-earth minerals. Rare-earth minerals are essential components in semiconductors that power everything from artificial intelligence to home appliances.

Rare earths aren’t actually rare, but China dominates their production. According to the International Energy Agency, 61% of global mining and 92% of processing take place in China. These elements are critical to U.S. defense systems; they are used on everything from fighter jets and submarines to advanced laser technologies.

By tightening its grip on these exports, China is weaponizing America’s dependence on its supply chain. This escalated tensions and is a move that takes the trade war to a new level.

The Market Reaction

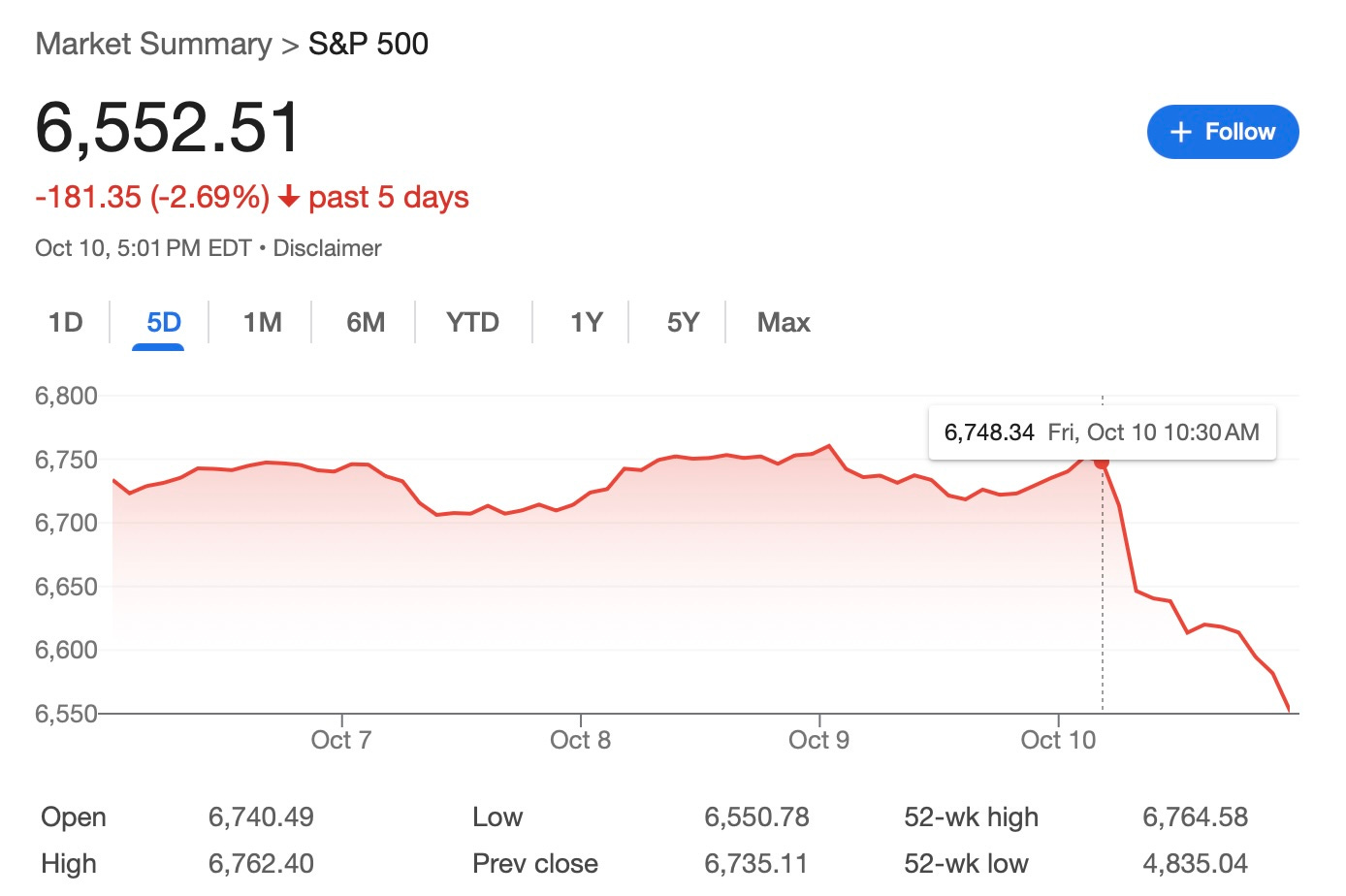

President Trump took to social media and threatened new tariffs on China, triggering a stock selloff on Friday. The Dow Jones Industrial Average tumbled 385 points, or 0.8%. The S&P 500 fell 1.25% and the tech-heavy Nasdaq dropped 1.75% by the end of the day.

Markets have been remarkably resilient up to now. But this latest round feels different. The fatigue is showing. Investors are starting to question whether these trade battles strengthen America’s long-term economic position or inject more uncertainty into global markets.

The Bottom Line

Trade wars rarely end cleanly. They ripple through supply chains, raise prices, and unsettle investors. As the U.S. and China dig in, global markets are watching for signs of strain and bracing for fallout if neither side steps back.

The bigger risk for Washington is policy fatigue, as investors and firms grow weary of reacting to every shift in trade rhetoric. So far, markets have been forgiving; equity prices remain surprisingly resilient. But patience isn’t infinite, and the longer uncertainty drags on, the harder it becomes to maintain confidence.

Keep an eye on the markets today. Will investors shrug off the latest trade headline as they’ve done before, or is this the moment sentiment finally cracks?

More on Economic Calendar Below

Share this post and help others make sense of the economy — one story at a time.

On the Economic Calendar

Thursday was supposed to be a big day for economic data, but we will miss several key reports due to the ongoing government shutdown, now entering its second week. If the stalemate continues, it will soon become the fourth-longest shutdown in U.S. history, and the data blind spots will start to impact decision makers.

Employment Data

Initial jobless claims (week ending Oct 11)

Inflation Indicators

Producer Price Index (PPI), September

Expected: +0.3% (m/m) | Previous: –0.1%

Year-over-year: 2.6% expectedCore PPI (excluding food & energy)

Expected: +0.3% (m/m) | Year-over-year: 2.8% expected

Consumer Spending

Retail sales, September

Expected: +0.4% | Previous: +0.6%Retail sales excluding autos, September

Expected: +0.4% | Previous: +0.7%

Business Activity

Business inventories, August

Expected: +0.2%

As the shutdown drags on, the lack of official data is creating a feedback problem: policymakers, investors, and businesses are forced to make decisions without visibility. The longer this goes on, the more the economy operates on speculation rather than evidence.