ADP reported that U.S. private-sector employers shed 32,000 jobs in September

Shutdown forces us to rely on fewer data sources

If the government shutdown continues until tomorrow, we will not see the official Employment Situation Report from the Bureau of Labor Statistics. That means the single most-watched measure of the U.S. labor market, the jobs report, will be unavailable.

In times like this, we turn to private data. ADP’s National Employment Report is built from payroll records covering 26 million workers. It is not a government statistic, and it has its limitations, but when the BLS cannot operate, ADP becomes the best and only lens we have into what is happening in the labor market.

The data released yesterday confirms a slowing and stagnant labor market.

What the September Numbers Tell Us

ADP reported that U.S. private-sector employers shed 32,000 jobs in September. That’s in the opposite direction of market expectations. Economists had predicted a gain of 51,000. Moreover, the August estimate, which originally showed a gain of 54,000 jobs, was revised sharply down to a small loss of 3,000. Both of these data points indicate the labor market is performing worse than expected.

The clear message is that hiring momentum has slowed through 2025. Even though private data, such as ADP’s, is subject to revisions, the trend is consistent with what we have seen: employers are cautious.

Where the Losses and Gains Are

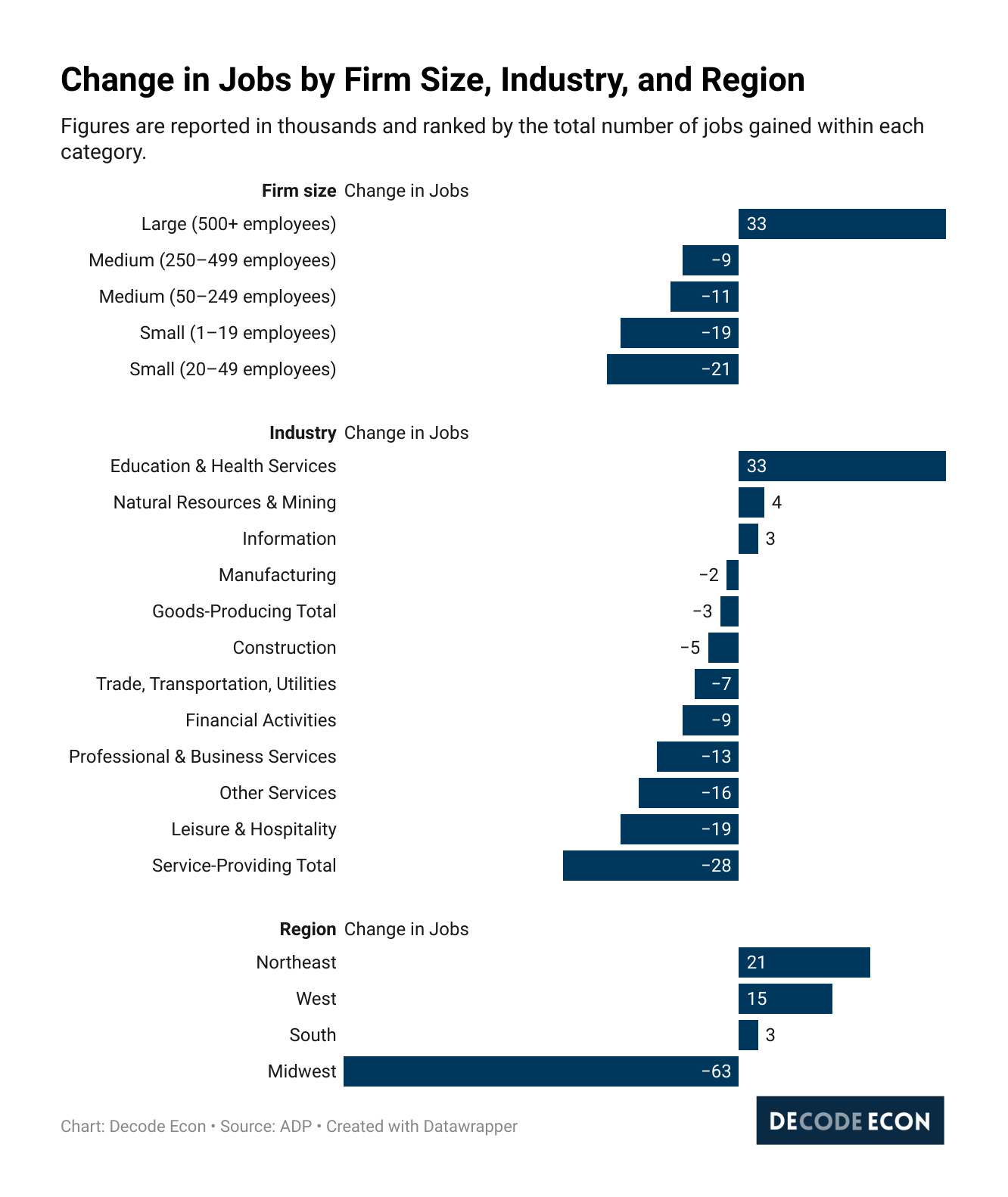

By size, small firms were hit hardest, losing 40,000 jobs. Medium-sized firms lost another 20,000. Large employers were the only group to add jobs, with gains of 33,000.

By industry, health care and education stood out as the lone source of growth, adding 33,000 jobs. Most other major sectors experienced losses, including leisure and hospitality, which declined by 19,000, professional and business services, which declined by 13,000, and financial activities, which declined by 9,000.

By region, the Midwest was the weakest, shedding 63,000 jobs. The Northeast added 21,000, the West added 15,000, and the South was roughly flat with a small gain of 3,000.

The Bottom Line

The last government report we received before the shutdown, the JOLTS survey, already signaled weakness. The hiring rate fell to 3.2 percent, its lowest level since 2013. ADP’s report reinforces that story. The labor market is not collapsing, but it is cooling, and small firms in particular are pulling back.

When the official data is out of reach, private indicators fill the gap. They are not perfect, but they still give us a direction. The current direction suggests slower hiring and more cautious employers.

Wow! The Midwest shed WAY more jobs than any other area of the US -- all other regions showed an increase, but the fall there was enough to lead to an overall national decrease. Gemini says: " the Midwest lost 63,000 jobs, a significantly steeper decline than in any other U.S. region. This was primarily driven by major losses in the East North Central division, and it reflects a broader national cooling of the labor market in industries that are prominent in the Midwest, such as manufacturing." Also construction. That suggests that Trump tariffs on manufacturing inputs and immigrant raids are the main drivers of the fall -- which is not surprising.

Gemini also says: "The ADP report also highlighted the growing impact of Artificial Intelligence (AI), which is driving job losses in certain sectors, particularly financial and business services." If you are a small accounting firm, your lunch is being eaten by AI.

Worried about the small businesses being forced to close. They are the vanguard against consolidation by large companies. We all know a purely competitive market offer better value to the consumers. For now we can only wait and see.