The Hidden Scars of Recessions

How recessions shape our world view

When economists talk about recessions, headlines often focus on GDP, unemployment, or the stock market. However, for individuals, recessions are not just dips in the data; they have the potential to leave lasting scars.

Research indicates that downturns in childhood and early adulthood can have a significant impact on health, family, and financial outcomes decades later. Children in low-income families do worse in school, face more behavioral challenges, and have poorer health when household income falls. Young adults who graduate during recessions tend to earn less for years, delay starting families, and face a higher risk of long-term financial instability. Economists call this “scarring.”

The Generational Story of Recessions

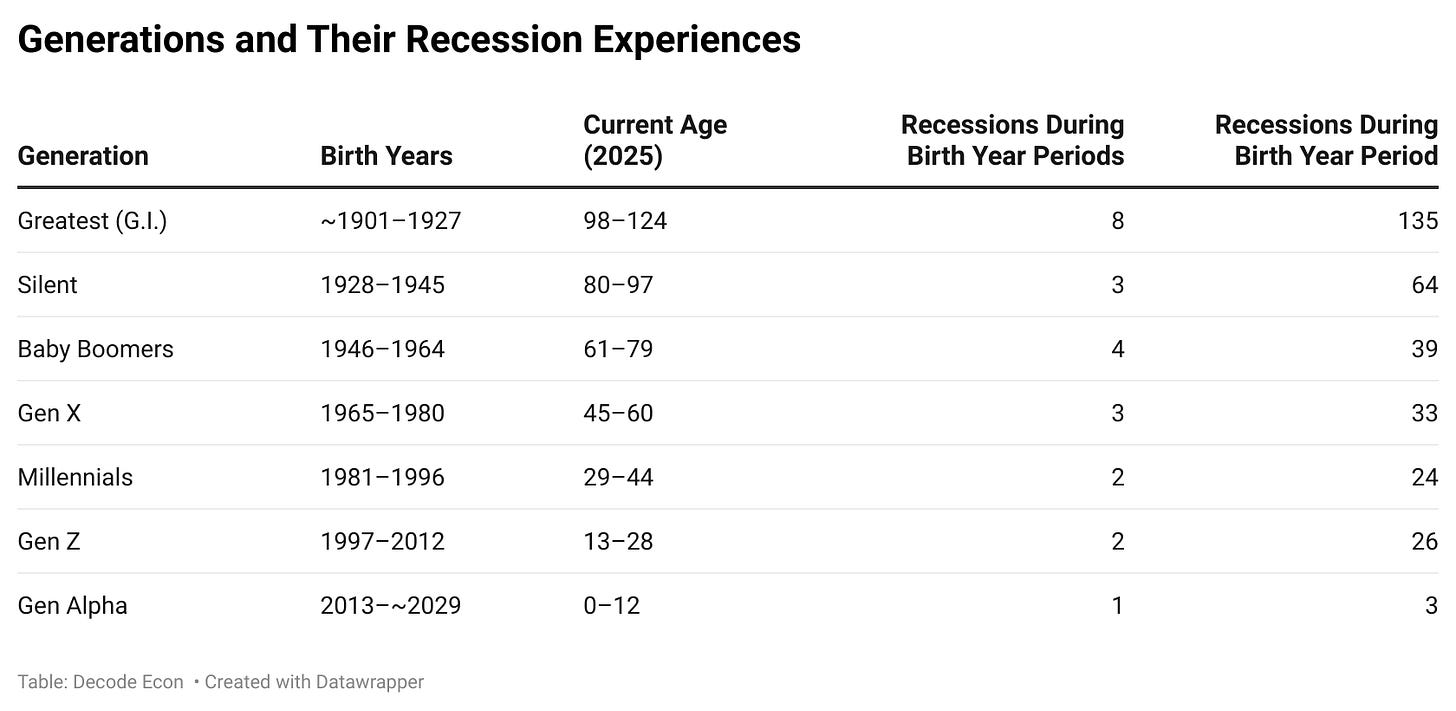

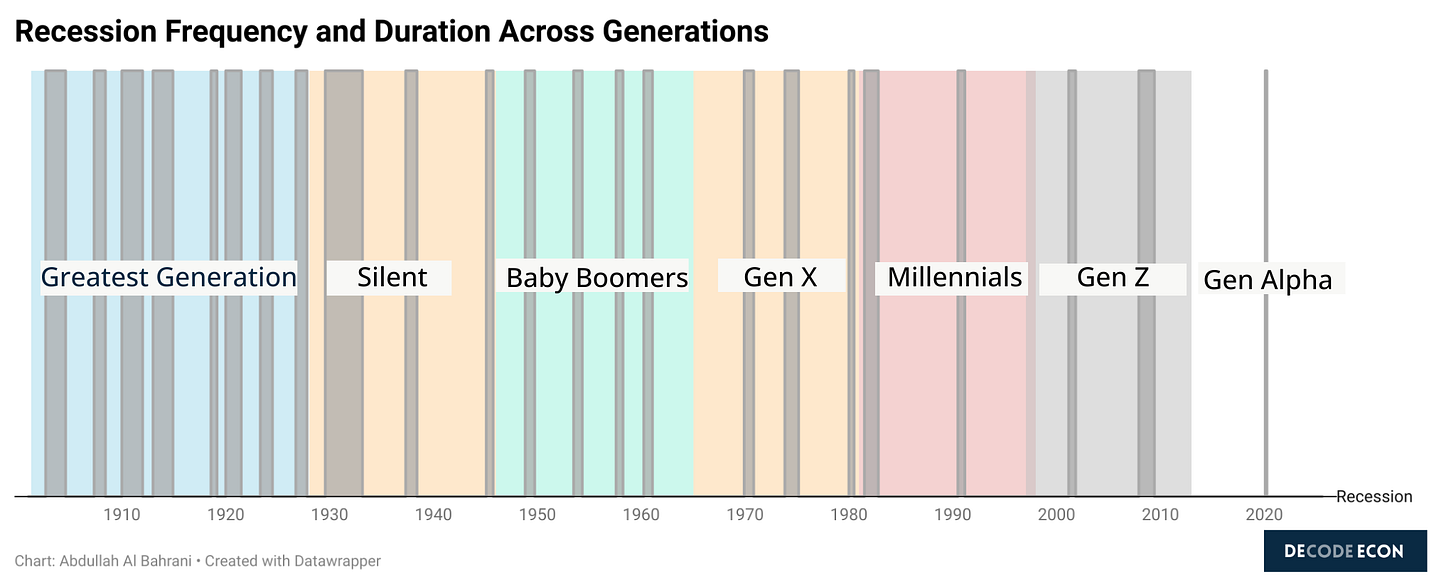

Since 1901, each generation has faced varying economic turbulence in its formative years. The table above lists the generations, their birth years, their current age, and the number of recessions they experienced. It also includes the total number of months during each generation’s birth years that the U.S economy was classified as being in a recession. The figure below provides a visual representation of the generations’ birth years and the frequency and length of recessions experienced during that time. It is essential to note that the severity of the recession, as measured by the magnitude of GDP change, is not considered here.

Generational Stereotypes and Economics Experiences

A quick search reveals plenty of stereotypes about each generation — from Boomers accused of hoarding wealth to Gen Z labeled as “quiet quitters.” But beneath the labels lie real differences shaped by each group’s economic experiences, especially how recessions affected their views on work, money, and stability. I’ve been diving into these ideas through Gentelligence: The Revolutionary Approach to Leading an Intergenerational Workforce, and it’s been an eye-opening read (H/T Dr. Jeni Al Bahrani for the recommendation.)

Silent Generation (1928–1945)

Stereotypes: Dutiful, disciplined, frugal, traditional.

Economic lens: Grew up with scarcity. “Waste not, want not.” Often seen as loyal workers who valued stability over risk.Baby Boomers (1946–1964)

Stereotypes: Optimistic, ambitious, “me generation,” resistant to change.

Economic lens: Benefited from postwar prosperity and accused of hoarding wealth, driving housing prices, and resisting policy changes that would shift resources to younger generations.Generation X (1965–1980)

Stereotypes: Independent, skeptical, latchkey kids, entrepreneurial.

Economic lens: Raised amid recessions and high divorce rates, and seen as resourceful but cynical, cautious about institutions and retirement.Millennials (1981–1996)

Stereotypes: Entitled, tech-obsessed, avocado-toast spenders.

Economic lens: Entered adulthood during the Great Recession. Often labeled “financially unlucky,” delaying homeownership, marriage, and wealth accumulation.Gen Z (1997–2012)

Stereotypes: Activist, digital natives, socially conscious but anxious, “quiet quitting.”

Economic lens: Came of age during the pandemic. Cautious about financial stability, skeptical of traditional career paths, often side-hustle oriented.Gen Alpha (2013– )

Stereotypes: iPad kids, hyper-connected, impatient, raised on AI.

Economic lens: Still forming, but growing up amid climate anxiety, inflation, and rapid tech change, may be stereotyped as even more digital, less tethered to “traditional” work and schooling.Experiencing a Recession During Childhood

A review of 54 studies across OECD countries (1988–2017) finds that higher income is associated with

Yes, money matters. Household income itself has a causal impact on children’s earning outcomes.

Cognitive gains. Better test scores and higher graduation rates.

Social benefits. Fewer behavioral problems, stronger social ties.

Health improvements. Higher birth weights, better mental health, and long-term gains.

The effects are especially strong for low-income families. Childhood recessions can cast long shadows and create economic scars that last for a lifetime.

Experiencing a Recessions Early in Your Career

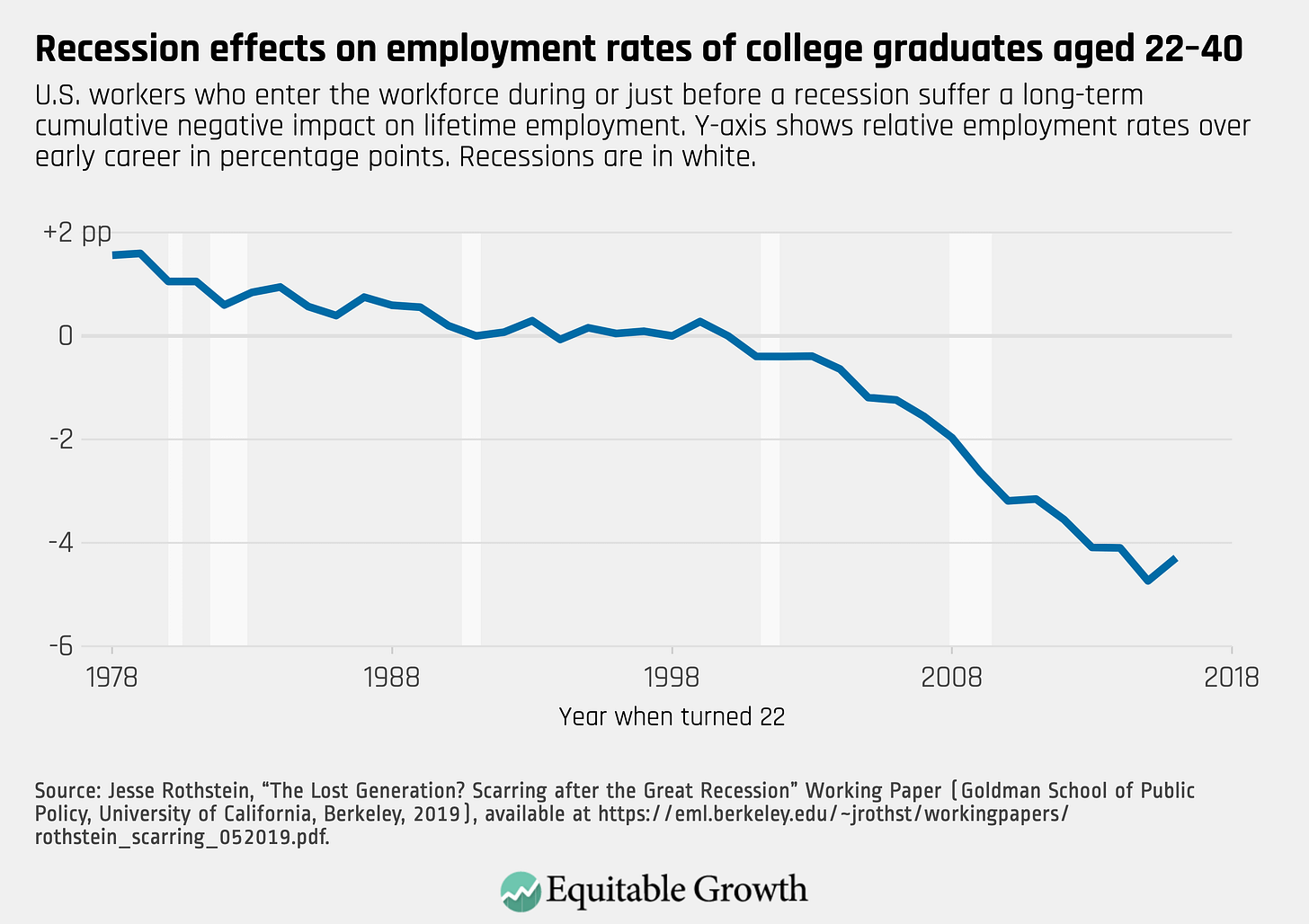

The scars don’t stop in childhood. Entering the workforce during a downturn can have lasting effects on an entire career.

UC Berkeley’s Jesse Rothstein finds that graduates starting their careers during a recession face permanently lower earnings and employment rates.

The Great Recession alone left young workers earning about 2% less for years. The power of compound growth tells us that a seemingly small number can add up to a massive generational loss.

Opportunity Insights estimates students who graduated during the pandemic recession will lose between $62,500 and $115,900 in lifetime earnings.

Economists call this “scarring.” Recessions can reshape the economic experiences of an entire generation by slowing growth, reducing spending power, and delaying family formation.

Bottom Line

Recessions are never shared equally. Whether as a child, a student, or a young worker, the timing of a downturn leaves marks that shape opportunities and identities for entire generations. Today’s economy may be more stable than in the past, but the scars of recessions still run deep. Behind every headline and data point are real people whose economic experiences shape not just their finances, but their outlook on life for a lifetime.

Question for readers: Which recession defined your generation? How did it shape your family or career? Share your experience — your story is part of the economic history we’re still writing.

About the Post

I’m excited to share that on September 24, 2025, I’ll be presenting at the Scripps Howard Center for Civic Engagement’s Six@Six program at the soon-to-open Sparkhaus in Covington. This event is open to the public, and I’d love for you to join us. (Heads up: the registration page can take a moment to load — thanks for your patience!)

I’ll be presenting joint work with Dr. Jeni Al Bahrani on Gen Z and the Growing Skills Gap. If you’re part of Gen Z, or if you hire, manage, or collaborate with them, this is a conversation you won’t want to miss.

Interesting article, I remember starting teaching in the late 70's and in the 1980's, particularly in poor neighbourhoods, the feeling of despair and lack of motivation held young people back. As a teacher, you had first to motivate the students before you could teach.

Thank you for another interesting article. Decode Econ is an informative way to start each day.