Delinquencies Are on the Rise

Who's missing payments and what does that say about the economy. We can blame the death of entry level options for this problem.

For the past five years, the American consumer has saved the U.S. economy. They continued to spend against all adversity.

At first, stimulus checks kept spending afloat. When those ended, people dipped into their savings. When savings ran dry, they turned to credit cards. Now, some are falling behind, and the strain is starting to show up in the data.

Today, I will share some recent data on delinquencies and insights I gained while I was a mortgage broker in the 2000s. I will also share some of my thoughts on the death of entry-level options in the U.S.

The Data

CNN summarized the problem as follows:

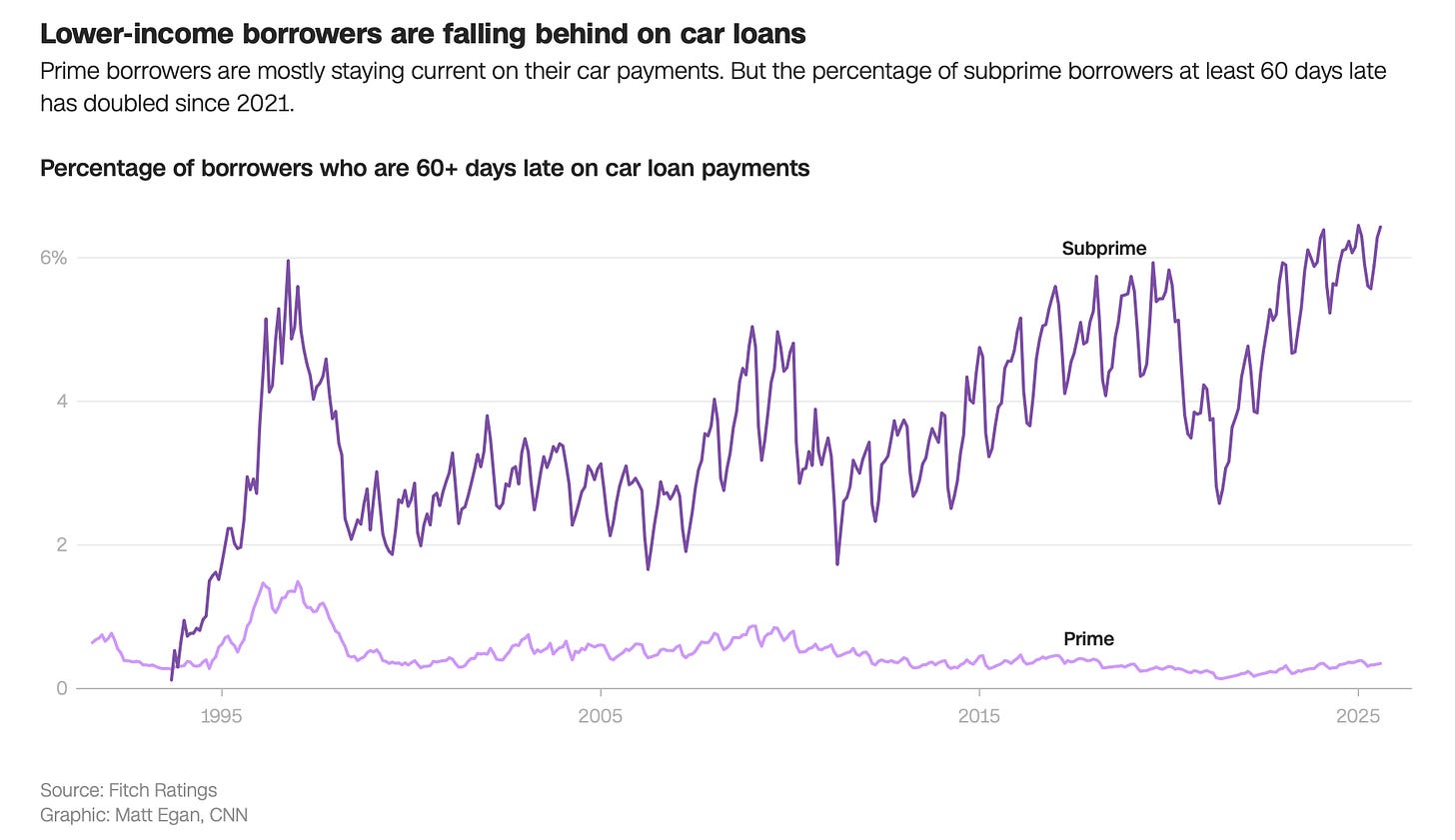

The percentage of subprime borrowers – those with credit scores below 670 – who are at least 60 days late on their car loans has doubled since 2021 to 6.43%, according to Fitch Ratings. That’s worse than during the past three recessions – during the Covid pandemic, the Great Recession or the dot-com bust.

America’s current subprime delinquency rate is at the second-highest level since the early 1990s. The only time it was higher: this past January. Cars are being repossessed at the highest rate since the Great Recession of 2008 and 2009.

America’s subprime auto-loan delinquency rate is now the second-highest since the early 1990s. The only time it was higher? This past January. Cars are being repossessed at the fastest pace since 2008.

The Death of “Entry-Level”

Car prices have climbed relentlessly. The average new vehicle now costs more than $50,000. Businesses, chasing profit, have focused their production and marketing on the top 10 percent of spenders, the consumers still willing and able to buy. This is an outcome of our bifurcated economy. Where the top 10% dictate what the market needs.

That leaves entry-level buyers behind. The same pattern exists in housing: starter homes are vanishing, and builders prioritize luxury units instead. When the “on-ramp” to ownership disappears, so does mobility. For many Americans, that first car or first home is the bridge to better opportunities.

Without it, participation in the economy narrows and negative sentiment rise as the American dream starts to feel out of reach.

Lessons from the Past

When I worked as a mortgage broker in the mid-2000s, I saw the first cracks before the mortgage collapse.