The Fed Cut Rates by Another Quarter Point

Labor market fears grow

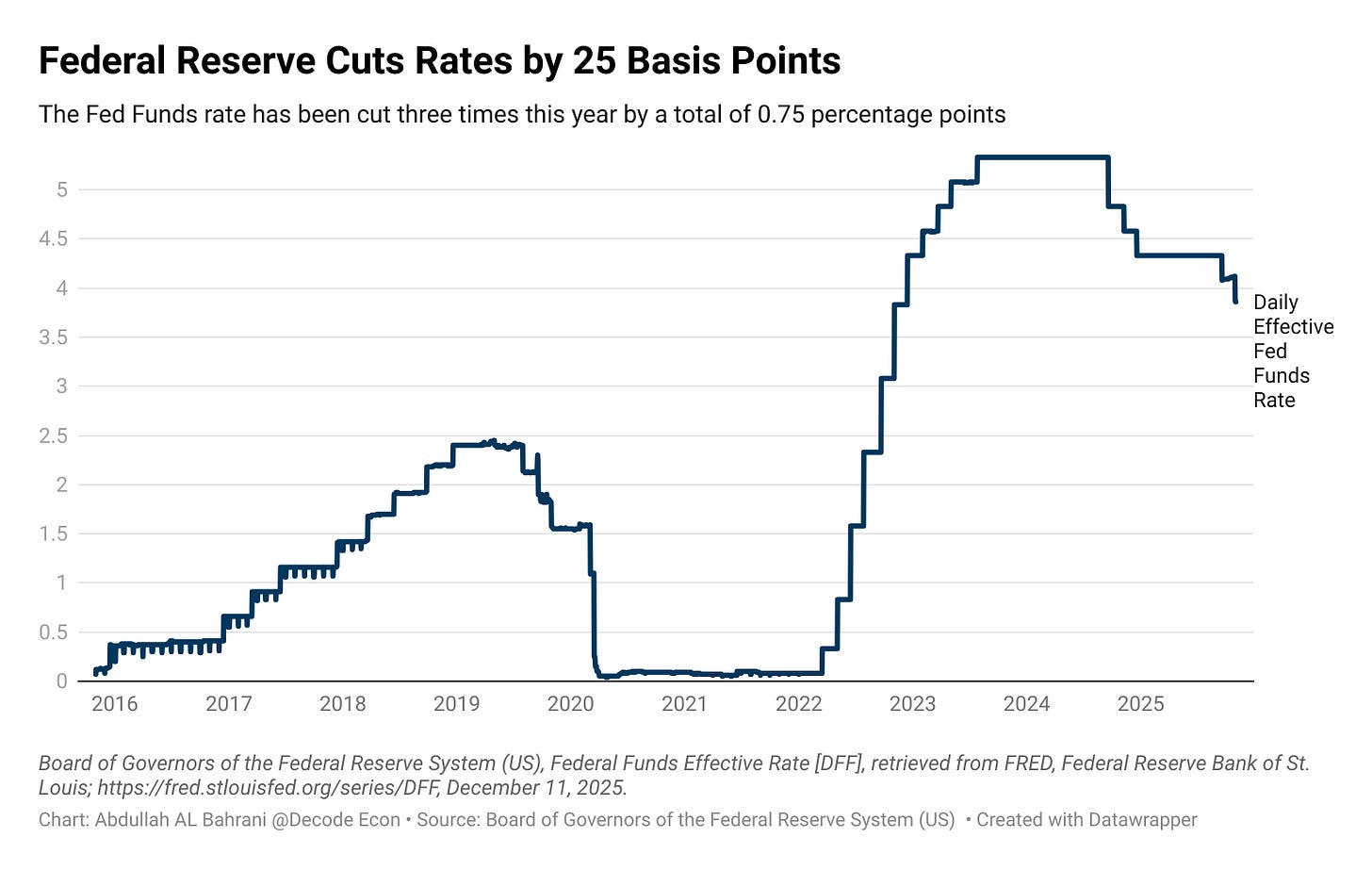

The Federal Reserve cut interest rates again by another quarter point. This brings the target range down to 3.5–3.75%. That means one thing: money just got cheaper.

What Rate Cuts Do

When the Fed cuts rates, borrowing becomes cheaper, and saving becomes less rewarding.

Borrowers (homebuyers, businesses, anyone with debt) benefit because their costs fall.

Savers lose some incentive to keep money parked in high-yield accounts as returns drop.

Investors tend to shift toward riskier assets in search of higher returns.

This is exactly what the Fed wants in a slowing economy. A rate cut is designed to spur more spending, more investment, and hopefully more economic activity.

Why the Fed Moved Now

The quarter-point cut signals the Fed is increasingly worried about the labor market. Their statement highlighted:

Elevated uncertainty about the economic outlook.

Rising downside risks to employment in recent months.

A willingness to adjust policy further if new risks emerge.

A 9–3 vote, with dissents split. Miran wants deeper cuts, Goolsbee and Schmid want no cut at all.

But here’s the tension: inflation is still sticky. The core PCE index rose 0.2% last month, which annualizes to about 2.8%, still above the Fed’s 2% target.

The Bottom Line

The Fed is prioritizing the labor market right now, even while inflation remains above target. For your wallet, this means:

Cheaper borrowing ahead

Lower yields on savings

More volatility as investors reposition

However, inflation remains a threat we need to monitor.

Reader Question

How worried are you about the labor market right now?

Do you agree with the Fed that weakening employment is a bigger concern than persistent inflation?

This has been quite the long “transition”.

The reason why it makes sense for an economist to support this cautious 25 basis point cut in part is that the inflation caused by tariffs is moderate. According to an October St Louis Fed analysis: "Over the June-August 2025 period, tariffs explain roughly 0.5 percentage points of headline PCE annualized inflation and around 0.4 percentage points of core PCE annualized inflation [of 2.8%]." (see https://www.stlouisfed.org/on-the-economy/2025/oct/how-tariffs-are-affecting-prices-2025#:~:text=Over%20the%20June%2DAugust%202025%20period%2C%20tariffs%20explain,explain%2010.9%25%20of%20headline%20PCE%20annual%20inflation.) Analysis by the San Francisco Fed suggests that while inflation in the first five months of 2025 were significantly a result of tariff effects on aggregate supply, since then the supply factor in inflation has been outpaced by demand effects; however, pass-through of tariff costs by suppliers has been slow, and so we may see inflation rise in 2026 (see https://economics.bmo.com/en/publications/detail/9e9142b5-607e-40ad-9716-9047612272f1/#:~:text=Surprisingly%2C%20the%20supply%2Ddriven%20shocks,emerge%20as%20public%20enemy%20%231.) So the Fed for now can focus on losses in the labor market.