What the Recent Fed Statement Tells Us

Layoffs, AI, and Redacted Statements

The Story

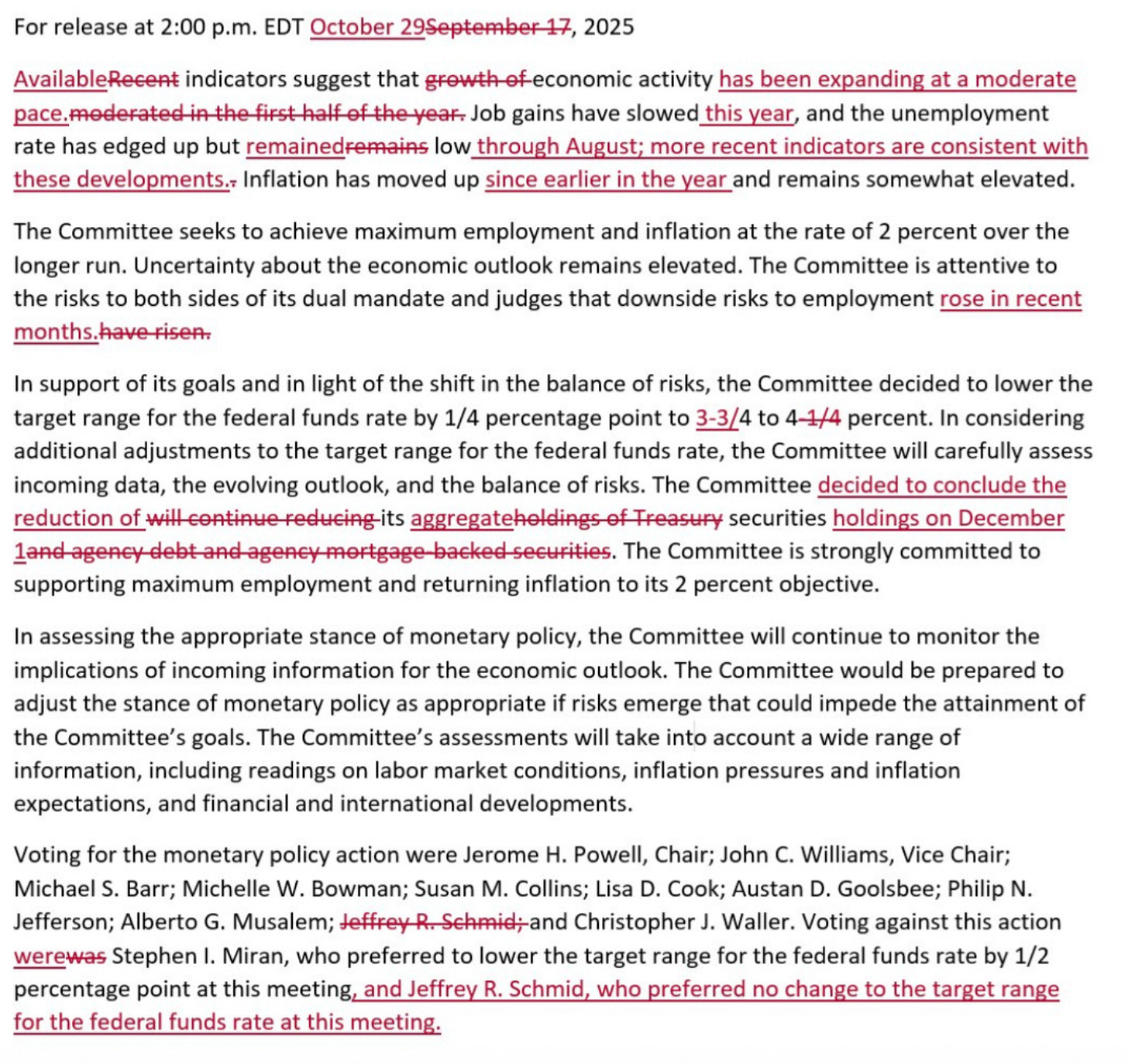

The Federal Reserve released its latest policy statement this week, and at first glance, it looks normal and as expected. The Fed cut interest rates by another quarter point, bringing the federal funds rate down to 3.75–4%.

But a closer look reveals a shift in language that signals concerns. Between the lines, the Fed quietly signaled how the government shutdown is interfering with its ability to read the economy.

In past statements, the Fed began with “Recent indicators suggest that economic activity has been expanding…” This time, “recent” was replaced with “available.”

Word choice matters, and that change suggests the Fed is having to decide without clear data. Even the country’s top economists may struggle to make the right decision without having the data they need.

The Economics

Beyond that single word, the statement reflects a deeper shift in tone and confidence:

It also says “risks to employment rose in recent months,” which is a shift from their previous statement that said “have risen.” The difference might sound small, but in Fed-speak, it’s a clear warning sign that they don’t have recent data to rely on.

These shifts tell us the Fed is proceeding with caution and humility. They’re aware that both inflation and growth data could look very different (positively or negatively) once the government reopens and delayed numbers start to flow in.

The Data We Have

Last week’s CPI report came in cooler than expected, yet higher than it should be.

Inflation rose 3.0% year-over-year, slightly below forecasts, but the 0.3% monthly increase shows that short-term price pressures persist and that overall inflation remains above the Fed's 3.0% annual target. Inflation remains a concern.

Meanwhile, the labor market is flashing new signals. According to NBC News, tens of thousands of layoffs are being attributed to artificial intelligence. Amazon announced 14,000 job cuts, calling AI a “transformative technology.” Walmart, Goldman Sachs, Salesforce, Microsoft, and UPS have all pointed to AI-driven efficiencies as reasons for trimming staff.

It is not clear whether AI is replacing workers or whether investments in AI are diverting dollars from labor spending. Signs indicate that the latter is more realistic. MIT’s David Autor questions whether AI is truly responsible. It’s often easier, he notes, for executives to say “we’re realizing AI-related efficiencies” than to admit to slowing growth, weak profits, or over-expansion.

AI may be the headline, but cost-cutting may still be the motive, or it might be a shift of resources from labor to capital investments. Investment in data centers and chips is what is driving the current economy. U.S. GDP growth in the first half of 2025 was almost entirely driven by investment in data centers, according to Harvard economist Jason Furman. Without data centers, GDP growth was 0.1% in the first half of 2025. Bill Gates believes we are in an AI bubble akin to the Dot-Com bubble of the late 90s.

Put together, the data we do have suggest an economy that’s cooling but unevenly. Prices are sticky, layoffs are rising, and the underlying reasons for what is happening and why are murky.

The Bottom Line

When the Fed says “available data,” it’s a reminder that even our most data-driven institution can be left guessing.

If they’re struggling to see where the economy is headed, then businesses and everyday Americans will likely find it even harder to predict what’s happening in their own economy.

For all of us, the takeaway is clear: policy, business, and life depend on good data.

Without it, making good decisions becomes harder.

Reader Question: How is your Economy doing?

I don’t understand enough about what the end of reduction of “aggregate securities holdings” means for the economic outlook. Is it significant that they took out the word Treasury?