The Latest on the Employment Situation

Hire, Layoffs, Productivity, and the Unemployment rate

Today, we cover the first on-time federal employment report since the shutdown and what it tells us about a labor market quietly shifting beneath the surface.

After weeks of delayed data and partial signals, this morning’s release gives us the clearest snapshot yet of where hiring, job security, and worker leverage stand as we head into 2026. We waited to send this newsletter so we could incorporate the most up-to-date employment and productivity numbers, and the story they tell is more nuanced than the headlines suggest.

Hiring is happening but slowing. Layoffs remain low. Beneath the surface, the labor market is cooling, firms are hesitating, and recent productivity gains may say more about stretched workers than booming efficiency.

Here’s what the data actually shows, and what it means for workers and the economy going forward.

The Economics: What the Data Is Telling Us

Private Data (ADP)

We’ll start with the private sector.

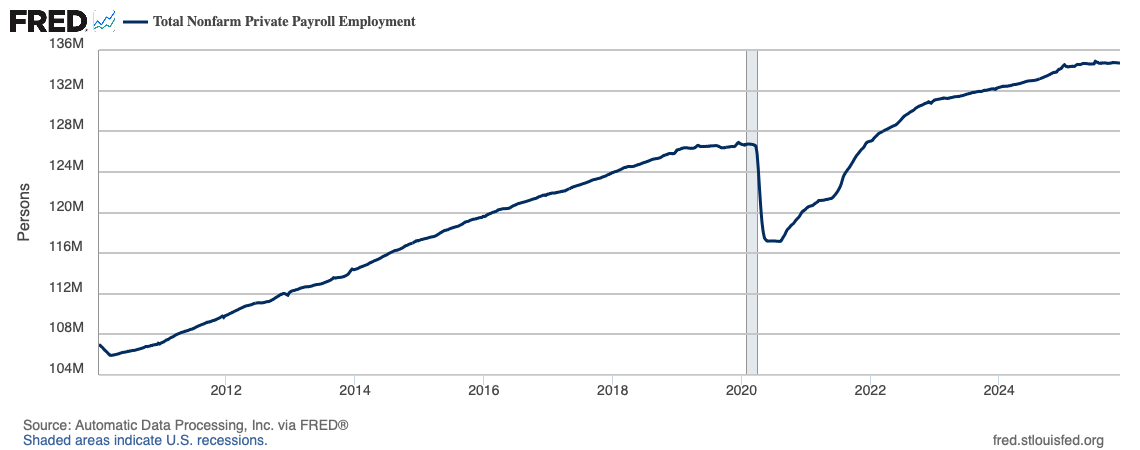

According to ADP, employers added 41,000 jobs in their most recent report. That’s modest growth in an economy with roughly 159.5 million jobs as of November 2025.

Hiring hasn’t stopped, but it has slowed.

A Low-Hire, Low-Fire Labor Market

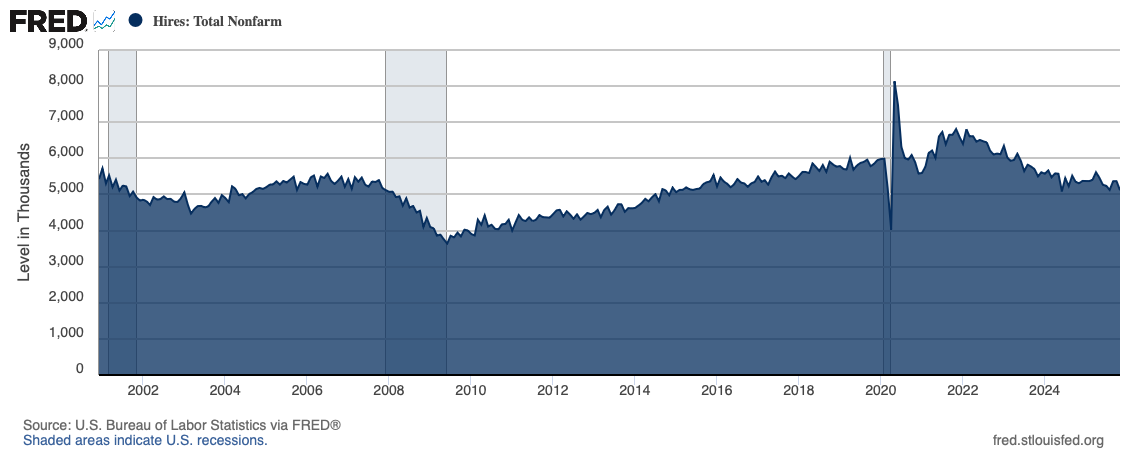

Earlier this week, the Bureau of Labor Statistics released the Job Openings and Labor Turnover Survey (JOLTS).

Job openings fell to their second-lowest level in the past five years. At the same time, layoffs declined.

This is what economists call a “low-hire, low-fire” labor market: Firms are hesitant to bring on new workers. But, they’re also reluctant to let go of the employees they already have

In November, job openings were 7.1 million, new hires were 5.1 million, and separations/quits totaled 3.2 million.

One encouraging detail: small firms (fewer than 50 workers) added 9,000 jobs, reversing job losses from prior months. That suggests some stabilization at the margin.

The Employment Report

This morning’s report has a common phrase “little changed”. A quick glance of the report doesn’t provide any new insights. The labor market isn’t broken, but it’s trickling along.

Unemployment Rate

Unemployment rate: 4.4 %

Last month: 4.5%

Job Growth

Jobs added in December: 50,000

Job gains continue to be driven by food services and drinking places, health care, and social assistance industries.

We will continue to review the report to identify any trends beyond the top-line figures.

The Productivity Paradox

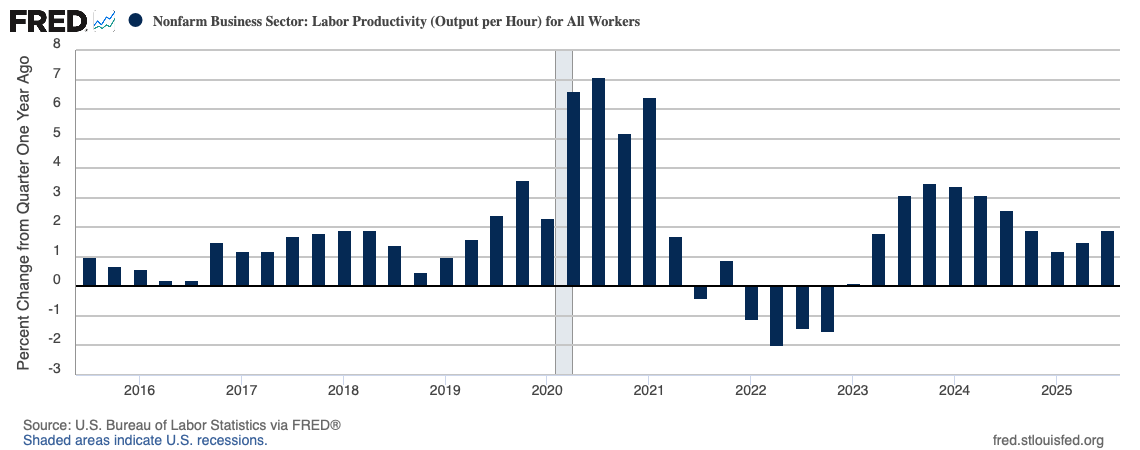

Nonfarm productivity, which measures hourly output per worker, accelerated at a 4.9% annualized rate. Worker productivity grew at its fastest pace in two years in the third quarter as businesses invested heavily in artificial intelligence, depressing labor costs.

This week’s productivity report looked like great news as productivity jumped at its fastest pace in two years, fueling headlines that AI is finally paying off.

But productivity tells us what happened, not how it happened. With hiring weak, job openings down, and quits low, some of today’s productivity gains are likely mechanical. It can simply be that firms maintain output by stretching existing workers rather than expanding payrolls.

That kind of productivity doesn’t capture burnout, task overload, role consolidation, or unpaid overtime, and it looks identical in the data to genuine efficiency gains from better technology. Historically, late-cycle productivity spikes often appear when firms are cautious and delaying hires, and they tend to fade unless followed by real investment, training, and job growth.

Rising productivity isn’t bad, but assuming all productivity gains signal a healthier labor market is a mistake.

The Bottom Line

Hiring is slowing. Job openings are falling. And firms are increasingly choosing to hold onto workers rather than expand. That combination creates stability on the surface, but caution underneath.

For workers, the message is mixed. If you have a job, it’s relatively secure. If you’re looking for one, the market is more competitive and less forgiving than it was a year ago. And while productivity gains make the economy look stronger, some of that strength reflects doing more with the same people, not necessarily healthier workplaces or better long-term growth.

This is a labor market in wait-and-see mode. And until hiring reaccelerates, each employment report matters, not for the headline number, but for the weakness it reveals beneath it.

If you find these updates useful, share Decode Econ with a friend or colleague who wants to make sense of the economy without the noise.

I love this Jobs Friday! I am working on a piece that could offer some opportunity in response to the job market!

Correct me if I’m wrong, but would this make 2025 the weakest non-recession year for jobs since 2003?