The Economics of Attention: Why Netflix Wants Your Ears Too

The Podcast Battle

After months of speculation, Netflix is officially entering the world of video podcasting.

The streaming giant announced a partnership with Spotify that will bring 16 video podcasts to Netflix early next year. You will be able to access The Bill Simmons Podcast, Rewatchables, Conspiracy Theories, and Serial Killers.

The deal gives Netflix exclusive rights to full-length episodes and prevents them from appearing in full on YouTube, the platform’s biggest rival.

But economically, this partnership signals something deeper: a new front in the battle for your attention.

The Data

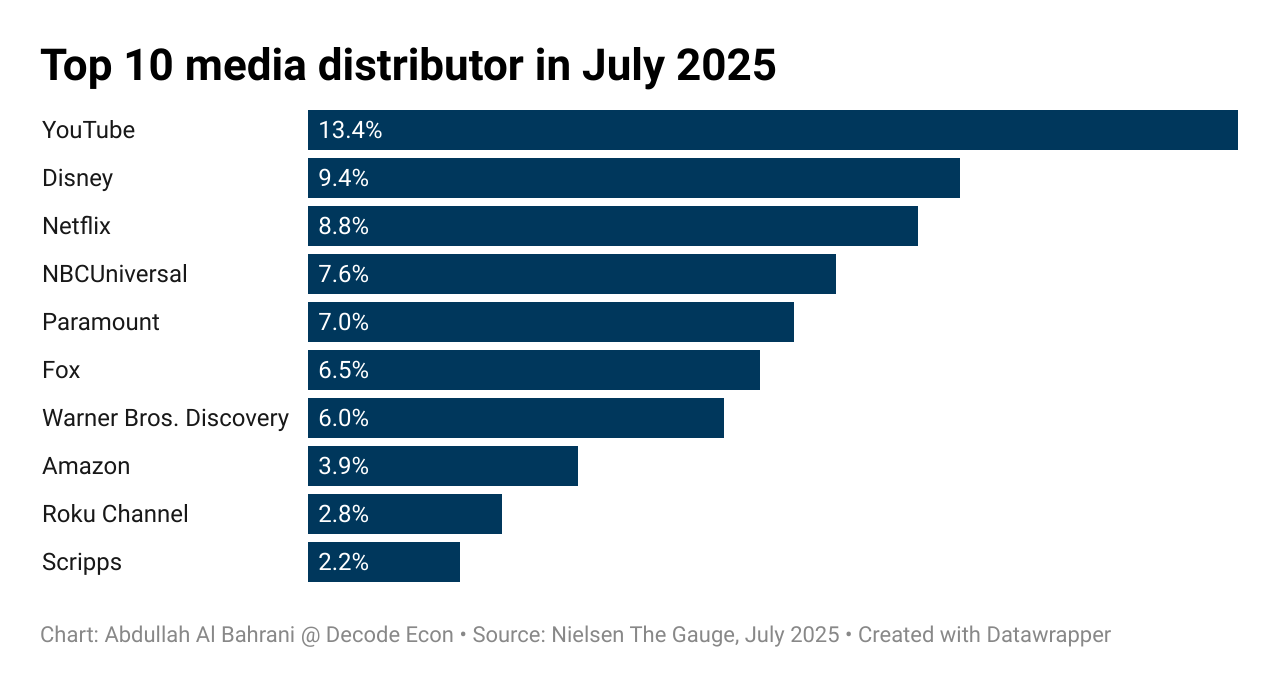

To understand why Netflix is expanding beyond shows, look at where viewers actually spend their time. YouTube still dominates the streaming landscape, followed by legacy studios and Netflix fighting for share.

With YouTube commanding more than 13 percent of total viewing, thanks mainly to video podcasts and creator clips, Netflix’s move is strategic. If it can pull even a small portion of that hybrid audience into its ecosystem, it gains millions of additional engagement hours.

The Economics of Scale

Netflix and Spotify are both searching for growth in maturing markets. Netflix dominates streaming video; Spotify dominates streaming audio. But both face the same pressure, high content costs, slowing subscriber growth, and intense competition for limited consumer time.

This deal offers both sides something they need:

Netflix gets cheaper, repeatable, “evergreen” content that can be consumed casually, not binged once and forgotten.

Spotify gains access to Netflix’s massive global video audience while retaining ad inventory and creator control.

Economically, this is a case of bundling and multi-sided markets in action:

Bundling allows Netflix to spread its fixed costs (servers, infrastructure, marketing) across new types of content.

Multi-sided markets connect creators, listeners, and advertisers, where each side’s value rises as the others grow, creating powerful network effects.

And behind it all sits data: podcasts reveal when users listen, multitask, and skip, all of which are valuable insights into daily attention cycles.

The Economics of Podcasts: A Tournament Market

The podcast industry is a textbook example of a tournament-style labor market. These markets have thousands of competitors, but only a few win disproportionately. The desire to win and reach the top keeps the suppliers entering the market. Sports athletes and actors know this market too well.

Spotify’s history shows it clearly:

2020 — Signed The Joe Rogan Experience for roughly $200 million.

2021 — Acquired Call Her Daddy for about $60 million.

By 2024, Spotify had shifted away from exclusivity after realizing that massive payouts didn’t always translate into platform growth.

In tournament markets, a handful of “superstars” capture most of the revenue while thousands compete for slivers of attention. It’s not a meritocracy of quality but of discoverability.

Netflix hopes to change that dynamic by using its recommendation engine to surface new podcasts, turning discovery into another engagement loop.

The Bottom Line

The real competition isn’t between Netflix and Spotify; it’s between both and everything else fighting for your time. Right now, YouTube is winning that battle.

Every partnership, ad-free tier, and podcast experiment is a play for habit formation. If Netflix succeeds, it will own not just your movie nights but also your background noise, the moments when you cook, commute, or clean.

Right now, YouTube is winning that battle. But the lines between video, audio, and social are blurring fast. YouTube, Netflix, and Spotify all see the same future: video podcasts as the next frontier for attention.

The attention wars are heating up, and it’s clear that podcasts are at the center.

Should Decode Econ start a podcast? I’d love to hear your thoughts. Reply, comment, or send me your ideas for what topics we should tackle first.

Where yotube wins and the other two fail is the large amount of diversity. Having so many creators means there is a market for everyone. I can say though that i have dicovered the more time i spend on myself the better the outcomes. Youtube is still my biggest sink but reading and learning is slowly gaining ground.

The attention economy angle here is fascinating - Netflix entering podcasts through Spotify isn't just about content diversification, it's about capturing different 'modes' of engagement. When people are commuting or doing chores, they can't watch video but can listen to podcasts. It's smart arbitrage of otherwise 'dead' atention time that competitors aren't monetizing effectively.