Two-Sided Risk: Which do you pick?

Jerome Powell spoke at the National Association for Business Economics conference in Philadelphia yesterday.

Even with the government shutdown cutting off official data, he said the outlook for jobs and inflation “does not appear to have changed much since our September meeting,” when the Fed cut rates for the first time this year.

At that meeting, officials projected two more cuts this year and one more in 2026. Translation: the Fed is more worried about jobs than it is about inflation.

Inflation is a cost we all bear. Unemployment, on the other hand, is felt by a smaller fraction of the population.

I’m not sure which is worse: targeted deep pain or a cost spread across everyone. But that is the calculus policymakers face and the problem they must solve.

The Stagflation Backdrop

The U.S. is flirting with stagflation, again.

One of our followers on Instagram asked us to write about stagflation, and Powell’s comments today make it the perfect time to do so.

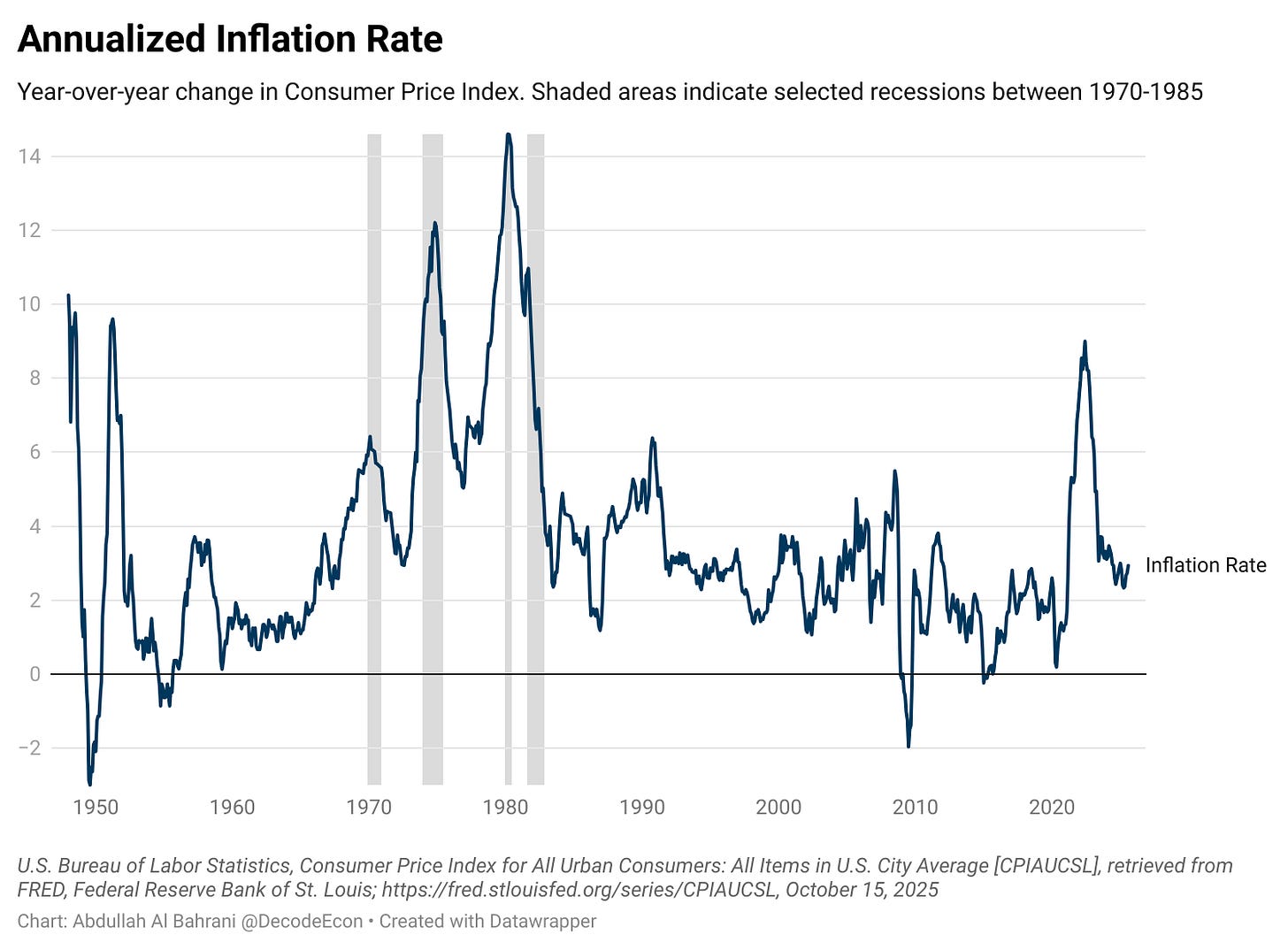

If you lived through the late 1970s or early 1980s, you remember what that word feels like. We experienced an economy that’s barely moving, entering several recessions, yet prices kept rising.

Stagflation happens when demand slows, but prices still climb because production costs rise. In the ’70s, it was the oil embargo. Today, it’s tariffs and policy uncertainty pushing up costs and slowing production. We also have residual inflation from the Covid era supply shocks and monetary policy. While I would say we experienced the soft landing we were aiming for, we never fully stopped the plane. Inflation has been sticky and never reached the 2% target. Now, based on the most recent data we have, inflation has been moving upward.

I would be remiss if I did not point out that we are going to miss the latest CPI and PPI figures due to the government shutdown. Which means we are navigating these decisions without the data we need.

On the demand side, spending is primarily driven by the wealthy and AI investment. Everyone else is pulling back.

That puts the Fed in a tough spot:

Focus on jobs- cut rates and risk more inflation.

Focus on inflation- hold tight and risk unemployment increasing.

Powell seems more worried about unemployment.

The Data Tells a Story

The New York Fed released its latest consumer expectations survey, and it shows inflation expectations inching up again. Consumers expect inflation to be:

One-year ahead: 3.4%, up from 3.2%

Three-year ahead: 3.0%, unchanged

Five-year ahead: 3.0%, up from 2.9%

The jump was largest among households earning under $50,000 and those with a high school education or less.

At the same time, credit card balances are climbing, showing that many households are struggling to keep up with expenses. Consumers have been propping this economy up, but it’s looking tight.

The Bottom Line

Powell’s speech made one thing clear: the Fed is walking a fine line.

Save the labor market and risk inflation, or fight inflation and risk job losses.

Either way, the trade-off is getting harder to manage.

The HUGE difference between the stagflation during Jimmy Carter's Presidency was that Carter did not cause either the inflation nor the recession. In our time Mr Trump is PERSONALLY responsible for BOTH the recession -- due especially to ICE clampdowns on immigrant workers -- AND inflation -- due to tariffs. Mr Powell is perfectly aware that at the turn of an Executive Order, both could be stopped in their tracks -- in fact, the inflationary pressure from tariffs has see-sawed due to ups and downs of tariffs, and no one has any idea what the levels will be tomorrow. Which adds considerable uncertainty, another recessionary driver.

The consumers keeping the US Economy afloat primarily are the top 10% of income strata with the tailwinds of Wealth Effect accounting for slightly more than 50% of all spending. While there may be a portion of consumers paying cash towards balances at literal "Customer Service Windows", 5.6M household are unbanked. That leaves a very large portion of the population making cash purchases or payments.

The job distortions from the new "Immigration/Tariff Policies" and the resulting lower job creation means we need roughly 34,000 job growth per month to stay healthy. With the uncertainty, the lock-in effect in housing is simply being replicated in employment with little movement.

We're experiencing old-school Fiscal Dominance vs Financial Repression, only this time the Fed Board/FMOC is slowly getting new players with positions pre-determined before the data is even available. (2026 is going to be a rollercoaster of Adminstration undue influence!)