The Consequences of a Weak Dollar

What you should know

It is early 2026, and the U.S. dollar has fallen roughly 10% from the previous year, a sharp move for a reserve currency and potentially the end of a 15-year bull run. The reasons will sound familiar to you—tariffs, geopolitical uncertainty—but the consequences are less discussed.

President Donald Trump has been openly supportive of a weaker dollar. Exports become cheaper. U.S. manufacturing looks more competitive. On the surface, that aligns neatly with his economic goals.

But a weakening dollar comes with other trade-offs, and some are expensive.

Why a Weak Dollar Can Force Rates Higher

Here’s the uncomfortable economics.

A weak currency usually reflects lower interest rates, weaker growth expectations, or rising uncertainty. In this case, all three are in play. The Federal Reserve has shifted toward rate cuts, trade policy has raised concerns about growth, and foreign investors are increasingly hedging their exposure to U.S. assets.

That creates a problem for the Federal Reserve.

Inflation

When the dollar falls too far, imports become more expensive. That feeds inflation. And inflation is the one thing the Fed cannot ignore, even if growth is slowing or politicians want easier money. It also disproportionately impacts low-income consumers.

Higher Rates to Attract Dollars

When a currency is too weak, central banks may raise interest rates to attract foreign capital and stop the currency from falling further.

So paradoxically, a weak dollar can force the Fed to raise interest rates to stabilize prices and defend the currency. That puts monetary policy directly at odds with the political desire for lower rates and a cheaper dollar.

The Debt Channel Everyone Ignores

There’s a second effect that matters even more: Treasury yields.

As the dollar weakens, foreign investors demand higher yields to compensate for currency risk.

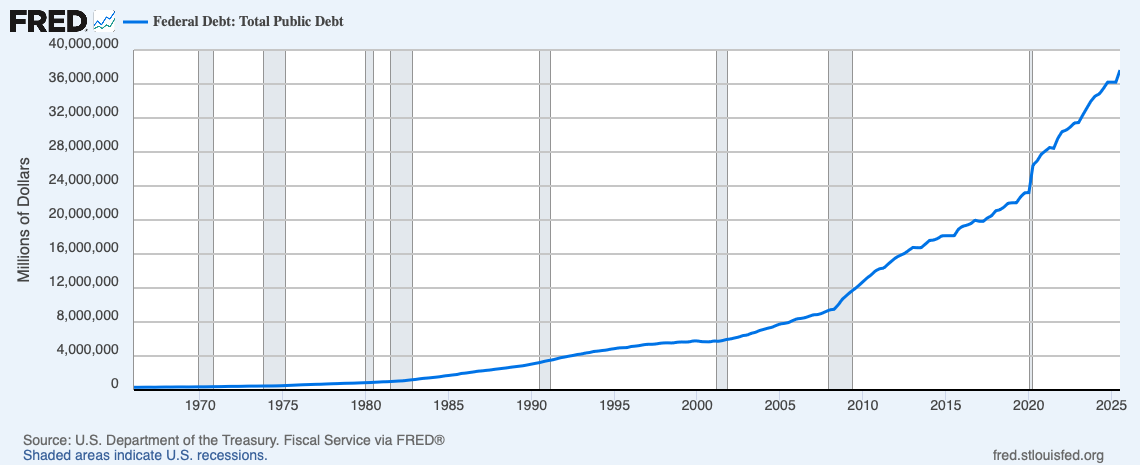

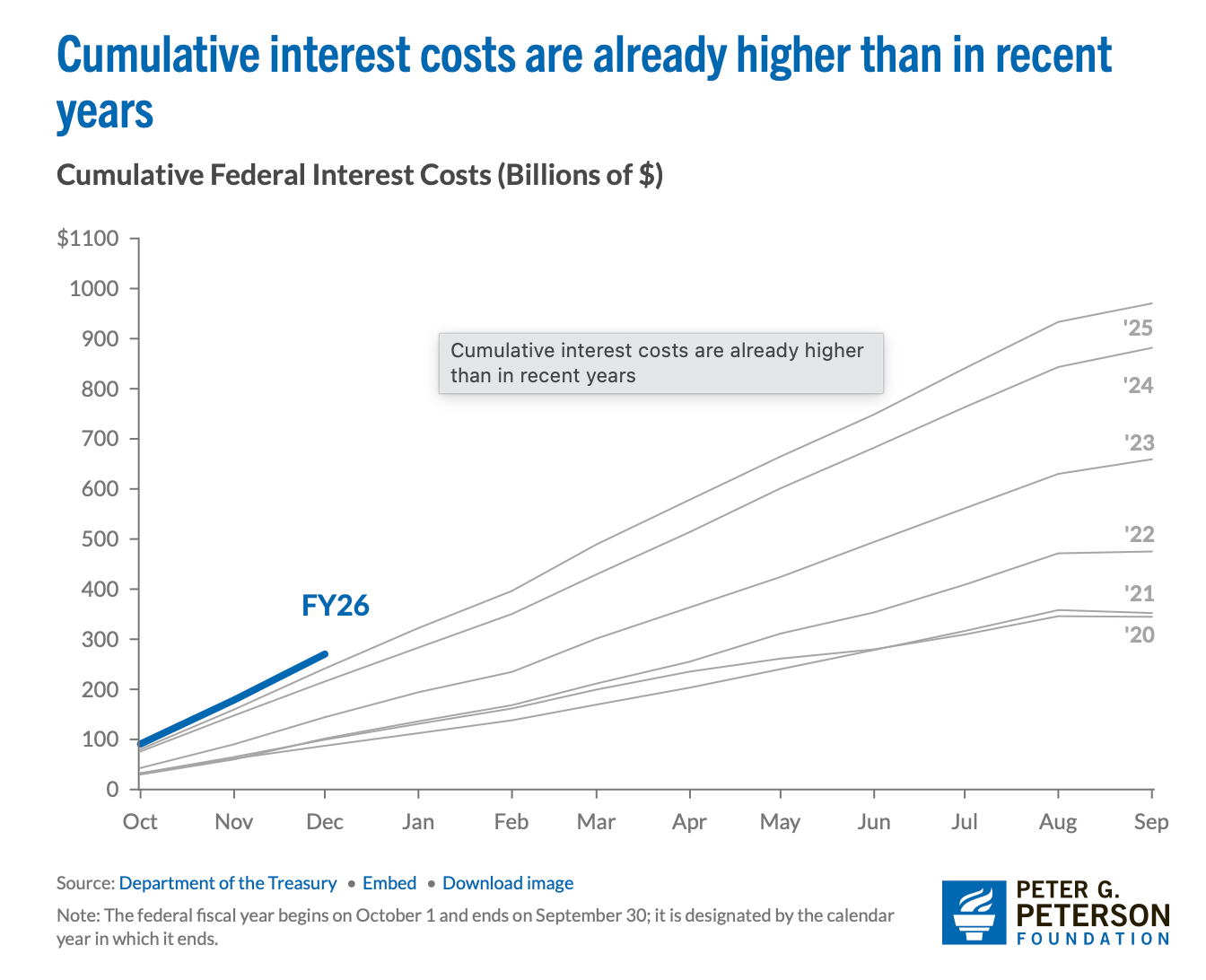

The U.S. is running massive budget deficits, and total debt continues to increase. Higher yields mean higher debt-servicing costs, fast. Every percentage-point increase in yields translates into hundreds of billions more in interest payments over time.

The U.S is expected to pay $270 billion to service its debt in 2026. In 2025, the total interest payments were $240 billion. Total interest payments are expected to be 11.9% higher than the previous year.

So while a weak dollar may help exporters today, it quietly raises the government’s borrowing costs tomorrow. That’s a tax on future budgets, future policy flexibility, and eventually future taxpayers.

The Bottom Line

A weak dollar feels like stimulus. Cheaper exports. Happier manufacturers. Political wins. It is a short-term win, but it isn’t free.

It can push inflation higher, force the Fed to tighten policy against its wishes, and raise Treasury yields, making an already large debt problem more expensive to manage. The very tool meant to boost growth can end up constraining it.

Personal Invite

I wanted to personally invite you to an upcoming Haile Research Lab session that I think many of you will genuinely enjoy.

On Friday, February 6, we’ll be welcoming Diego Mendez-Carbajo, a FRED® Economics Champion from the Federal Reserve Bank of St. Louis, for a session titled:

Meet FRED® and Friends: Your Trusted Source of Data Since 1991

Diego is engaging, practical, and deeply knowledgeable about how researchers actually use data. If you’ve ever used FRED® (or thought you should be using it more effectively), you’ll walk away with ideas you can put to work right away.

Details:

Friday, February 6, 2026

11:00 a.m. – 12:30 p.m.

BC 111, NKU

No charge to attend

The Haile Research Lab is designed to bring together faculty, students, and community researchersaround data and applied research, and this session is very much in that spirit. We’d love to have members of our broader regional data community in the room.

There is no cost to attend, but we ask that participants register so we can ensure we have enough snacks and drinks for everyone. Registration is available via the QR code on the attached flyer. Join us at NKU Haile College of Business.

Please feel free to share this invitation with colleagues you think would benefit. I hope you’ll be able to join us.

https://www.eventbrite.com/e/haile-research-lab-tickets-1978129761366

Brilliant breakdown of the currency paradox here. The point about how cheapr exports today mean costlier debt servicing tomorrow is something most coverage misses entirely. I've seen this play out with emerging market currencies before, but it's wild to watch it unfold in real time with the dollar given the scale.

But then Trump appointed Kevin Warsh as next Fed Chair, and things got better ;-). What a lot of global craziness around the unpredictability of one man! And I don't mean Kevin...