The Bifurcated Economy

Tell us about your economy

In 2008, Meredith Whitney became known as the “Oracle of Wall Street” after predicting the financial crisis. Today, she’s sounding the alarm again, warning that the U.S. economy is already experiencing a downturn, one that is already impacting some of you more than others.

Her take highlights what she calls a bifurcated economy, where the affluent continue to fuel spending, while seniors and lower-income households face rising debt, stagnant incomes, and limited options.

Meredith’s View: Two Economies, One Country

If you have followed the discussions on kyla scanlon’s Vibe Economy or social media’s dismal take on the state of the economy, then you are familiar with the argument. Whitney argues that we’re not all living in the same economy:

High-end consumers, what she dubs the “avocado toast generation”, continue to drive spending and keep retail numbers afloat.

Lower-income households and seniors are dealing with declining after-tax incomes and higher debt burdens.

Housing as a Flashpoint

In recent interviews, she has highlighted some areas of weakness in the economy. Here is a summary:

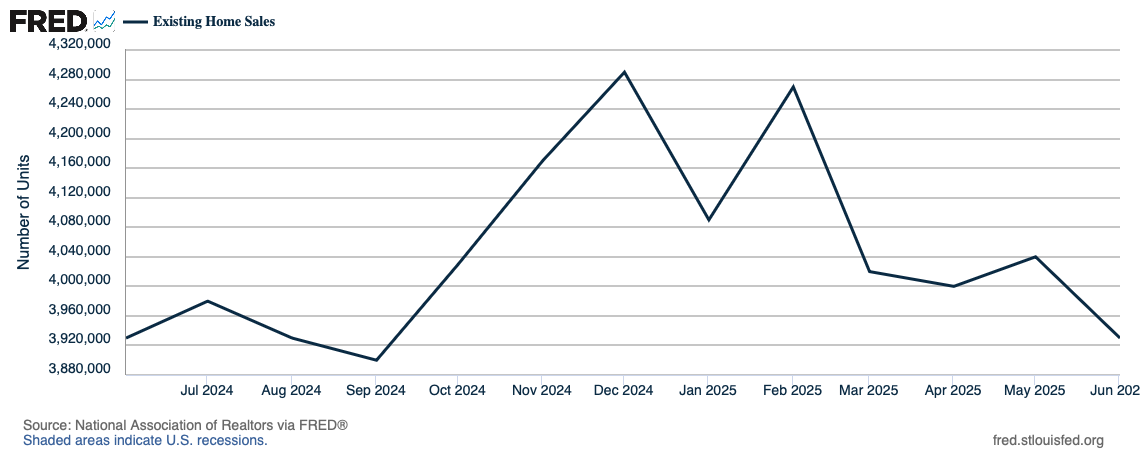

Existing home sales are on pace for their worst year in decades, with annual sales expected to drop below 4 million units, the weakest since 2009.

Housing impacts GDP beyond just the sale itself. Families who move typically spend on furniture, renovations, and home goods. The National Association of Realtors estimates that over 14% of GDP is tied to home sales. Weakness here ripples throughout the economy.

Seniors own over 60% of existing homes and are choosing to “age in place.” With only 1 in 10 seniors able to afford assisted living, many are instead tapping into home equity to cover costs and stay put.

Consumer Confidence and Inflation Expectations

For the past several years, Economists have struggled to explain the disconnect between the consumer sentiment (The Vibes) and consumer spending. The American consumer continues to spend, despite declining expectations. Recent University of Michigan survey data shows:

Consumer sentiment has slid back to levels not seen since the inflation surge three years ago. The recent Michigan survey index is at 58.6. That’s a 5.5% month-over-month decline.

Year-ahead inflation expectations rose sharply—from 4.5% to 4.9%—well above the current 2.7% inflation rate.

Notably, these concerns cut across political lines, suggesting households across the spectrum are feeling squeezed.

Consumer spending accounts for about two-thirds of U.S. economic activity. If sentiment continues to sour, even affluent spending won’t be enough to offset declines elsewhere.

The Bottom Line

Whitney’s warning is clear: while top-line economic data might suggest resilience, parts of the economy are already in recession-like conditions. The affluent keep consumption numbers elevated, but seniors and lower-income households are struggling with debt, stagnant wages, and rising costs.

The split in economic experience matters because broad-based growth can’t survive on the spending of the few. If consumer sentiment continues to weaken and housing remains sluggish, the economy could face more turbulence than headline numbers suggest.

How is the economy treating you? What are your current economic concerns? Please drop a comment and tell us about your economy

Reader of the Month: Brian O'Roark

This month, we want to highlight Brian O’Roark, whose thoughtful engagement has made our community discussions even more meaningful.

In a recent chat, Brian shared that he follows Decode Econ for the

Lively discussions on the issues of the day .... from an economist's viewpoint of course.

Thanks to you and all the community members that continue to engage and share our posts.

About Brian:

Brian O’Roark received his Ph.D. in economics from George Mason University. He is the author of dozens of scholarly articles in areas such as public finance, the economics of information security, and economic education. He serves as an associate editor for the Journal of Economics Teaching, and is the editor of the Economics and Popular Culture Series for Routledge Press. He has won the Mid-Atlantic Association of Colleges of Business Administration Innovative Teaching Award and a Best in Class Teaching Award from the National Economic Teaching Association. At Robert Morris University he has won the Undergraduate Teaching Innovation Award and the President’s Award for Outstanding Teaching. His first textbook, Essentials of Economics, is available from WW Norton Publishers, and his book, Why Superman Doesn't Take Over the World: What Superheroes Can Tell Us About Economics, is available on Amazon.

You know what I'd love to see from Decode Econ? One newsletter arguing that the economy is really strong, and another one arguing that it's really weak. The strongest evidence from each perspective. Please please please?

Sentiments matter. Consumer Sentiments are what we reminds us that economics is a social science. People wont spend what they feel they dont have.