We Have Data! (Finally.)

Markets signal confusion

After six long weeks of no data, the BLS finally pushed out the September Jobs Report. The data was initially scheduled for October 3rd. Yes, it’s “shutdown-era data,” meaning it tells us what the economy looked like just as we entered the longest government shutdown ever …but still: we have numbers to work with.

Let’s make sense of what’s happening in markets.

The Data

The U.S. economy added 119,000 jobs in September, more than double the Dow Jones estimate of 50,000. At the same time, unemployment ticked up to 4.4%, the highest level in almost four years.

That combination of more jobs and rising unemployment creates a strange signal. And in a market desperate for clarity, mixed signals only add more volatility.

No Rate Cuts?

Even outdated data can move markets. And this report did just that.

With job creation stronger than predicted, traders immediately pushed down expectations for a December rate cut. According to CME’s FedWatch tool, the consensus is shifting back toward “higher for longer.”

Volatile Markets: Are You Buying the Dip?

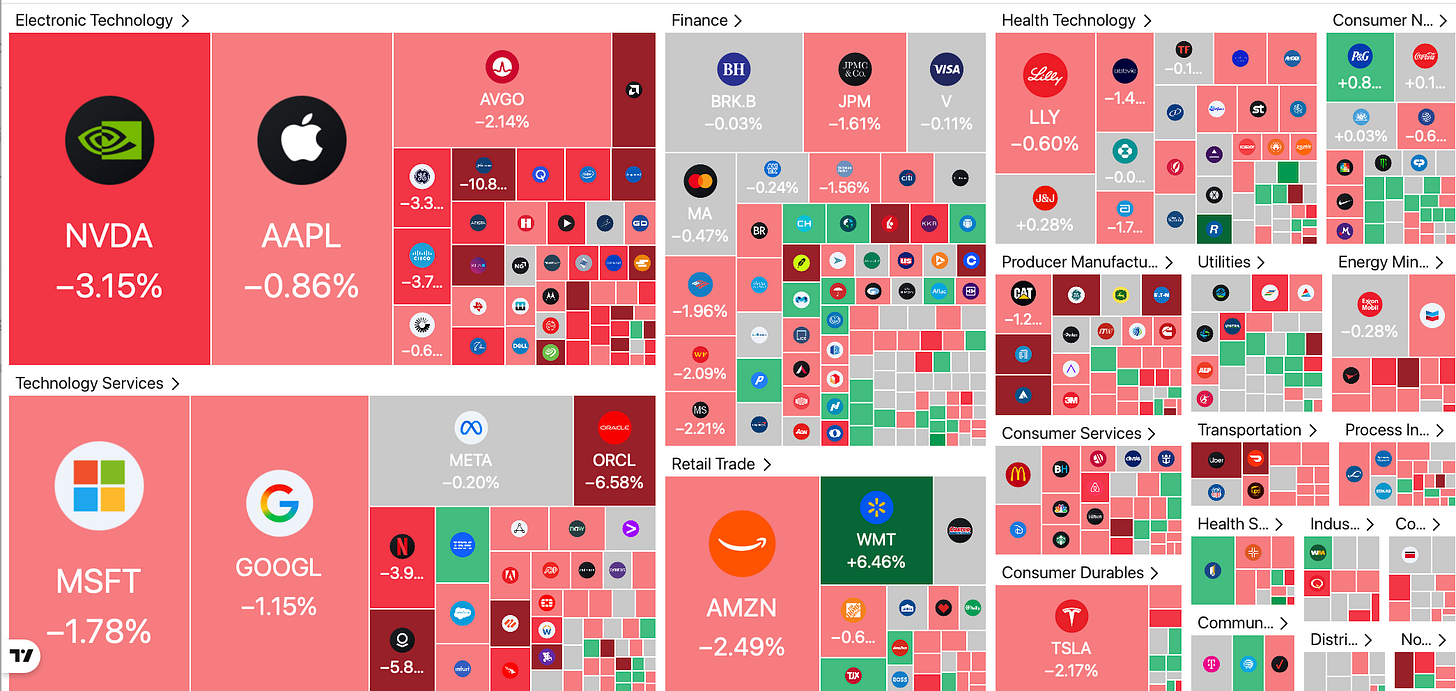

The equity markets spent the day doing their best impression of a roller coaster:

Nasdaq: Started the day up 2.6% and closed down 2.16%

S&P 500: Up 1.9% early and closed down 1.56%

Dow: Up 1.56% early and closed down 0.84%

These are not normal moves. These are “investors don’t know what to believe” moves.

Part of the confusion comes from Nvidia, now a $4.5 trillion company, reporting record revenue and a 65% jump in net income. AI optimism is lifting markets, but AI companies' spending to expand their data centers is raising concerns about sustainability.

Losing Grip

Even the political headlines mirror the economic uncertainty: reports that Trump’s grip on the MAGA base is slipping raise questions about how durable those cracks are and whether policy expectations should be adjusted.

It’s Giving… Confused

If you came into this week hoping for clarity about where the economy is heading, you didn’t get it.

Instead, you got:

Delayed but surprisingly strong labor data

A central bank trying to cool inflation without breaking anything

AI-driven optimism smashing into interest-rate pessimism

Politics layered on top of everything

This is the kind of macro environment where markets overshoot in both directions. Brace yourself.

The Bottom Line

If you’re “buying the dip,” just make sure you know which story you believe the most.

See you next week—stay curious.

The jobs numbers aren't anything to crow about. Looking at a Y/Y basis Information lost 79,000 jobs (3.8% to 7.0% UE), Mining went from 2.0 to 6.8% (21,000 decrease) and Leisure/Hospitality 5.6 to 6.7% (178,000 decrease). This is before any revisions to the monthly or quarterly stats.

Agriculture is an immigration story given the legal status of workers.

Self-employed is troublesome as a category.

The market is currently overweight in AI related valuations and the vendor financing aspect is just playing with house money. (Not financial advice, go to a CFA who understands your specific needs.)

The Fed will pause... no Government Data at a granular level is an easy out.

Shiller's CAPE (Cyclically Adjusted P/E Ratio) is showing signs of pain ahead.

It really comes down to your news sourcing and current job/income situation.