The Hidden Message Behind the Fed’s Rate Cut

Tracking the edits between July and September to see how the Fed’s outlook has shifted.

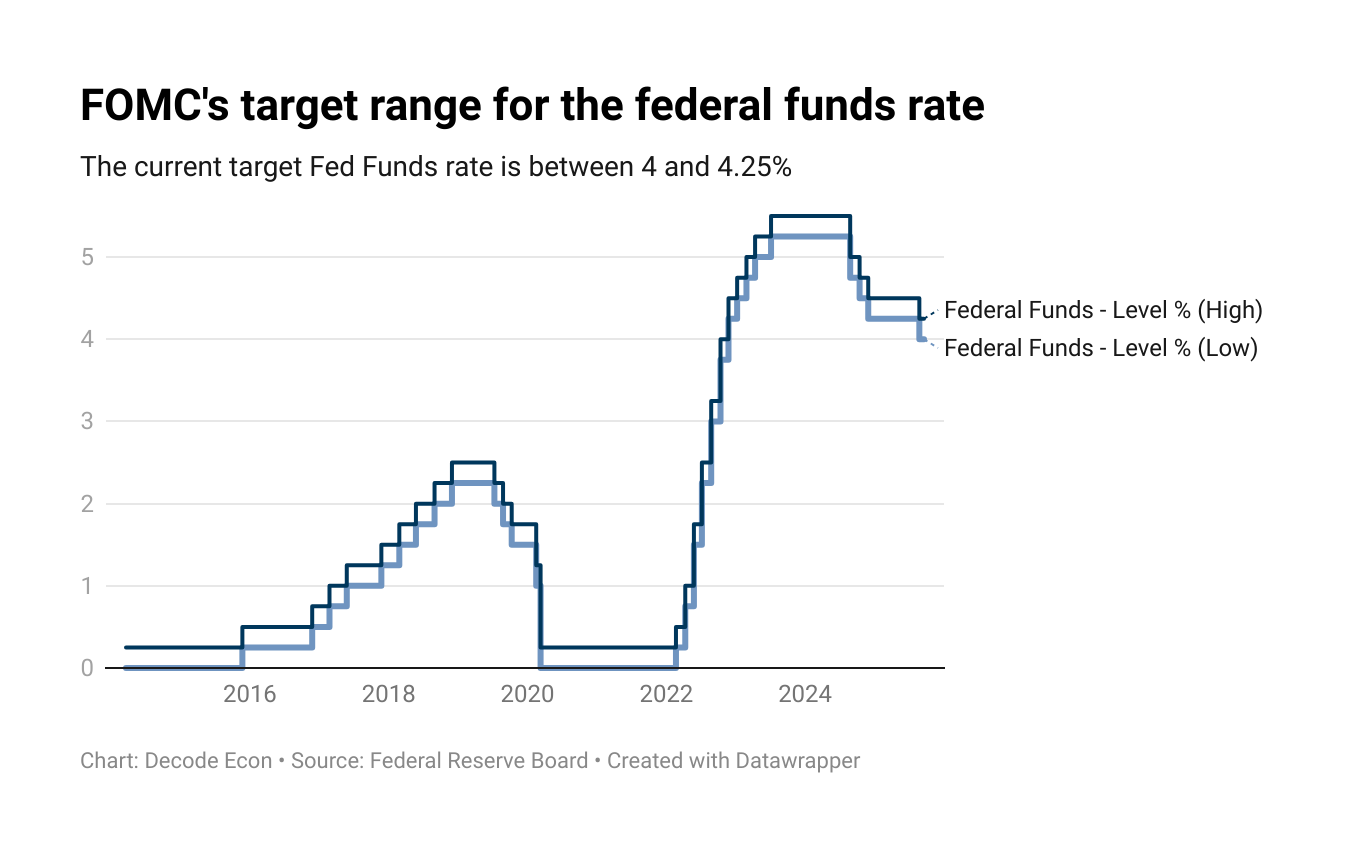

By now, every news outlet has reported that the Fed announced it will cut the target interest rate by a quarter point, or as they say in the industry, 25 basis points. While the markets had priced this in as a near certainty, the decision was far from easy given the recent economic data.

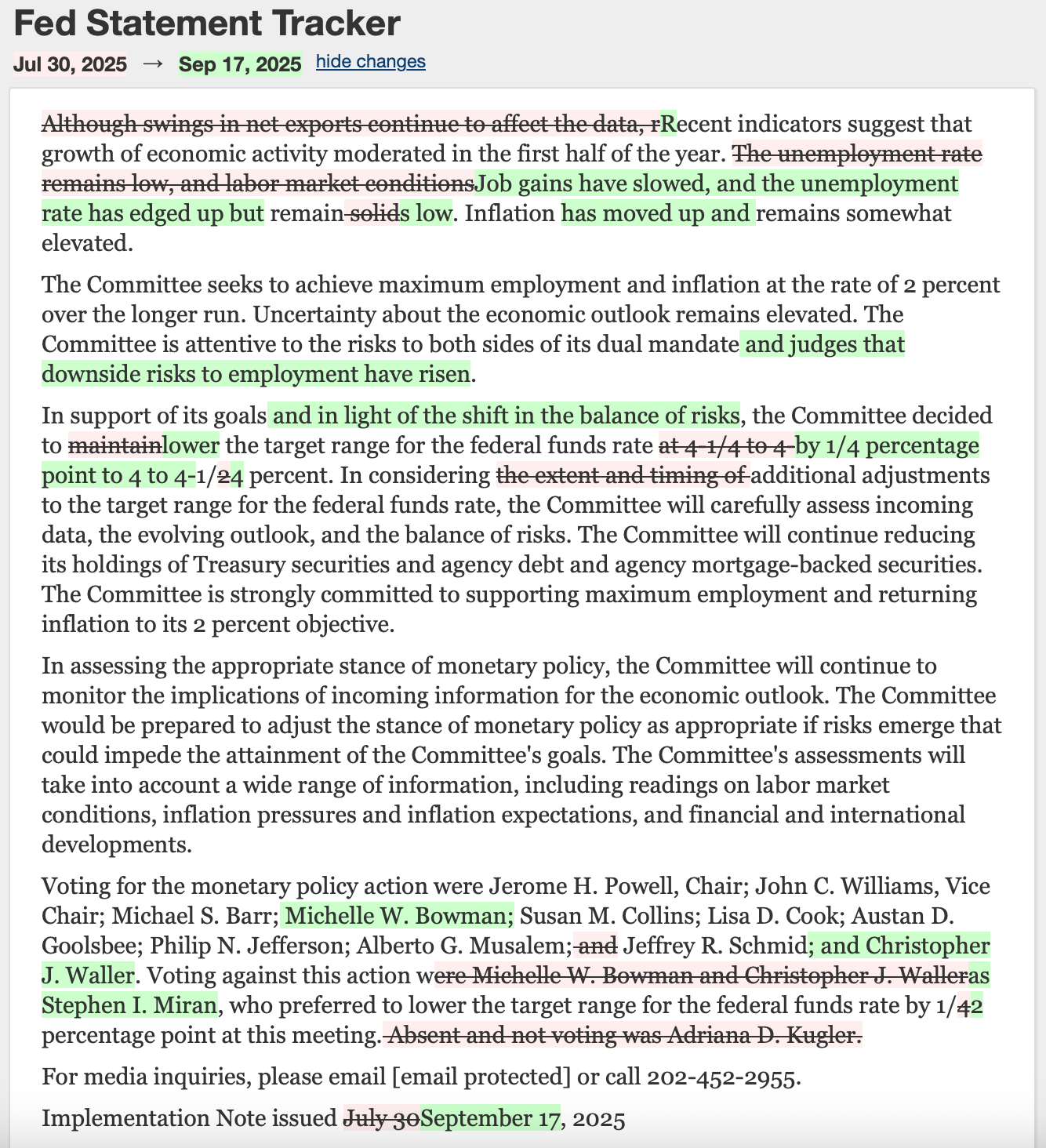

To shed light on the Fed’s decision, let’s look at the Open Market Committee’s statement and compare it to the July 30th statement.

The Statement

The Wall Street Journal’s Fed Statement Tracker (see below) provides a track-changes comparison of the September 17 statement with the July 30 statement. By tracking what the Fed adds or deletes, we can see how its outlook has shifted and why this decision was anything but straightforward.

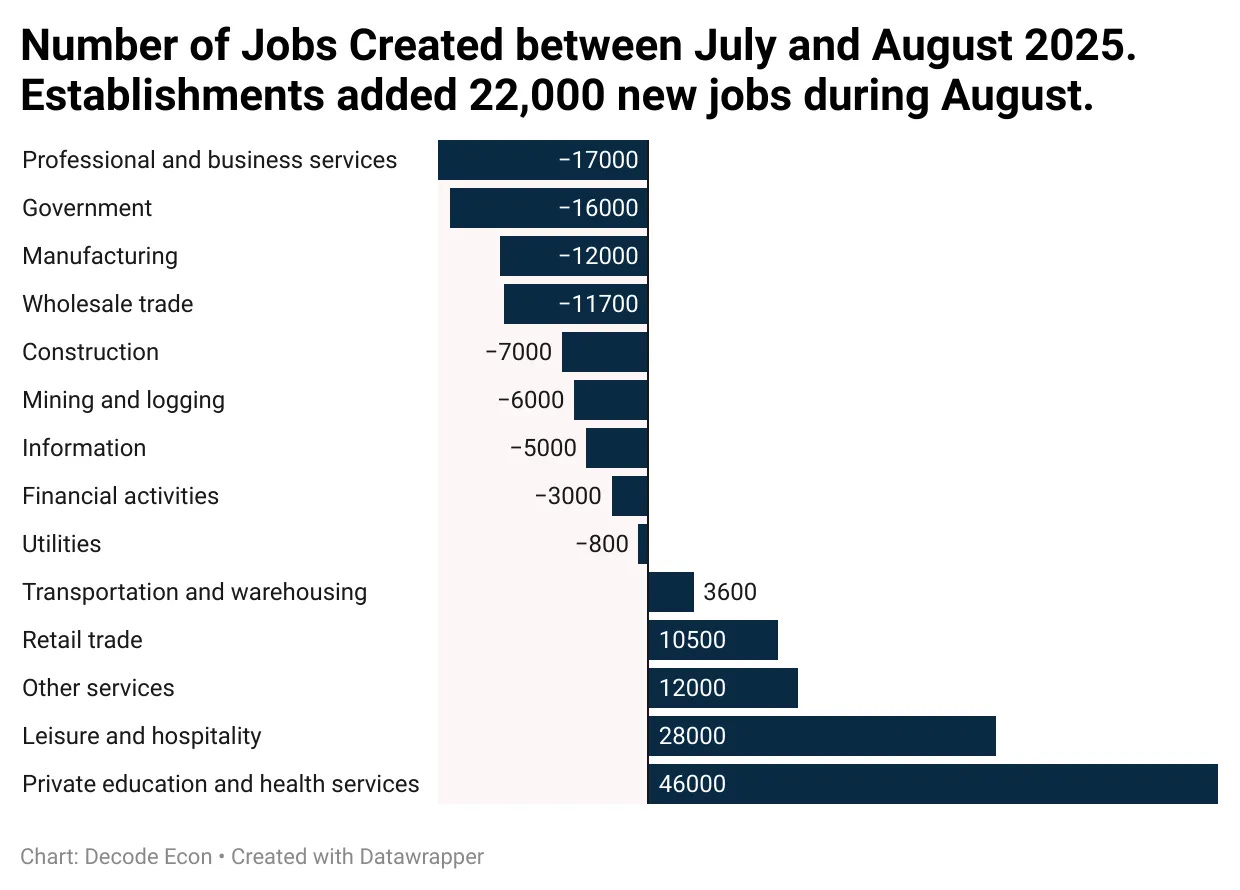

The Fed’s latest statement shows just how much the committee’s focus has shifted in the past six weeks. In July, the Fed described the labor market as “solid.” Today, they acknowledge that job gains have slowed, the unemployment rate has edged up, and downside risks to employment have risen. Based on our recent articles, you know that the labor market is even weaker than previously thought, making this a critical turning point.

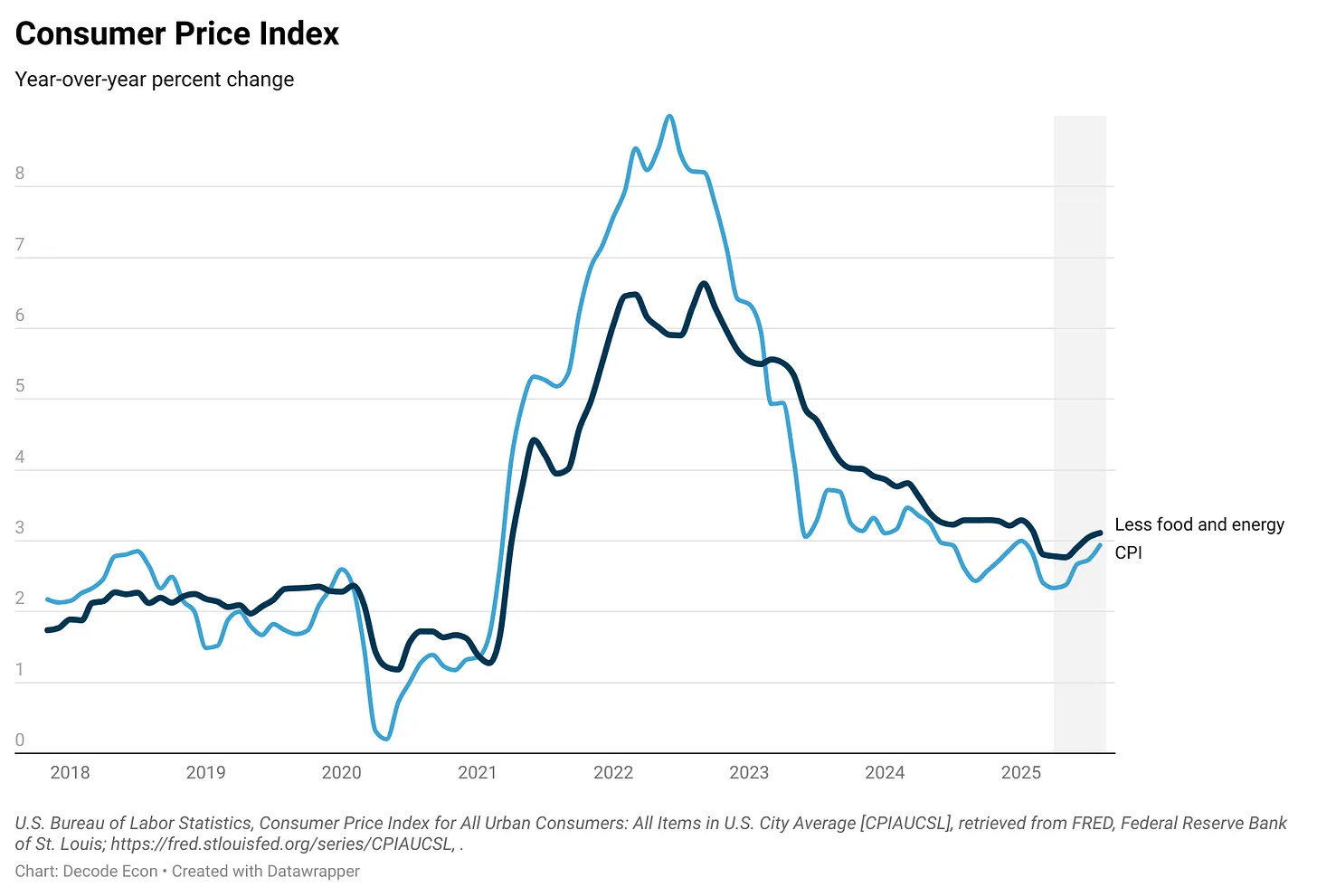

At the same time, the Fed continues to wrestle with inflation. Consumer inflation remains closer to 3% than to the Fed’s 2% target, reminding us that inflation has not yet been fully tamed. Still, the September statement makes it clear: the Fed is more concerned about softening labor markets than stubborn inflation.

The debate inside the Fed underscores how difficult this balancing act has become. President Trump’s recent appointee, Stephen Miran, voted against the quarter-point cut, not because he wanted higher rates, but because he wanted a larger 50 basis point cut. That dissent highlights growing pressure within the committee, as well as from the president, to move more aggressively in support of the labor market.

The Bottom Line

As the Fed put it, ‘uncertainty about the economic outlook remains elevated.’ For now, the Fed is prioritizing the labor market while still acknowledging the risks posed by sticky inflation. Keep an eye on both jobs and prices in the coming weeks. The Fed has two more meetings left this year; the next one is scheduled for October 28–29.

Reader Question: The Fed is signaling more concern about jobs than inflation. Do you think they’re cutting rates at the right pace—or should they be more aggressive?

As a special token of appreciation to our dedicated readers, we are offering a 50% discount on an annual subscription to Decode Econ. You can help us grow and improve our efforts to increase economic literacy.

I still think the environment is till too risky for many businesses to make investments. I mean average owners not delusional leaders like Tim cook who thinks because apple is opening a plant it will spark a domino effect. The tariff environment is too high and businesses are seeing softer demand . Only time will tell. I think a quarter point is also good. With inflation picking up and the holiday season coming around.

My rule is never to believe that a speaker or writer, especially in politics, believes what they say, but to suppose that this is what they want us to think. When this Administration says they want a 1% interest rate, I am reminded of the 1896 electoral battle between William McKinley, that solid Republican, and the flamboyant lawyer William Jennings Bryan, that was mostly fought on the issue of "free silver". McKinley eventually won, but the real issue was the use of inflation (hence "free silver") by Bryan to reduce the load of debt-holders of the time, farmers, who would otherwise lose their farms. In our day, Mr Trump says that he want to help poor workers, but that is certainly not the reason why he wants low interest rates -- it has not passed unnoticed that he recently passed a major budget-busting spending bill to reduce taxes on the President's fellow rich Americans at a time when interest payments by the federal government had recently risen to a higher level than military spending as a result of the inflation of 2022-2023 and interest rate increases by the Fed to bring it down. Mr Trump wants to reduce the national debt by the time-honored method used by Germany in 1921-1923 -- by inflation.