Getting Your Finances Together in 2026

One change that makes tomorrow easier

Tomorrow is the start of a whole new year. If getting your finances right is on your resolution list, this post is for you.

This is the one financial change I consistently recommend because it has done so much for us. It is the first step to getting your finances right and on track.

The Problem

If your New Year’s goal is to “get your finances in order,” you’re not alone. Most people start January motivated… and lose momentum by February.

The best way to overcome this issue is to develop systems.

For years, I did what many people do. I had Excel files for spending. Another for net worth calculations. Another for debt paydown and amortization. It worked, but it was clunky and made managing finances more frustrating than it already was. It required constant upkeep, manual updates, and attention I didn’t always have.

I knew I needed a better way to track and measure.

If you can’t track it, you can’t measure it.

If you can’t measure it, you can’t influence it.

The Economics

Economists obsess over measurement for a reason. GDP, inflation, unemployment—none of these are perfect, but they shape behavior because they make the invisible visible. Data helps us make better decisions.

Personal finance works the same way. How much money do you bring in? How much did you pay in taxes, spend on food, and invest in retirement or brokerage accounts? You are expected to know the answers to these questions.

When your money is fragmented across spreadsheets and accounts, cognitive costs rise. You delay decisions. You avoid checking. You can’t see where your money is going. Small inefficiencies compound quietly.

What you need isn’t willpower. You need lower friction and better feedback.

That’s why, in 2022, I stopped doing it the “cheap” way and invested in a system.

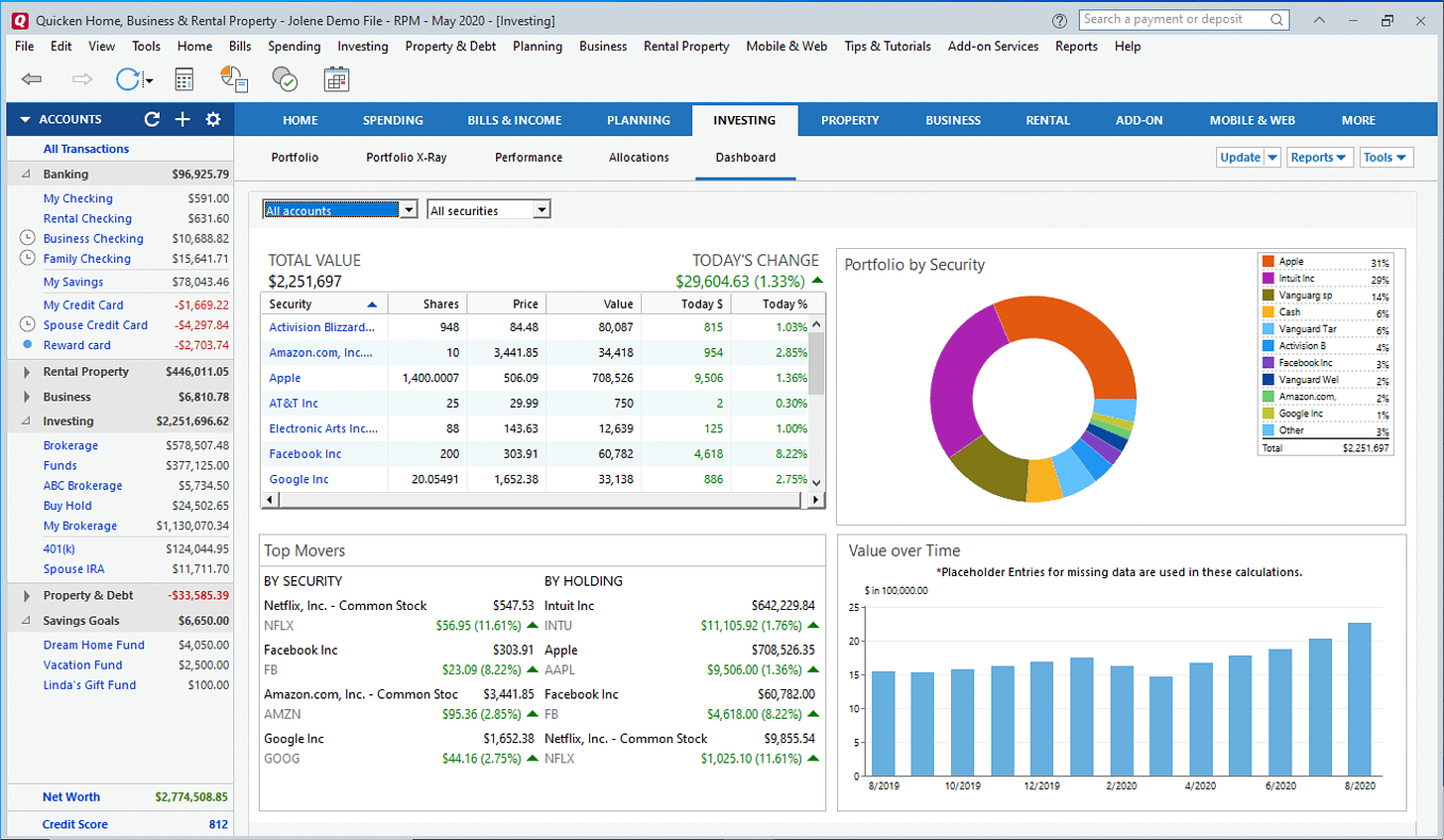

I started using Quicken, and I haven’t looked back. I recommend it to everyone, especially early-career professionals starting on their financial journey.

Everything syncs automatically. Spending, net worth, debt, and trends all live in one place. I spend less time tracking and more time making decisions with confidence.

What I Like About Quicken

Everything is in one place – no more spreadsheet juggling. Assets, debt, investments, spending, etc, are all in one place.

Automatic updates – less effort, more consistency. Most accounts are linked and update automatically. I have had some issues with retirement accounts updating values frequently, but I am not worried about managing those daily.

Clear trends over time – progress becomes visible. I enjoy following net worth and spending categories. Makes it easier to identify success and trouble areas.

Lower mental load – I actually love looking at my finances now because it is easier.

I use Quicken Classic, but many people can get by with Quicken Simplifi at about half the annual cost.

If you’re interested, here’s an affiliate link to use:

https://quicken.sjv.io/c/2940321/847678/11856

Using it supports Decode Econ—but more importantly, it supports you building a system that works. This is not a sponsored post.

The Bottom Line

The biggest upgrade you can make in 2026 isn’t a new investment strategy or a complicated Excel budget sheet. It’s creating a system you’ll actually use, one that makes your money measurable, understandable, and less stressful. The goal for 2026 should be to reduce friction and improve clarity.

This system allows us to track how much we save each year, how our investments grow, and how our spending changes. At the end of each year, I prepare a presentation for Dr. Jeni Al Bahrani that recaps our finances and helps us finalize our financial goals for 2026. While everyone is celebrating New Year’s Eve, I will be finalizing my PowerPoint deck!

Let’s start tomorrow with clarity.

Note: There are other tracking systems, but I have not used them and therefore cannot recommend them.

I’ve been using Quicken for 30+ years, since the DOS days, when “the cloud” meant weather.

It’s not just about tracking transactions. It’s about seeing how today’s choices quietly compound into tomorrow’s outcomes. Most people miss that. Quicken makes it hard to ignore.

I used to use quicken a long time ago, but kept having to do too many manual updates so it lost its value when I didn’t keep maintaining it. But you inspired me to go back to it since hopefully in the next five years, I’ll be heading into retirement and definitely need to get the budget under control as we make that transition. Thanks for sharing your system!