Who Is Kevin Warsh

And why his nomination matters

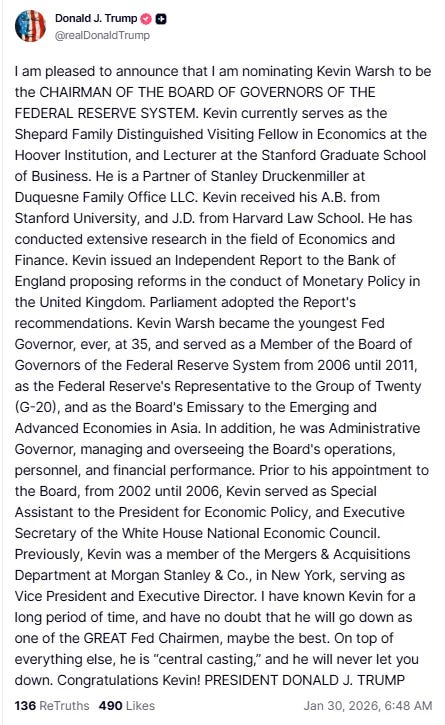

With Jerome Powell nearing the end of his term, the question of Fed leadership has moved from speculation to reality. President Trump announced last week that he plans to nominate Kevin Warsh as the next Chair of the Federal Reserve.

That immediately raises a bigger question: Can Warsh protect the Fed’s independence the way Powell has?

The Resume: Wall Street, the Fed, and the Crisis Years

Kevin Warsh is not a household name, but he’s no outsider.

He served as a Federal Reserve Governor from 2006 to 2011, a period that included the Global Financial Crisis.

Before and after the Fed, he worked in Wall Street finance and policy circles, including roles tied closely to financial markets.

Like Powell, Warsh is a lawyer, not an economist, a fact that continues a trend that many economists find troubling.

Powell’s nomination in 2017 surprised the economics profession because he was the first Fed chair in three decades without a PhD in economics. Warsh’s nomination doubles down on that shift and reinforces the sense that economists have lost influence in monetary policymaking.

The Real Concern: Independence Under Pressure

The Federal Reserve’s power comes from its credibility—and that credibility depends on independence from political pressure.

Powell has demonstrated that independence clearly. Despite intense pressure from President Trump, Powell resisted calls to cut rates prematurely and took political heat to protect the institution.

Will Warsh do the same?

That’s where concerns emerge.

The economist I trust most on Fed credibility, Claudia Sahm, has a great column on this topic. She says:

“He’s long on criticisms and short on solutions, which is troubling for someone who served as a Fed official during the largest financial and economic crisis since the Great Depression.”

That critique matters. Leading the Fed requires strong leadership. She does add

While I have questions about his judgment and ability to maintain the Fed’s independence, I also respect his public service and commitment to economic policy

Hawk or Dove? Even the Market Isn’t Sure

Markets are still trying to figure out what Warsh actually believes.

Hawks prioritize inflation and are cautious about cutting rates.

Doves focus more on employment and are quicker to ease policy.

Warsh has sounded like both at different times. That ambiguity creates uncertainty, and uncertainty is not what markets want from a Fed chair.

Add in the administration’s clear preference for lower interest rates, and the pressure will be immediate.

The Bottom Line

Kevin Warsh is experienced. He understands markets. He knows the Federal Reserve from the inside.

But the job he’s being nominated for isn’t about credentials alone. It’s about institutional strength.

Jerome Powell proved that a Fed chair can stand up to political pressure, even when it’s costly. The open question is whether Kevin Warsh will do the same, or whether the Fed’s independence becomes the next casualty of politicized economic policy.

If this nomination moves forward, it’s worth paying attention, not just to who Kevin Warsh is, but to who he chooses to be when the pressure arrives.

If you want to understand where the risks lie, I strongly recommend reading Claudia Sahm’s full piece and the PBS overview.

The Fed affects your mortgage, your job market, your savings, and the economic stability we all need. We will have to wait to see if this nomination passes all its checks.

Stay tuned for more on this topic.

It's really interesting to look back and see that the concerns we had about Powell didn't pan out as expected. Perhaps having a lawyer in the spot in times like these isn't such a bad idea. Powell's understanding of precedent has made him a solid chair.

Let's start with the basic premise that Warsh agreed to make every effort to lower interest rates. Trump's public statements to that effect, that he wouldn't nominate someone with a differing point-of-view, make that obvious.

The sidenote of Warsh's Father-in-Law, Robert Lauder (of Estee Lauder fame) being not only a large financial backer of the current President but also the main proponent for annexing Greenland, creates another point of consideration.

Warsh gave an interview during the Pandemic (Hoover Institute, April 2, 2020) where he talked about monetary policy needing to be dovish during "peace" and hawkish during times of conflict. That's where our current political policies create the conflict. We're not in a shooting war but an economic one.

How he navigates the inflation that may result from all of the announced Direct Foreign Investment, a consumption cycle vastly different from 2008-09, and labor offsets as AI shifts job functions.

*All of this changes should the Democrats assume legislative control after November 2026 elections. They would reassert themselves via oversight and Constitutional authority making several current policy positions moot.